- United States

- /

- Auto

- /

- NasdaqGM:PSNY

Polestar (NasdaqGM:PSNY): Evaluating Valuation as New Kuopio Store Expands European Network

Reviewed by Simply Wall St

Polestar Automotive Holding UK (NasdaqGM:PSNY) is expanding its presence in Finland, thanks to a new full-service store opening in Kuopio through a broader partnership with Wetteri. This move gives Polestar additional reach in both sales and aftersales services across the region. It is a notable step as the company continues building its network in Europe.

See our latest analysis for Polestar Automotive Holding UK.

This store opening comes shortly after Polestar received a Nasdaq notice over its share price falling below $1.00, signaling both expansion efforts and ongoing market challenges. Despite these moves to grow in Europe, shares have slid sharply, with a 1-year total shareholder return of -44.3% and momentum still clearly fading as the stock trades at $0.6739.

If you’re following shifts in the auto sector, you might want to check out what else is happening. See the full list for free: See the full list for free.

With shares well below $1 and new initiatives underway, the question for investors is whether Polestar is trading at a bargain or if the current price already reflects any potential rebound ahead.

Most Popular Narrative: 32.6% Undervalued

At $0.6739, Polestar’s shares trade far below the narrative fair value of $1.00, suggesting a major disconnect between recent price action and what analysts project for the company’s future. This gap raises the stakes on the assumptions powering the most popular valuation outlook.

Persistent high cash burn, reliance on external funding, and a lack of clear path to sustainable profitability raise the risk of further shareholder dilution through equity issuance. This could potentially depress EPS and constrain future investment.

Curious what’s driving the optimism in this widely followed narrative? The math behind the fair value hinges on aggressive revenue expansion and a dramatic swing in margins. There is one financial projection in particular that could make or break the story. Want the full breakdown? Dive in to uncover how the narrative stacks the numbers for Polestar.

Result: Fair Value of $1.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on external funding and intensifying competition from new and established automakers could undermine Polestar’s path to sustainable profits.

Find out about the key risks to this Polestar Automotive Holding UK narrative.

Another View: What Do Market Ratios Say?

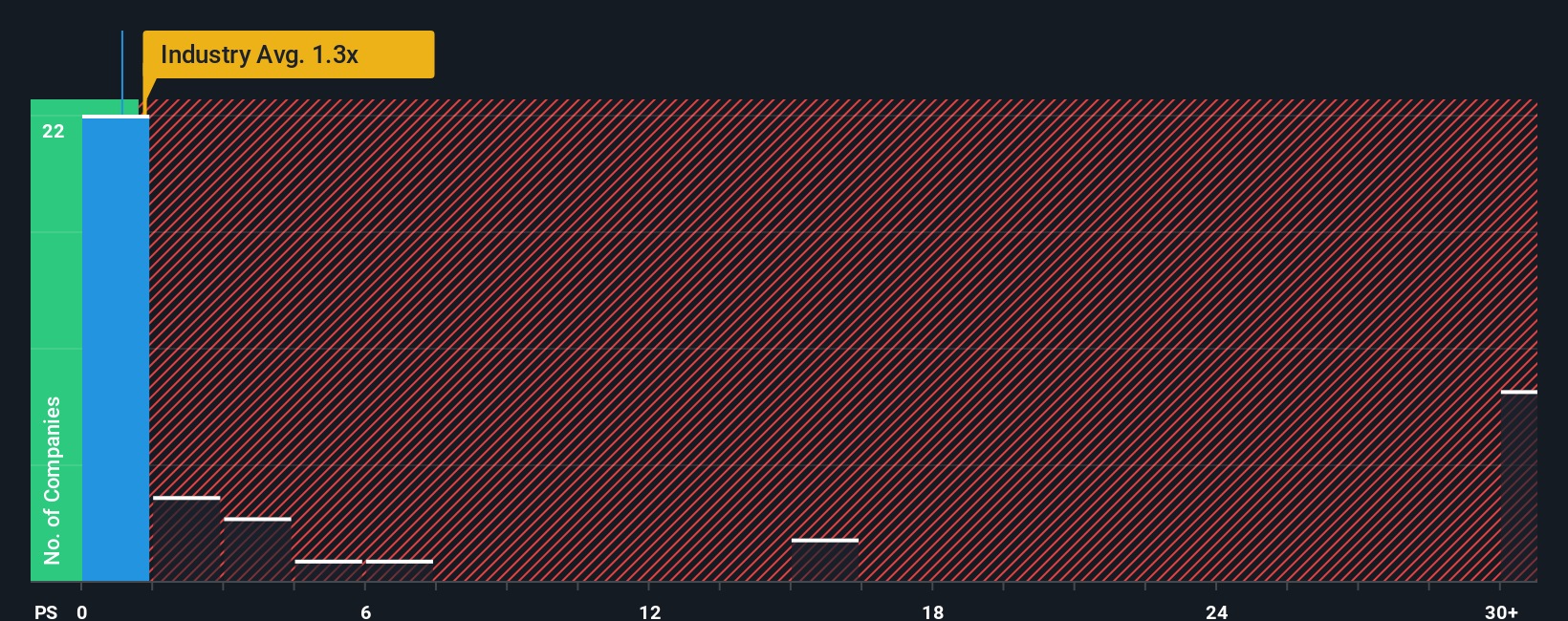

Switching gears from analyst forecasts, let’s look at how Polestar stacks up using its price-to-sales ratio. At 0.6x, it is much cheaper than the industry average of 1x and peer average of 1.8x, but sits well above its fair ratio of 0.4x. This wide range signals plenty of valuation risk and opportunity. Could the market swing further either way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Polestar Automotive Holding UK Narrative

If you have a different take on Polestar’s outlook or want to crunch your own numbers, creating a personal narrative is fast and straightforward. Do it your way.

A great starting point for your Polestar Automotive Holding UK research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not settle for just one opportunity. There are far more trends to target. Use Simply Wall Street’s powerful tools to ensure you never miss out on stocks with strategic potential.

- Start chasing generational wealth with these 3585 penny stocks with strong financials that show strong financial health and explosive growth potential.

- Get ahead of emerging tech trends by spotting innovation early through these 27 AI penny stocks as they reshape industries and redefine productivity.

- Maximize your chances of securing undervalued gems with these 883 undervalued stocks based on cash flows based on rigorous cash flow analysis and smart valuation metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PSNY

Polestar Automotive Holding UK

Engages in the research and development, marketing, commercialization, and sale of battery electric vehicles and related technology solutions.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives