- United States

- /

- Auto Components

- /

- NasdaqGS:THRM

The three-year shareholder returns and company earnings persist lower as Gentherm (NASDAQ:THRM) stock falls a further 3.8% in past week

If you love investing in stocks you're bound to buy some losers. Long term Gentherm Incorporated (NASDAQ:THRM) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 51% drop in the share price over that period. Shareholders have had an even rougher run lately, with the share price down 14% in the last 90 days.

With the stock having lost 3.8% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Gentherm

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

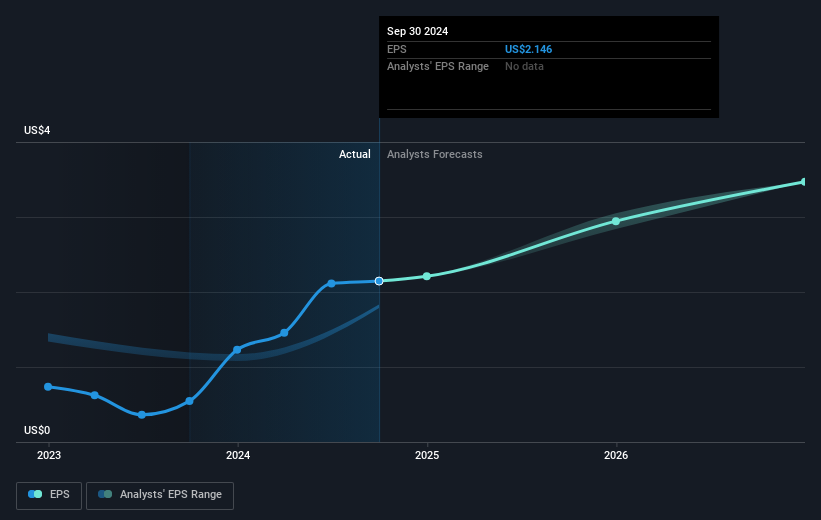

Gentherm saw its EPS decline at a compound rate of 12% per year, over the last three years. This reduction in EPS is slower than the 21% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Gentherm has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

Gentherm shareholders are down 9.4% for the year, but the market itself is up 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Gentherm in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Gentherm may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:THRM

Gentherm

Designs, develops, manufactures, and sells thermal management and pneumatic comfort technologies in the United States and internationally.

Undervalued with excellent balance sheet.