- United States

- /

- Auto

- /

- NasdaqGS:LI

Li Auto Inc. (NASDAQ:LI) Stocks Shoot Up 39% But Its P/E Still Looks Reasonable

The Li Auto Inc. (NASDAQ:LI) share price has done very well over the last month, posting an excellent gain of 39%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

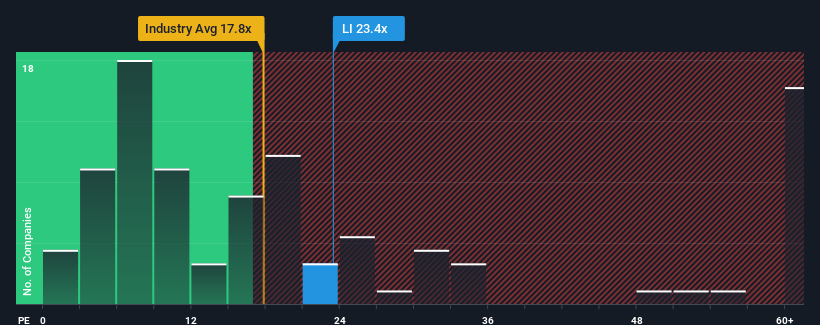

After such a large jump in price, Li Auto may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.4x, since almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Li Auto has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Li Auto

Is There Enough Growth For Li Auto?

The only time you'd be truly comfortable seeing a P/E as high as Li Auto's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered an exceptional 59% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the analysts watching the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we can see why Li Auto is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Li Auto's P/E?

The large bounce in Li Auto's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Li Auto maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Li Auto with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LI

Li Auto

Operates in the energy vehicle market in the People’s Republic of China.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives