- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Visteon (VC) Margin Slide Versus Industry Norms Challenges Bullish Sentiment

Reviewed by Simply Wall St

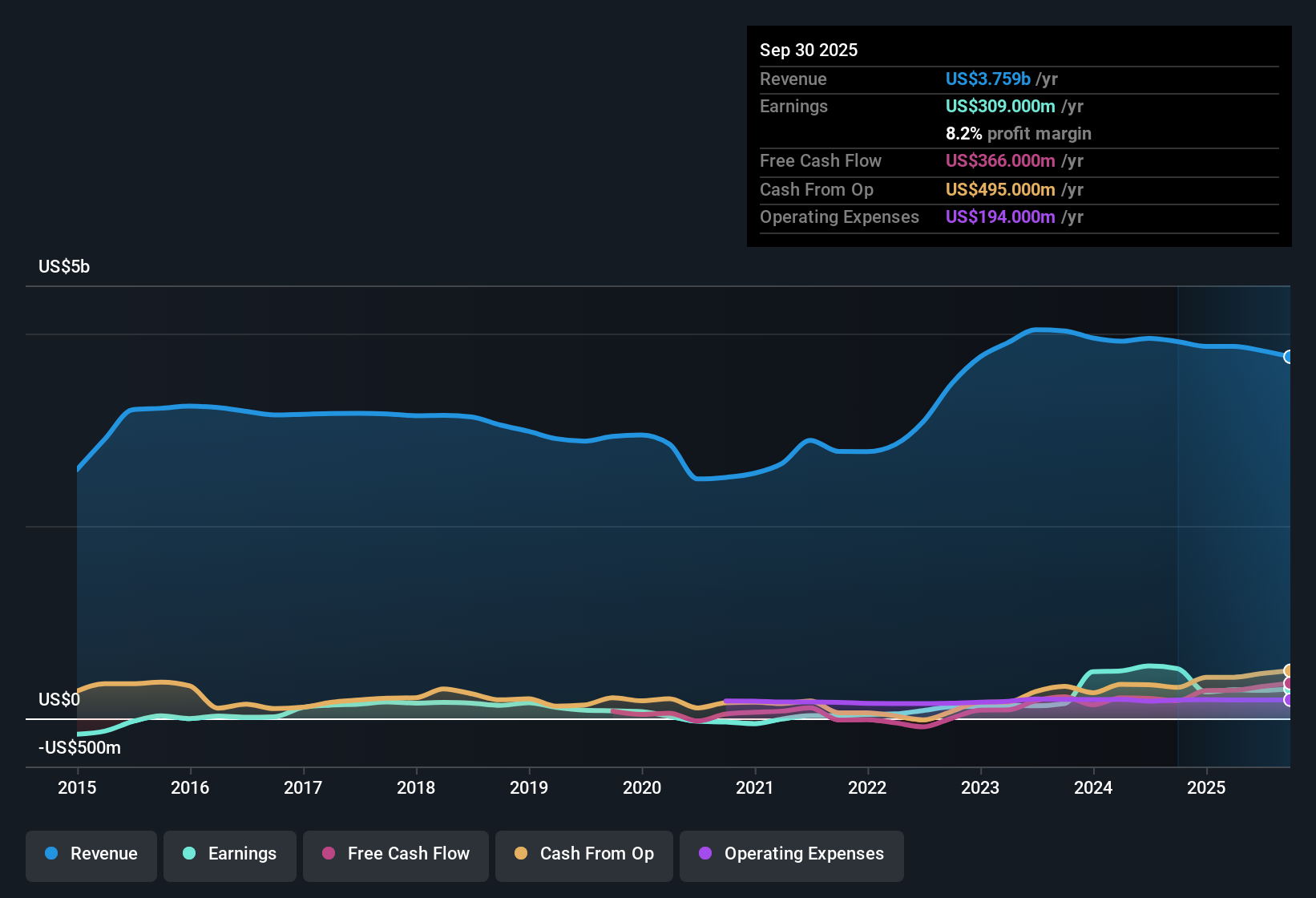

Visteon (VC) posted revenue growth forecasts of 4.8% per year, which lags the broader US market average of 10%. Net profit margin came in at 7.6%, slipping from last year’s 13.8%, while earnings are only expected to grow at 7.1% per year compared to the market’s 15.5% pace. Over the past five years, annual earnings grew quickly, but the most recent year saw earnings decline, and shares now trade at $110.22, notably below the company's fair value estimate of $157.77. With decent value metrics and expectations for continued, though slower, growth, investors may see cause for optimism despite recent margin pressures.

See our full analysis for Visteon.Next, let’s see how these numbers measure up against the narratives the market is watching. Some long-standing assumptions could get confirmed or called into question.

See what the community is saying about Visteon

Margin Pressures Outpace Industry Trends

- Net profit margin declined to 7.6%, a steep drop from last year’s 13.8%, signaling a stronger-than-expected squeeze compared to margin norms in the broader auto components sector.

- According to analysts' consensus view, this margin compression is notable because:

- Visteon’s strategy to expand in high-growth markets and boost revenue through new business wins, such as $1.9 billion in deals with top OEMs, provides some offset. However, the persistent margin decline could weigh on future earnings power even as sales diversify.

- Analyst projections for profit margins falling further to 6.1% over three years directly test the bullish narrative that new market initiatives and cost controls will meaningfully support profitability in the near-term.

Consensus narrative points to tech wins, margin strains, and market expansion. See the full consensus perspective for where the numbers take us. 📊 Read the full Visteon Consensus Narrative.

PE Ratio Stands Out Versus Peers

- With a Price-To-Earnings ratio of 10.3x, which is far lower than the US Auto Components industry average of 18.2x or the peer average of 37.7x, Visteon’s valuation appears favorable versus its sector.

- Analysts' consensus view notes the valuation gap is driven by:

- The company’s track record of high historical earnings growth (55.6% annually over five years) and ongoing, if slower, future profit forecasts justify some discount. However, the scale of the valuation gap suggests skepticism about sustaining those trends.

- To reach the analyst consensus price target of $135.15, investors would need to assume a future PE of 16.0x in 2028 as profits moderate, requiring renewed confidence in execution and margin recovery over the next cycle.

Profit Growth Slows After Impressive Run

- Although Visteon posted 55.6% annual earnings growth over the last five years, the most recent year’s earnings declined, and forward growth estimates (7.1% annually) now fall short of the market’s broader projected pace.

- Analysts' consensus view sets expectations for subdued earnings momentum:

- Forecasts suggest earnings could decrease from $291 million today to $260.2 million by 2028, challenging optimistic takes that the prior strong run can be sustained as costs, tariffs, and regional auto demand dynamics shift.

- Bulls count on wins in digital cockpit technology and large OEM deals to drive a rebound, but the consensus outlook points to slower and more volatile profit trends in coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Visteon on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on these figures? Shape your perspective and create your version of the story in just a few minutes. Do it your way

A great starting point for your Visteon research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Visteon's slowing profit growth, declining margins, and lower earnings forecasts point to challenges in delivering steady performance as industry cycles shift.

If consistency matters to you, use our stable growth stocks screener (2088 results) to focus on companies demonstrating reliable revenue and earnings growth through a variety of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)