- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Does Visteon Corporation's (NASDAQ:VC) CEO Salary Reflect Performance?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In 2015 Sachin Lawande was appointed CEO of Visteon Corporation (NASDAQ:VC). First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for Visteon

How Does Sachin Lawande's Compensation Compare With Similar Sized Companies?

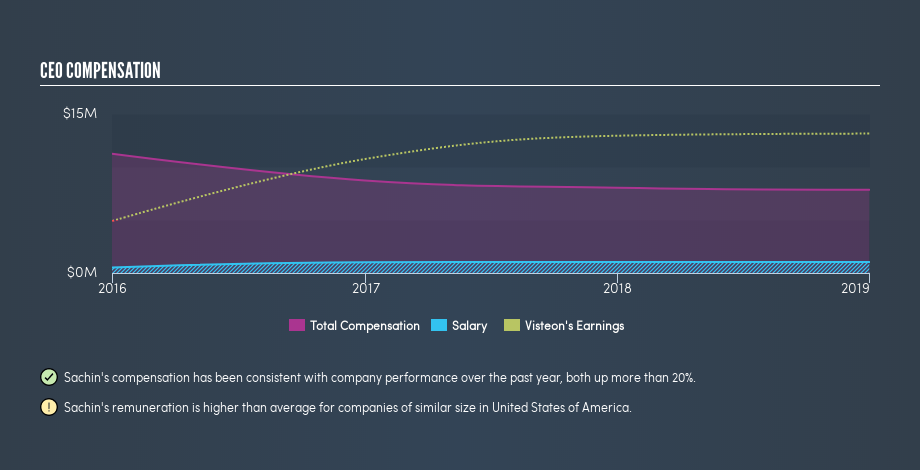

At the time of writing our data says that Visteon Corporation has a market cap of US$1.5b, and is paying total annual CEO compensation of US$7.9m. (This is based on the year to December 2018). That's actually a decrease on the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$1.0m. We looked at a group of companies with market capitalizations from US$1.0b to US$3.2b, and the median CEO total compensation was US$4.1m.

Thus we can conclude that Sachin Lawande receives more in total compensation than the median of a group of companies in the same market, and of similar size to Visteon Corporation. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

The graphic below shows how CEO compensation at Visteon has changed from year to year.

Is Visteon Corporation Growing?

Visteon Corporation has increased its earnings per share (EPS) by an average of 42% a year, over the last three years (using a line of best fit). In the last year, its revenue is down -7.7%.

This shows that the company has improved itself over the last few years. Good news for shareholders. Revenue growth is a real positive for growth, but ultimately profits are more important. It could be important to check this free visual depiction of what analysts expect for the future.

Has Visteon Corporation Been A Good Investment?

Given the total loss of 29% over three years, many shareholders in Visteon Corporation are probably rather dissatisfied, to say the least. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

We compared total CEO remuneration at Visteon Corporation with the amount paid at companies with a similar market capitalization. We found that it pays well over the median amount paid in the benchmark group.

However we must not forget that the EPS growth has been very strong over three years. Having said that, shareholders may be disappointed with the weak returns over the last three years. Considering the per share profit growth, but keeping in mind the weak returns, we'd need more time to form a view on CEO compensation. Whatever your view on compensation, you might want to check if insiders are buying or selling Visteon shares (free trial).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives