- United States

- /

- Auto Components

- /

- NasdaqGS:PATK

Patrick Industries (PATK): Evaluating Valuation After New President Appointment and Bullish Analyst Signals

Reviewed by Kshitija Bhandaru

Patrick Industries (PATK) recently announced that Jeff Rodino is stepping into the role of President, taking on leadership, strategic planning, and financial responsibilities. Leadership changes like this often draw investor attention, particularly when paired with valuation signals.

See our latest analysis for Patrick Industries.

The leadership shakeup comes as Patrick Industries signals quiet but steady momentum, with its share price recently closing at $103.84 and the company posting a 1-year total shareholder return of 8.4%. While the past quarter has seen moderate gains, investors seem encouraged by the company’s solid financial trends and the potential for new strategic direction under fresh leadership.

If the possibility of shifts at the top inspires you to explore further, now is a smart time to broaden your investing horizons and discover See the full list for free.

So with new leadership at the helm and positive signals from valuation metrics, should investors view Patrick Industries as an overlooked value play, or has the market already factored in its future growth prospects?

Most Popular Narrative: 3.9% Undervalued

Patrick Industries' consensus narrative points to a fair value above its last closing price, suggesting renewed upside that recent trading has yet to capture. This pricing hints at optimism driven by the company's evolving end markets and operational strategy.

Ongoing innovation and product expansion, including proprietary composite roofing systems, digital dashboards, integrated marine tower systems, and value-added content for utility vehicles, position Patrick to capture more content per unit. This approach drives both organic revenue growth and margin expansion through higher-value engineered offerings.

Curious what assumptions are fueling this price target? The real story is a set of bold growth forecasts and a path to higher margins. But what specific financial leaps do analysts believe Patrick Industries can actually achieve? Unlock the playbook to see the numbers that set the stage for this valuation.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or a slowdown in recreational vehicle demand could quickly put pressure on Patrick Industries' earnings outlook and margin forecasts.

Find out about the key risks to this Patrick Industries narrative.

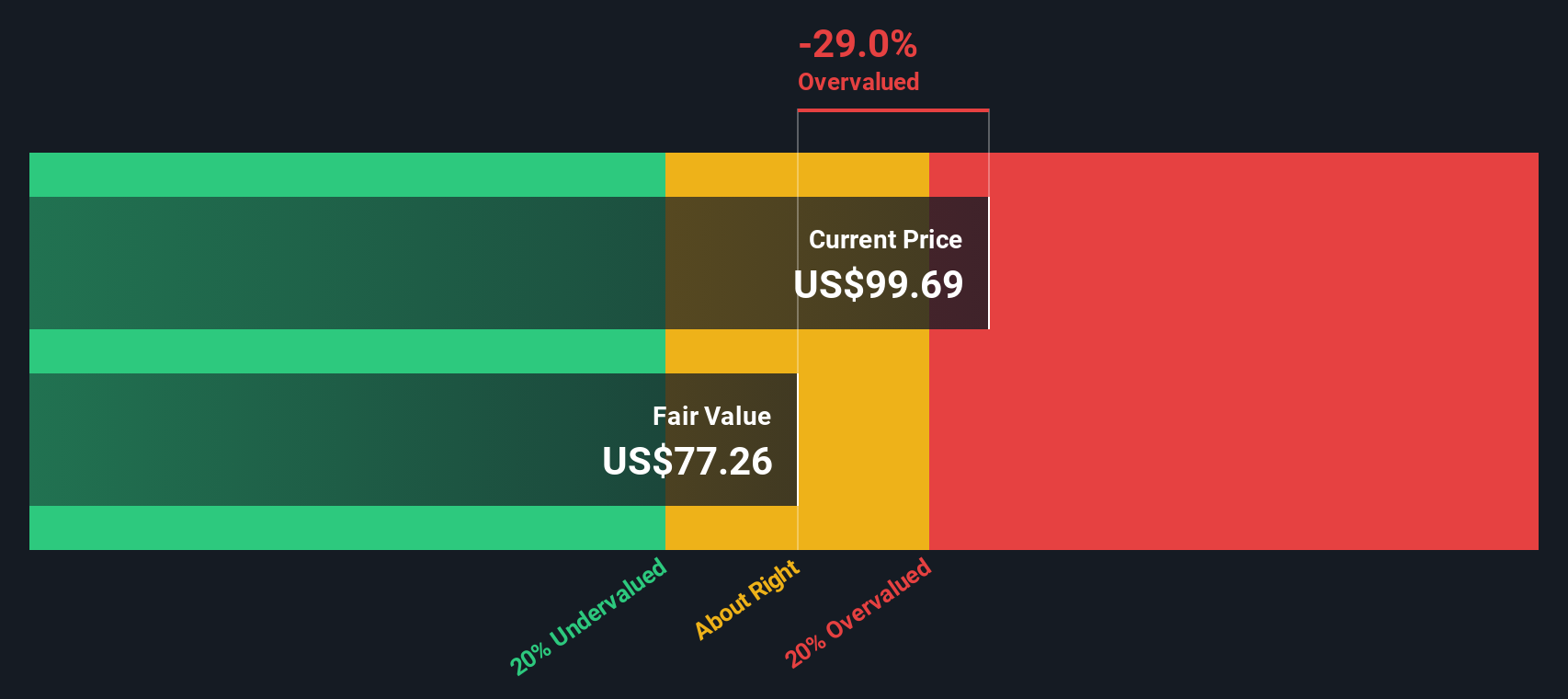

Another View: DCF Model Challenges the Upside

Looking through the lens of the SWS DCF model, Patrick Industries appears overvalued, with a fair value well below its current market price. This approach focuses on cash flow projections rather than analyst expectations and challenges some of the optimism found in the consensus. Which valuation method offers the clearest signal?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Patrick Industries Narrative

If you want a deeper dive or see the story differently, it takes just a few minutes to shape your own perspective. Do it your way

A great starting point for your Patrick Industries research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Expand your portfolio by tapping into fresh trends and growth themes that other investors are chasing right now. Don't miss your chance to spot tomorrow's top performers with powerful screening tools at your fingertips.

- Accelerate your growth strategy by targeting high-yield opportunities with these 19 dividend stocks with yields > 3%, which is ideal for income-focused investors seeking strong annual returns.

- Power your portfolio with rapid advancements by seizing the momentum behind these 24 AI penny stocks, where cutting-edge artificial intelligence companies are shaping the market.

- Supercharge your strategy and stay ahead of the crowd with market standouts found among these 896 undervalued stocks based on cash flows, helping you spot hidden value before it gets priced in.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PATK

Patrick Industries

Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives