- United States

- /

- Auto

- /

- NasdaqGS:VFS

How VinFast’s Armored EV Delivery Could Influence VFS Investors’ View on Innovation and Global Prestige

Reviewed by Sasha Jovanovic

- VinFast and INKAS® announced the delivery of the Lac Hong 900 LX, an armored electric SUV with rare ballistic and blast certifications, to Vietnam's Ministry of Foreign Affairs for official dignitary transport.

- This partnership merges advanced electric vehicle technology with world-class security engineering, elevating VinFast’s technological reputation and deepening its cultural significance for Vietnam on a global stage.

- We'll examine how VinFast's innovation in armored EVs may reshape its investment narrative amid intense competition and financial pressures.

Find companies with promising cash flow potential yet trading below their fair value.

VinFast Auto Investment Narrative Recap

For investors considering VinFast, the belief centers on rapid electrification in emerging markets and the company's unique ability to combine Vietnamese heritage with advanced EV technology. The recent launch of the Lac Hong 900 LX armored SUV showcases successful product innovation and cultural branding but, on its own, does not materially change the dominant short-term catalyst: improving cash flow and achieving operational scale to address persistent liquidity and margin pressures. The biggest risk, heavy reliance on continued financial support from Vingroup and the founder, remains unchanged and should stay front of mind.

Among recent announcements, VinFast's expansion of its dealership network in Europe stands out, as it directly supports its international growth ambitions and the shift toward more efficient distribution, both critical to delivering on volume and revenue catalysts that could eventually improve the bottom line. The armored EV development highlights VinFast's technical progress, but without higher sales volumes and cost control, product achievements alone may not address the underlying business challenges.

But as investors weigh VinFast’s global momentum, they should not overlook ongoing risks from continued high cash burn and...

Read the full narrative on VinFast Auto (it's free!)

VinFast Auto's narrative projects ₫177,527.7 billion revenue and ₫8,991.9 billion earnings by 2028. This requires 48.9% yearly revenue growth and a ₫91,207.8 billion increase in earnings from ₫-80,215.9 billion currently.

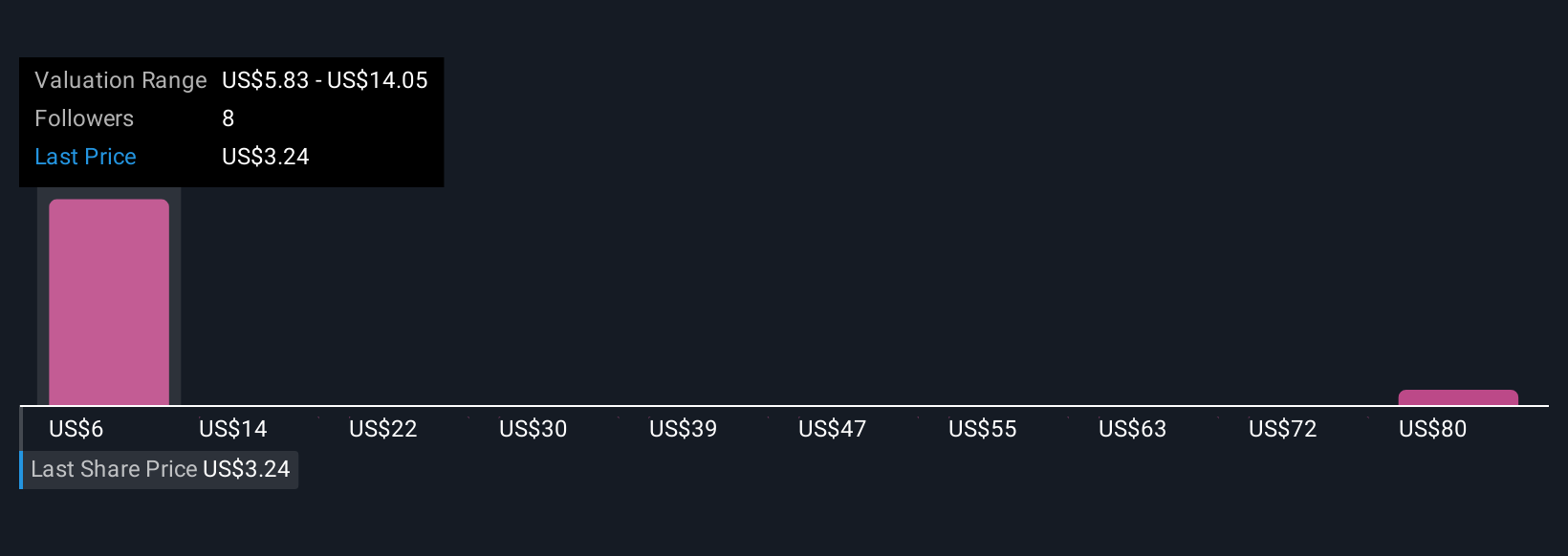

Uncover how VinFast Auto's forecasts yield a $5.83 fair value, a 77% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community span from US$5.83 to US$88, reflecting broad differences in long-term outlooks. With heavy cash burn still a pressing issue, you can compare these wide-ranging opinions for more context on VinFast's future.

Explore 3 other fair value estimates on VinFast Auto - why the stock might be worth just $5.83!

Build Your Own VinFast Auto Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your VinFast Auto research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free VinFast Auto research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate VinFast Auto's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VFS

VinFast Auto

Engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

Low risk and slightly overvalued.

Market Insights

Community Narratives