- United States

- /

- Auto Components

- /

- NasdaqGM:SYPR

Sypris Solutions And Two Other Promising Penny Stocks To Watch

Reviewed by Simply Wall St

As the U.S. stock market grapples with AI valuation concerns and fluctuating index performances, investors are keenly assessing earnings reports for guidance. Amid these broader market dynamics, penny stocks—despite their somewhat outdated moniker—remain a compelling area of interest for those seeking opportunities in smaller or newer companies. By focusing on firms with solid financial foundations, investors can uncover potential value and growth prospects that larger companies may overlook.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.75 | $377.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $603.98M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.38 | $731.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.93 | $56.46M | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.945 | $246.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.08 | $25.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.75 | $1.06B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.90 | $6.63M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.08 | $67.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 369 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sypris Solutions (SYPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sypris Solutions, Inc. provides truck components, oil and gas and water pipeline components, and aerospace and defense electronics primarily in North America and Mexico, with a market cap of $48.06 million.

Operations: The company generates revenue through two primary segments: Sypris Electronics, which accounts for $63.35 million, and Sypris Technologies, contributing $66.69 million.

Market Cap: $48.06M

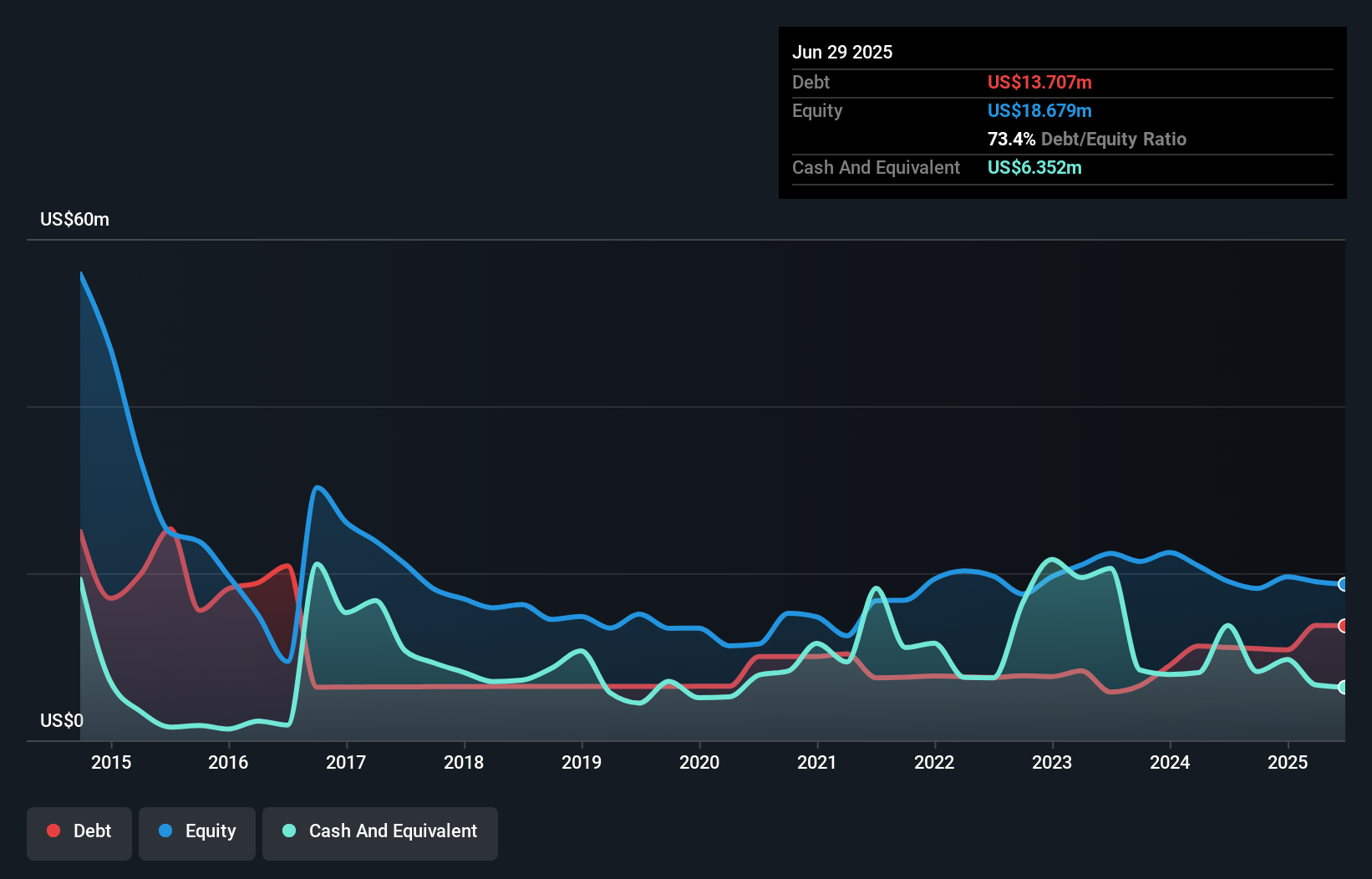

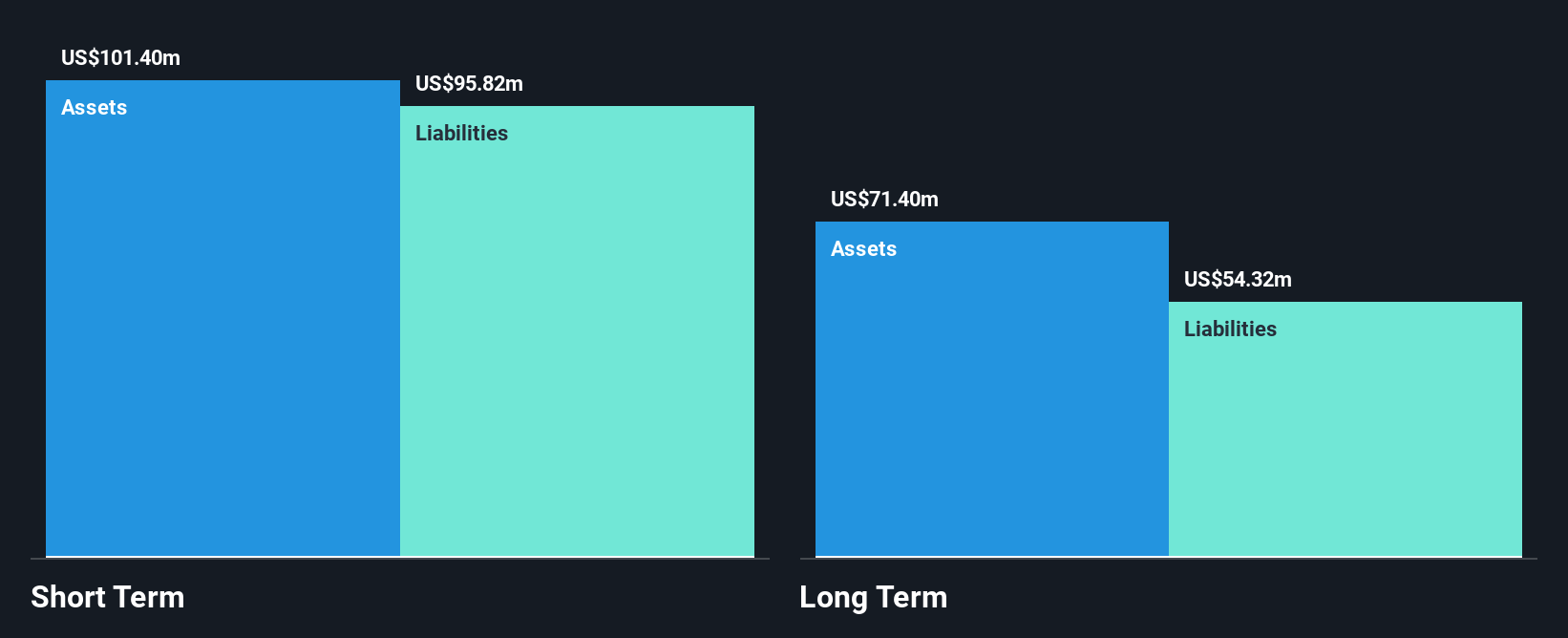

Sypris Solutions, with a market cap of US$48.06 million, operates in the truck components and aerospace sectors. Despite its satisfactory net debt to equity ratio of 39.4% and experienced management team, the company faces challenges as it is currently unprofitable with a negative return on equity of -12.98%. Recent earnings reports show declining sales from US$35.52 million to US$31.43 million year-over-year for Q2 2025 and a net loss of US$2.05 million compared to a small profit previously. While short-term assets exceed liabilities, cash runway remains under one year, highlighting financial constraints amidst increasing losses over five years at 41.1% annually.

- Click to explore a detailed breakdown of our findings in Sypris Solutions' financial health report.

- Evaluate Sypris Solutions' historical performance by accessing our past performance report.

Kaltura (KLTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kaltura, Inc. offers a range of software-as-a-service (SaaS) and platform-as-a-service (PaaS) solutions globally, with a market cap of approximately $231.74 million.

Operations: The company's revenue is primarily derived from its Enterprise, Education and Technology segment, which generated $132.96 million, and the Media & Telecom segment, contributing $48.39 million.

