- United States

- /

- Auto Components

- /

- NasdaqGS:PATK

Does Jeff Rodino’s Promotion Signal a New Strategic Phase for Patrick Industries (PATK)?

Reviewed by Sasha Jovanovic

- Patrick Industries, Inc. recently announced that Jeff Rodino has taken on the role of President, overseeing the company's leadership, strategic planning, and financial performance.

- This executive leadership change coincides with analysts highlighting Patrick Industries' attractive valuation metrics and cash flow, which has put the company in the investment spotlight.

- We’ll assess how Jeff Rodino’s appointment as President may influence Patrick Industries’ investment narrative and its outlook on future growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Patrick Industries Investment Narrative Recap

To be a shareholder in Patrick Industries, an investor needs to believe in the resilience of North American RV, marine, and manufactured housing markets, as well as the company’s capacity to adapt to changing consumer preferences. The recent appointment of Jeff Rodino as President is a meaningful internal move, but does not materially alter the immediate catalyst for Patrick, namely, the potential for demand recovery if interest rates ease. The most pressing risk remains the company’s exposure to cyclical end markets that are sensitive to economic and rate changes.

Among recent announcements, the July 2025 share buyback update stands out. The repurchase of over 277,000 shares signals ongoing confidence in long-term value creation, even as earnings have shown mixed trends and margin pressures persist. In this context, the company’s commitment to returning capital to shareholders may help offset near-term revenue volatility connected to broader industry cycles.

By contrast, investors should be aware of how a sharp rise in input costs or further economic slowdown could quickly...

Read the full narrative on Patrick Industries (it's free!)

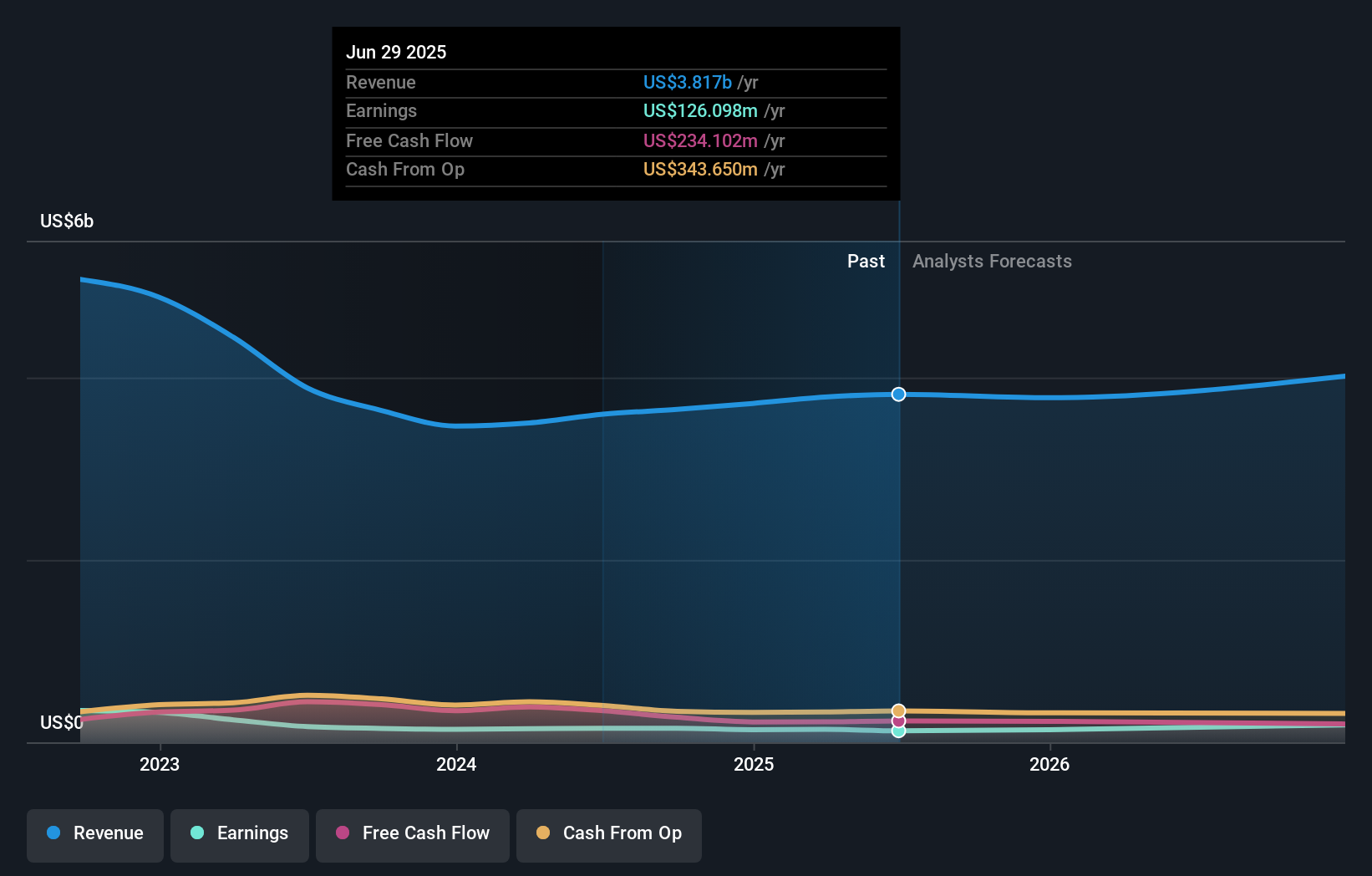

Patrick Industries is forecast to reach $4.2 billion in revenue and $273.7 million in earnings by 2028. This outlook is based on anticipated annual revenue growth of 3.2% and a $147.6 million increase in earnings from current levels of $126.1 million.

Uncover how Patrick Industries' forecasts yield a $108.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community provided fair value estimates for Patrick Industries, ranging from US$77.97 to US$108. While short-term demand could rebound if economic conditions improve, ongoing earnings volatility tied to cyclical markets remains a factor for future performance. Consider reviewing several viewpoints before forming your own expectations.

Explore 2 other fair value estimates on Patrick Industries - why the stock might be worth as much as $108.00!

Build Your Own Patrick Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patrick Industries research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Patrick Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patrick Industries' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PATK

Patrick Industries

Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives