- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (LCID): Evaluating Valuation Gaps and Future Prospects After Recent Developments

Reviewed by Simply Wall St

Lucid Group (LCID) shares have moved modestly over the past week, down about 1% in the past month and 37% lower over the past 3 months. Investors are weighing recent developments and performance numbers as they try to gauge where the stock might go next.

See our latest analysis for Lucid Group.

Lucid Group’s 1-month share price return of -28.95% adds to a tough year, with the 1-year total shareholder return sinking 38.5%. While recent momentum has faded, investors remain alert for signs of renewed growth potential or shifts in perceived risk.

If Lucid’s swings have you rethinking your watchlist, this could be the perfect moment to discover See the full list for free.

With Lucid shares trading at a steep discount from recent highs, the question for investors is clear: is this a prime entry point for value hunters, or are ongoing challenges already reflected in the price?

Most Popular Narrative: 28.7% Undervalued

Relative to Lucid Group's last close at $13.13, the most popular narrative places fair value around $18.43. This suggests a meaningful gap that has many investors watching for a turning point. The narrative is based on high expectations for Lucid’s expansion through innovative partnerships and breakthrough product launches, all set against ongoing uncertainty about profits.

The newly announced Uber and Nuro partnership, including a planned $300 million Uber investment and a commitment to deploy at least 20,000 Lucid Gravity vehicles as robotaxis over six years, is expected to open a large and fast-growing autonomous fleet market to Lucid. This initiative could drive significant revenue expansion and potential margin improvement through technology licensing and high-volume fleet sales.

Want a look beneath the headlines? This valuation rests on bold projections for Lucid's revenue surge and margin transformation. What aggressive financial assumptions make this possible? The full narrative reveals the pivotal beliefs shaping this eye-catching target.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent negative margins and Lucid's reliance on external funding could challenge the upbeat narrative, particularly if setbacks delay progress toward profitability.

Find out about the key risks to this Lucid Group narrative.

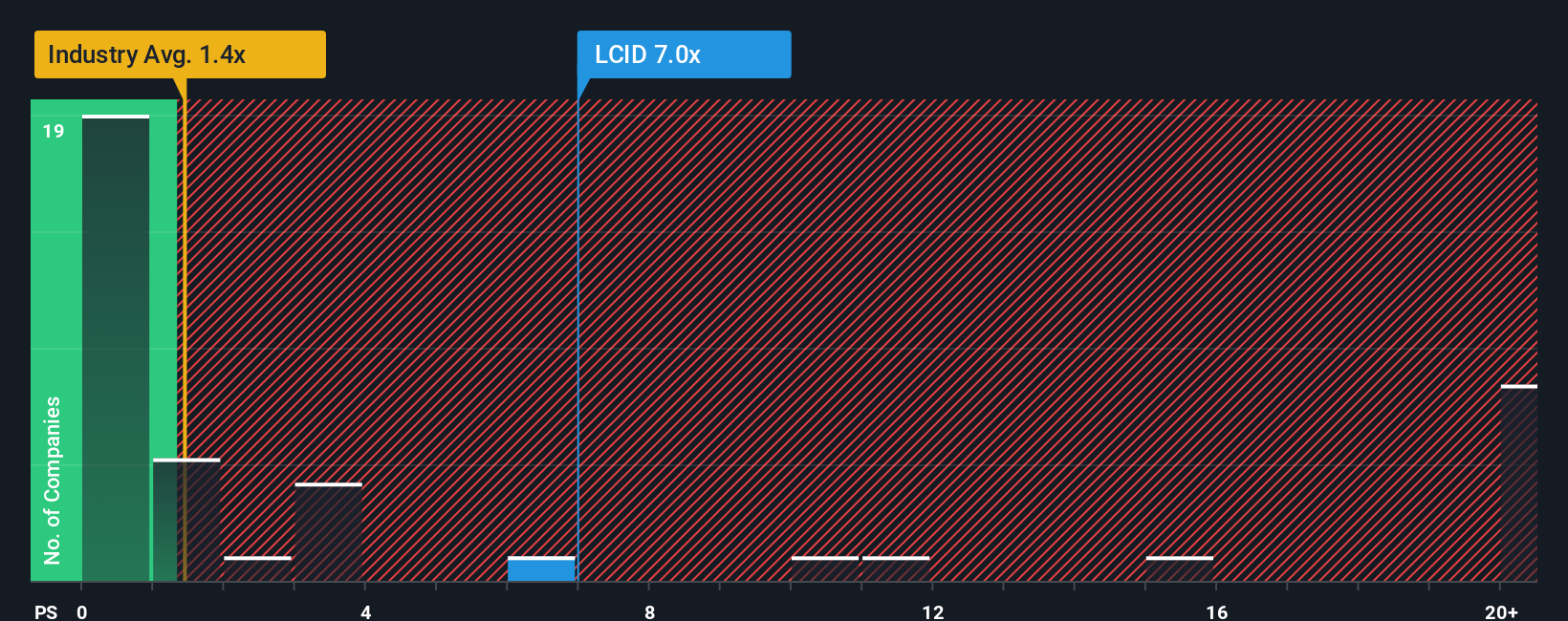

Another View: Price-to-Sales Multiple Tells a Different Story

Looking beyond the bullish narrative, Lucid trades at a price-to-sales ratio of 4x. This is substantially higher than both the US Auto industry average of 0.8x and its peers. The fair ratio, based on regression analysis, is just 0.1x. This significant gap suggests Lucid may be overvalued on this basis, posing valuation risks if the market shifts towards industry norms. Could this divergence last, or is a correction on the horizon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If these views do not align with your perspective, or you would rather rely on your own analysis, you can shape your own narrative in under three minutes, Do it your way

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let great opportunities pass by. The Simply Wall Street Screener puts you within reach of cutting-edge investment themes you will not want to miss out on.

- Boost your portfolio’s income potential by targeting steady payouts through these 14 dividend stocks with yields > 3% with yields above 3%.

- Ride the exponential growth of artificial intelligence by backing innovation leaders among these 26 AI penny stocks poised for rapid expansion.

- Capitalize on mispriced opportunities and secure value with these 925 undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success