Market Cap: $231.74M

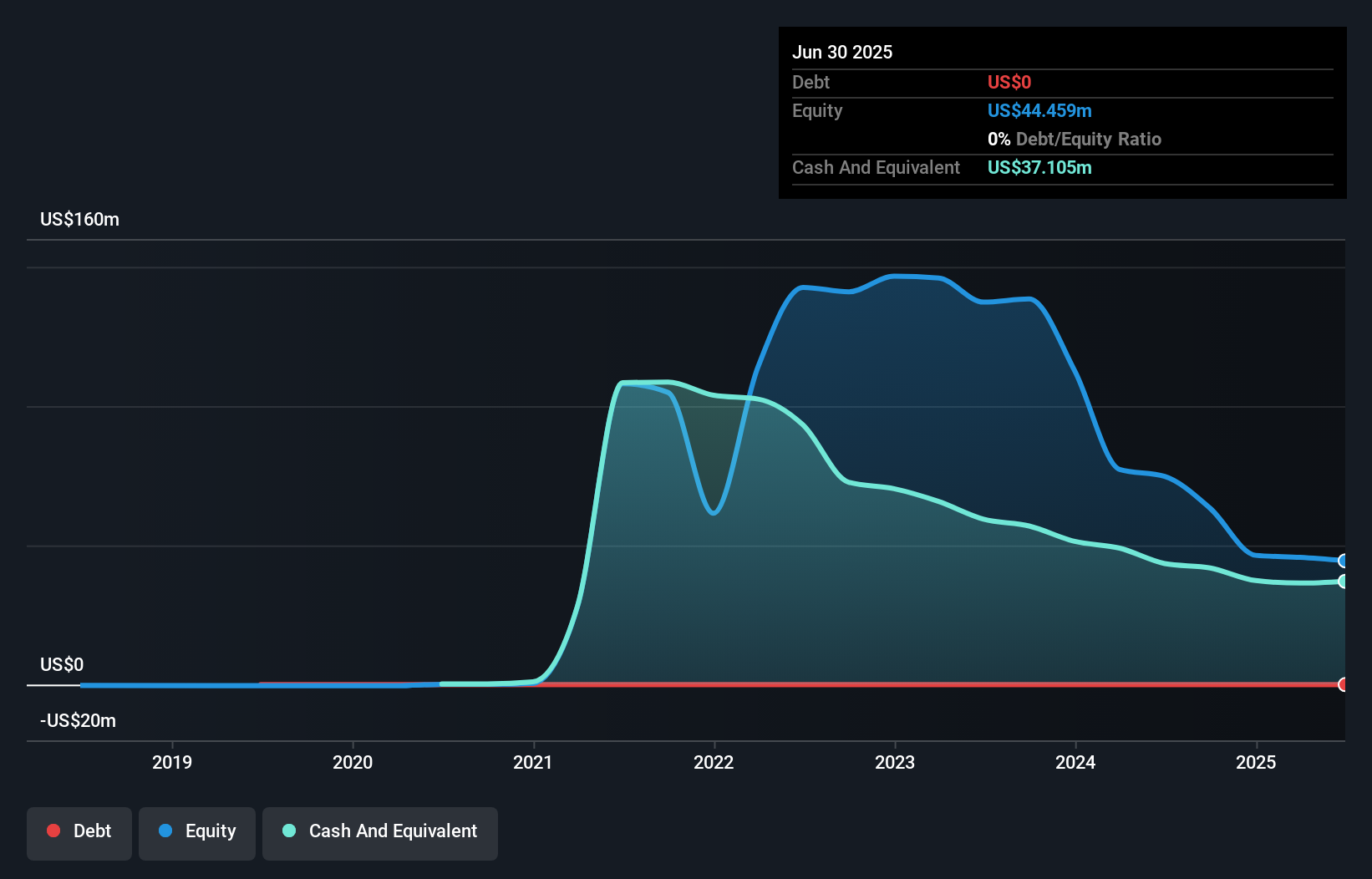

Kaltura, Inc., with a market cap of US$231.74 million, remains unprofitable but has shown progress by reducing losses over the past five years at a rate of 23.7% annually. The company’s short-term assets exceed both its short and long-term liabilities, providing some financial stability. Despite negative return on equity and recent insider selling, Kaltura's cash runway extends beyond three years due to positive free cash flow growth. Recent developments include the unveiling of a new Media Publishing Agent aimed at enhancing revenue opportunities and inclusion in the S&P Global BMI Index, potentially increasing its visibility among investors.

- Click here and access our complete financial health analysis report to understand the dynamics of Kaltura.

- Explore Kaltura's analyst forecasts in our growth report.

Carbon Streaming (OFST.F)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carbon Streaming Corporation is a carbon credit streaming and royalty company that aims to create shareholder value through the acquisition and sale of carbon credits, with a market cap of $26.92 million.

Operations: The company's revenue segment is focused on the acquisition of carbon credit streaming and royalty arrangements, accounting for -$26.21 million.

Market Cap: $26.92M

Carbon Streaming Corporation, with a market cap of US$26.92 million, is pre-revenue and unprofitable, with negative sales reported at US$1.47 million for Q2 2025. Despite this, the company maintains financial stability as its short-term assets of US$37.8 million exceed liabilities and it remains debt-free with a cash runway extending over three years. Recent efforts focus on maximizing existing portfolio value through strategic acquisitions and partnerships to enhance shareholder value. Although the management team is relatively new, Carbon Streaming's stable weekly volatility suggests some consistency in its stock performance amid ongoing challenges.

- Get an in-depth perspective on Carbon Streaming's performance by reading our balance sheet health report here.

- Explore historical data to track Carbon Streaming's performance over time in our past results report.

Where To Now?

- Navigate through the entire inventory of 369 US Penny Stocks here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SYPR

Sypris Solutions

Engages in the provision of truck components, oil and gas and water pipeline components, and aerospace and defense electronics primarily in North America and Mexico.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives