- United States

- /

- Auto

- /

- NasdaqGS:LOT

Lotus Technology (NasdaqGS:LOT): Reassessing Valuation After IAA Mobility 2025 Reveal and Analyst Optimism

Reviewed by Kshitija Bhandaru

Lotus Technology (NasdaqGS:LOT) drew investor attention after announcing plans to showcase its Theory 1 concept car and unveil a Senna-inspired Emira Limited at IAA Mobility 2025 in Munich. The company continues to focus on product innovation, even though delivery numbers are lower this year.

See our latest analysis for Lotus Technology.

Lotus Technology’s announcement of its upcoming IAA Mobility 2025 showcase, despite a sharp 49% drop in Q2 deliveries, has reignited interest and suggests that the market is hoping new models will help turn things around. Even so, the stock’s recent total shareholder return has slipped by just over half a percent in the past year, reflecting a cautious but still watchful sentiment among investors as the company navigates both near-term challenges and long-term promise.

If Lotus’s bold moves make you curious about the broader sector, now’s the perfect moment to discover See the full list for free.

With the shares now down over 57% in the past year and still trading at a notable discount to analyst price targets, investors are left wondering whether Lotus Technology represents a true value opportunity or if the market is already factoring in its future trajectory.

Most Popular Narrative: 29% Undervalued

The narrative assigns Lotus Technology a fair value of $3.00 per share, notably above the last close at $2.13. The gap reflects confidence in a turnaround, even as current figures are challenged.

The recently completed funding agreements, including a $300 million convertible note with ATW Partners and new credit facilities from Geely, enhance balance sheet flexibility and ensure sufficient capital for accelerated product development, technology innovation, and global expansion. These initiatives support higher future revenues and improved operating margins.

Curious what powers this bullish outlook? The secret lies in daring growth targets, improved margins, and a valuation multiple inspired by high-flying peers. Can Lotus hit the numbers behind this price? The narrative’s core assumptions may surprise you.

Result: Fair Value of $3.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing steep delivery declines and persistent net losses could undermine the bullish case if Lotus struggles to regain momentum and achieve sustainable profitability.

Find out about the key risks to this Lotus Technology narrative.

Another View: Industry Multiples Paint a Harsher Picture

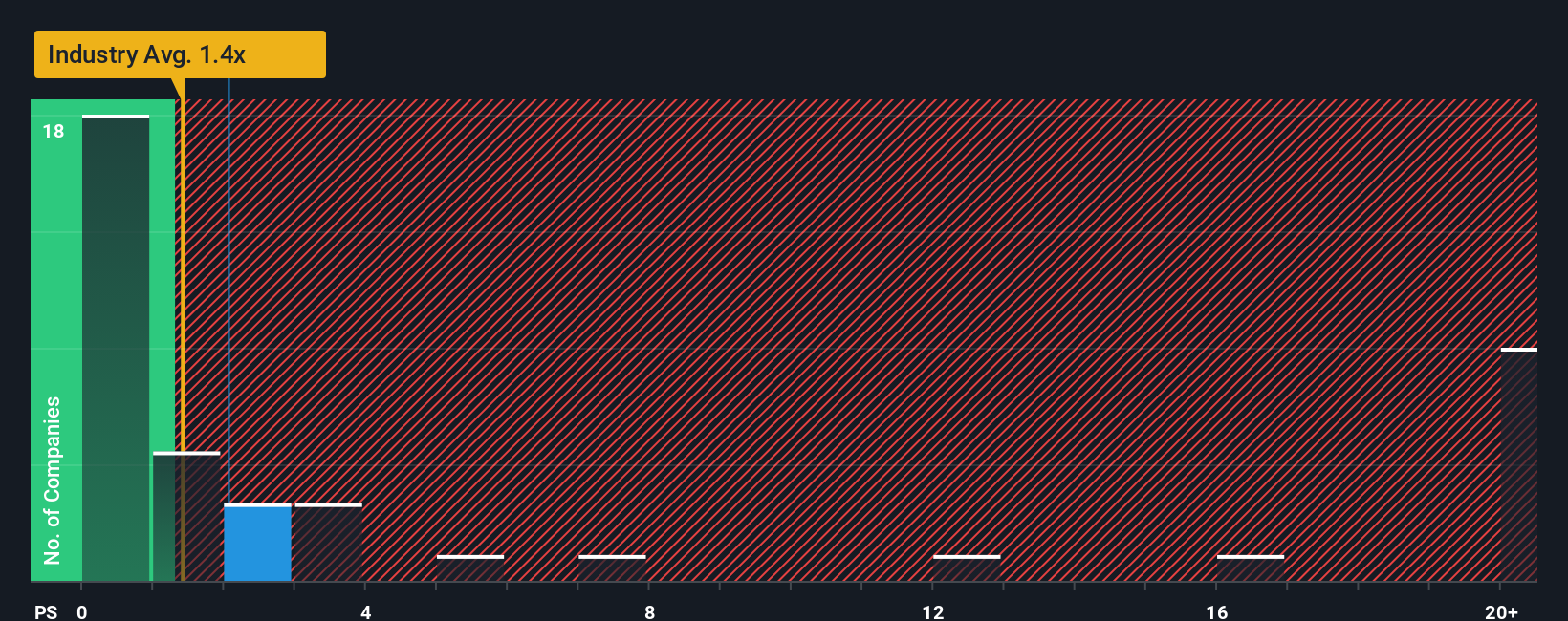

While the fair value estimate suggests Lotus Technology is undervalued, comparing its price-to-sales ratio of 1.9x to the US Auto industry's 1.4x average tells a different story. Against its peer group at 11.7x, Lotus appears cheap. However, compared to the market and the fair ratio of 2.4x, it still carries some risk. Does this mean the upside is capped or that the market is missing a comeback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lotus Technology Narrative

If you’d rather draw your own conclusions or want to dig deeper into the numbers, you can build a personal valuation view in just a few minutes, or Do it your way.

A great starting point for your Lotus Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now and expand your horizons; there are smart opportunities waiting beyond Lotus Technology. Don’t let your next breakout stock pass you by.

- Unlock strong income potential by checking out these 19 dividend stocks with yields > 3% that deliver consistent yields and reward shareholders with solid cash returns.

- Seize the edge in innovation by targeting these 24 AI penny stocks advancing artificial intelligence across industries and set to shape the future of tech.

- Capture tomorrow’s growth stories early by scouting these 3566 penny stocks with strong financials with robust fundamentals and market-defying potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LOT

Lotus Technology

Engages in the design, development, and sale of battery electric lifestyle vehicles worldwide.

High growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success