- United States

- /

- Auto Components

- /

- NasdaqGS:VC

Does $1.9B in New Wins and Analyst Praise Redefine the Bull Case for Visteon (VC)?

Reviewed by Sasha Jovanovic

- Visteon has recently attracted positive analyst attention for its strong value metrics and has announced new business wins totaling US$1.9 billion with major OEMs like Toyota and expanding partnerships in China.

- This combination of favorable industry recognition and major contract successes highlights Visteon's position as an emerging leader in automotive displays and digital cockpit solutions.

- We'll now look at how these high-profile contract wins and value-focused analyst coverage may influence Visteon's overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Visteon Investment Narrative Recap

For an investor considering Visteon, the core belief centers on the company’s ability to turn its recent US$1.9 billion in contract wins and recognized industry value into sustained earnings, while managing risks from shifting OEM production schedules and global tariffs. Although these high-profile deals lift visibility and may ease concerns over volume declines in core markets, the short-term revenue impact could be limited if broader production headwinds persist. The biggest immediate catalyst remains further contract momentum in China, while challenges tied to tariff volatility continue to loom.

Among Visteon's latest announcements, its strategic collaboration with FUTURUS to develop advanced Head-Up Display technologies directly supports the company's focus on cockpit innovation, a segment underscored by recent analyst upgrades and OEM partnerships. This reinforces the importance of technology leadership as Visteon aims to diversify and secure additional revenue sources across new, high-growth mobility platforms.

On the other hand, the growing risk of unexpected shifts in OEM production forecasts is something every investor should be aware of, especially if...

Read the full narrative on Visteon (it's free!)

Visteon's outlook anticipates $4.3 billion in revenue and $260.2 million in earnings by 2028. This is based on a 3.8% annual revenue growth, but a decrease of $30.8 million in earnings from the current $291.0 million.

Uncover how Visteon's forecasts yield a $129.54 fair value, a 7% upside to its current price.

Exploring Other Perspectives

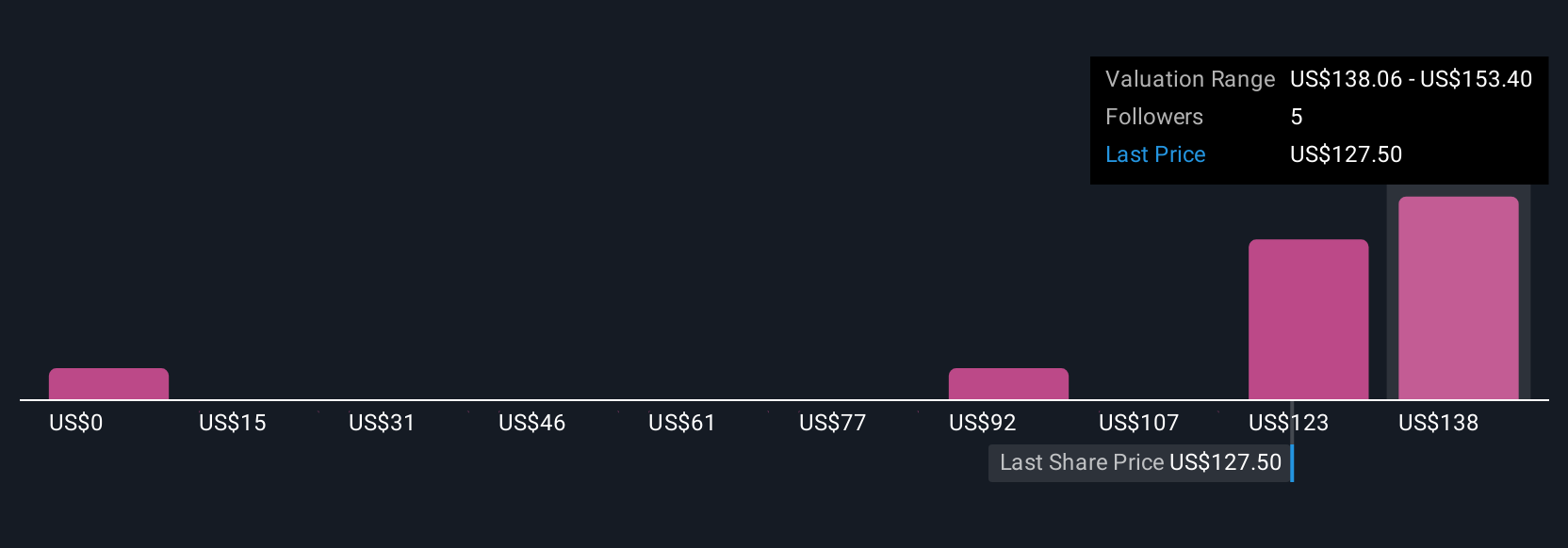

You’ll find 5 fair value estimates for Visteon from the Simply Wall St Community, spanning US$15 to US$151 per share. While these diverging views highlight how contract wins can impact company outlooks, they also show how perspectives on tariff and production risks can shape future expectations, explore more viewpoints for a deeper understanding.

Explore 5 other fair value estimates on Visteon - why the stock might be worth as much as 25% more than the current price!

Build Your Own Visteon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Visteon research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Visteon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Visteon's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VC

Visteon

An automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives