- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Will Polestar’s (PSNY) Dealer Shift and Reverse Split Redefine Its Premium Brand Ambitions?

Reviewed by Sasha Jovanovic

- Earlier in 2025, Polestar Automotive Holding UK Plc executed a one-for-thirty reverse stock split to retain its Nasdaq listing amid ongoing financial challenges, while restructuring operations and shifting its European sales approach from direct-to-consumer to a dealer network.

- This marks a significant transformation in Polestar's business model and signals the company's commitment to premium positioning and sustainability, with goals to halve greenhouse gas emissions by 2030 and achieve climate neutrality by 2040.

- Now, we will examine how the operational restructuring and dealer network transition could shape Polestar’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Polestar Automotive Holding UK Investment Narrative Recap

To invest in Polestar, you would need to believe in the company's ability to leverage its premium brand and sustainability focus, even as it restructures for operational efficiency and navigates a highly competitive EV market. The recent reverse split and sales channel shift are attempts to address immediate financial pressures and restore stability, but with continued high losses and looming going concern warnings, the biggest near-term catalyst remains access to new funding, while the most significant risk is ongoing cash burn and potential dilution; the latest announcements have not materially reduced this risk so far. Among recent announcements, the opening of a new full-service Polestar store in Kuopio stands out as especially relevant. This development aligns with Polestar’s transition to a dealer-based European sales model, aiming to boost reach and customer engagement, a potential catalyst for improved short-term sales, but not enough on its own to resolve underlying financial issues. However, investors should also be aware that persistent losses and a short cash runway mean Polestar’s ability to...

Read the full narrative on Polestar Automotive Holding UK (it's free!)

Polestar Automotive Holding UK's narrative projects $11.0 billion revenue and $559.6 million earnings by 2028. This requires 63.1% yearly revenue growth and a $3.26 billion earnings increase from current earnings of -$2.7 billion.

Uncover how Polestar Automotive Holding UK's forecasts yield a $1.00 fair value, a 64% upside to its current price.

Exploring Other Perspectives

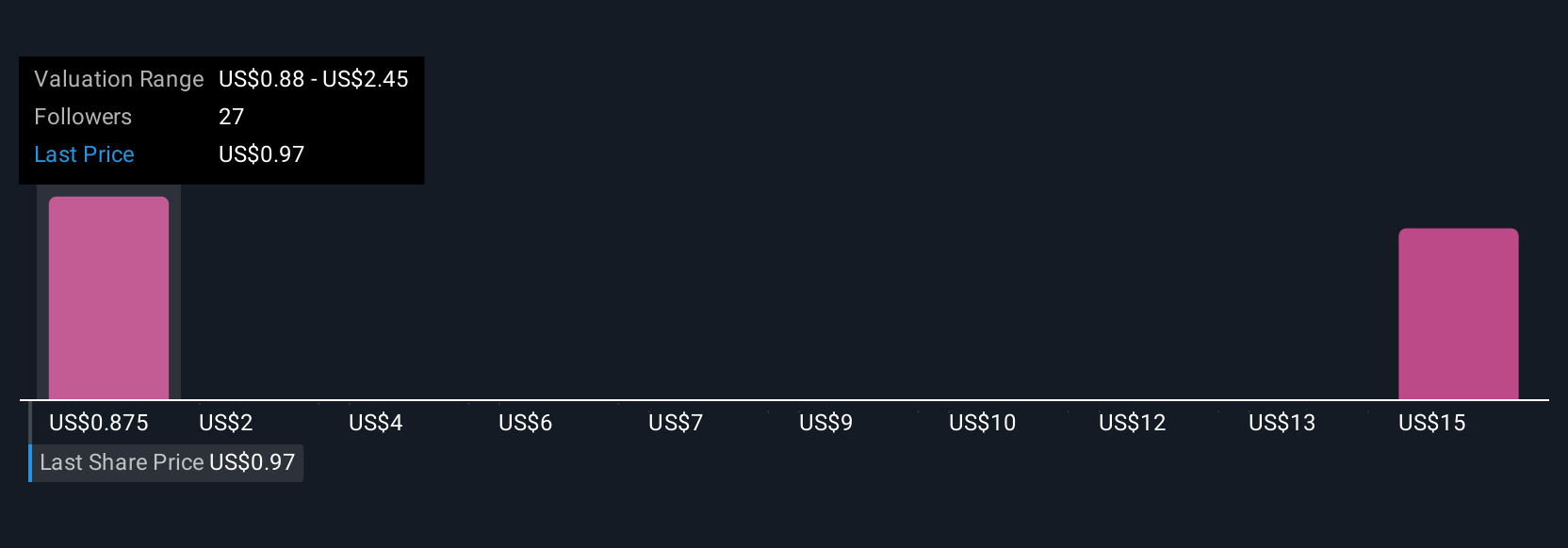

Simply Wall St Community members provided 9 fair value estimates for Polestar, spanning from US$1 to as high as US$4.59. While opinions differ sharply, ongoing concerns over cash burn and the risk of shareholder dilution remain front of mind for many participants considering the company’s near-term viability.

Explore 9 other fair value estimates on Polestar Automotive Holding UK - why the stock might be worth over 7x more than the current price!

Build Your Own Polestar Automotive Holding UK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Polestar Automotive Holding UK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Polestar Automotive Holding UK's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives