- United States

- /

- Auto

- /

- NasdaqGS:VFS

What VinFast Auto (VFS)'s 100,000 EV Sales Milestone Means for Shareholders

Reviewed by Sasha Jovanovic

- VinFast Auto recently announced that it reached 100,000 electric vehicles sold in the nine months ended September 2025.

- This rapid sales achievement underscores growing demand for VinFast's products and highlights its expanding presence in the competitive EV sector.

- We'll explore how reaching 100,000 vehicle sales in nine months could impact VinFast Auto's outlook and analyst expectations.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

VinFast Auto Investment Narrative Recap

To be a VinFast Auto shareholder, you need to believe the business can convert rapid electric vehicle sales growth into lasting profitability in a fiercely competitive sector. While hitting 100,000 EV sales in just nine months is an eye-catching benchmark, it does not immediately resolve the company’s current need to sustain high delivery volumes in order to reach breakeven, a factor closely watched by analysts as the main near-term catalyst and risk.

Of the company’s recent announcements, VinFast’s expansion into European bus markets with the launch of its EB 12 and EB 8 electric buses stands out. Launching these new products and pursuing commercial operations in markets like Germany and the Netherlands directly links to the broader sales ramp-up, which will be critical if the company is to reach volume levels that could improve margins and address cash burn concerns.

But before getting carried away by big delivery milestones, investors should also be mindful of the persistent negative operating cash flow and the ongoing reliance on external financial support, because if these do not improve…

Read the full narrative on VinFast Auto (it's free!)

VinFast Auto's outlook anticipates ₫177,527.7 billion in revenue and ₫8,991.9 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 48.9%, with earnings increasing by ₫91,207.8 billion from the current ₫-80,215.9 billion.

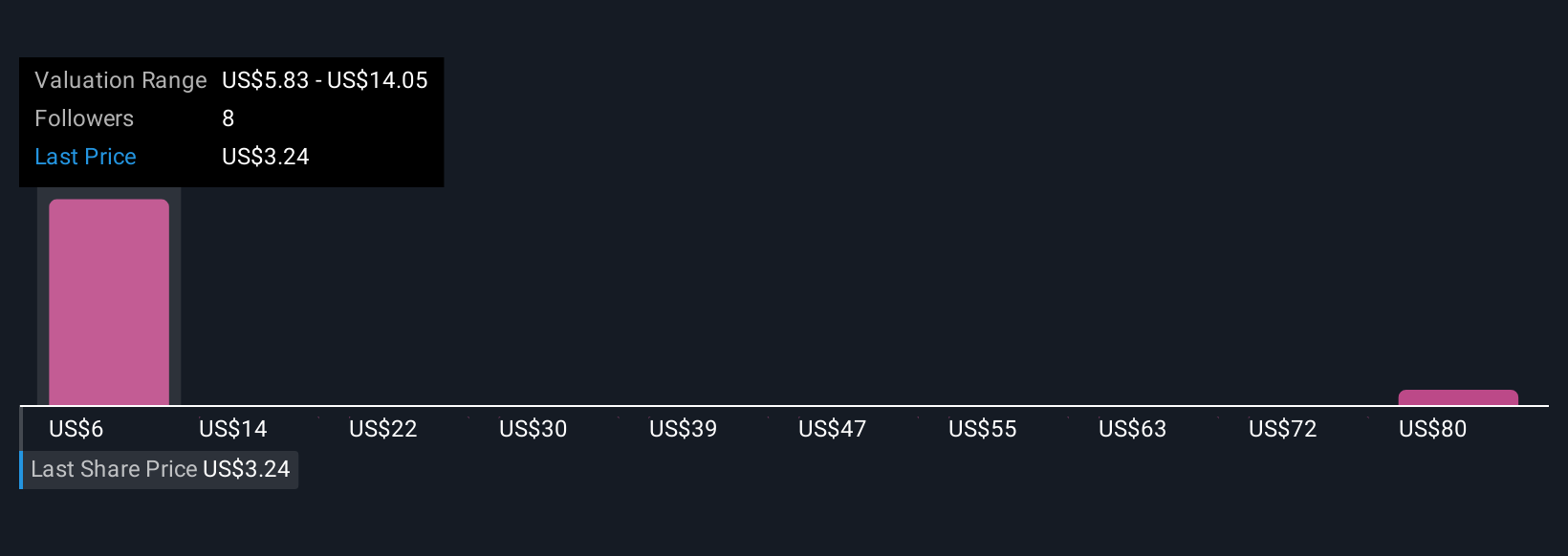

Uncover how VinFast Auto's forecasts yield a $5.83 fair value, a 78% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community currently estimate VinFast’s fair value between US$5.83 and US$88 per share, reflecting sharply contrasting outlooks. Some analysts continue to flag aggressive volume growth as essential for profitability, but also caution this may pressure margins, highlighting why opinions can vary substantially.

Explore 3 other fair value estimates on VinFast Auto - why the stock might be a potential multi-bagger!

Build Your Own VinFast Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VinFast Auto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VinFast Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VinFast Auto's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VFS

VinFast Auto

Engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

Low risk with limited growth.

Market Insights

Community Narratives