- United States

- /

- Auto Components

- /

- NasdaqGM:STRT

How Does Strattec Security's (NASDAQ:STRT) CEO Pay Compare With Company Performance?

Frank Krejci has been the CEO of Strattec Security Corporation (NASDAQ:STRT) since 2012, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Strattec Security

How Does Total Compensation For Frank Krejci Compare With Other Companies In The Industry?

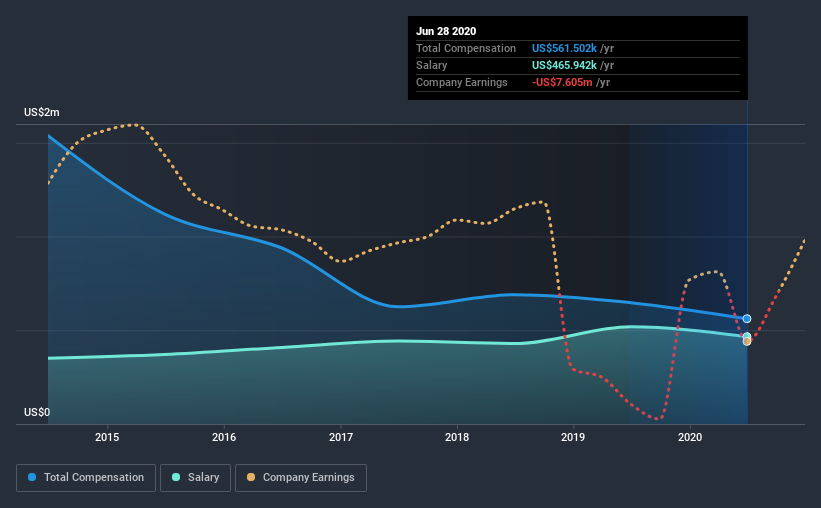

According to our data, Strattec Security Corporation has a market capitalization of US$216m, and paid its CEO total annual compensation worth US$562k over the year to June 2020. We note that's a decrease of 13% compared to last year. We note that the salary portion, which stands at US$465.9k constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$288k. Accordingly, our analysis reveals that Strattec Security Corporation pays Frank Krejci north of the industry median. Furthermore, Frank Krejci directly owns US$2.7m worth of shares in the company, implying that they are deeply invested in the company's success.

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. It's interesting to note that Strattec Security pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Strattec Security Corporation's Growth

Strattec Security Corporation has reduced its earnings per share by 12% a year over the last three years. It saw its revenue drop 15% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Strattec Security Corporation Been A Good Investment?

Most shareholders would probably be pleased with Strattec Security Corporation for providing a total return of 56% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we noted earlier, Strattec Security pays its CEO higher than the norm for similar-sized companies belonging to the same industry. We feel that EPS have been a bit disappointing, but it's nice to see positive shareholder returns over the last three years. So while we would not say that Frank is generously paid, stockholders would want to see some EPS growth before agreeing that a raise is a good idea.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 2 warning signs for Strattec Security that investors should be aware of in a dynamic business environment.

Switching gears from Strattec Security, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Strattec Security, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:STRT

Strattec Security

Designs, develops, manufactures, and markets automotive security, access control, and user interface controls products in North America and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion