- United States

- /

- Auto

- /

- NasdaqGS:LCID

Lucid Group (LCID): Evaluating Valuation as Shares Extend Recent Decline

Reviewed by Kshitija Bhandaru

Lucid Group (LCID) stock has caught investors’ attention after recent trading activity saw a drop of about 4% in a single day. The electric vehicle maker’s share price movement has prompted some investors to re-evaluate its valuation and near-term outlook.

See our latest analysis for Lucid Group.

Lucid’s share price drop this week continues a broader losing streak, with the stock down over 35% year-to-date and the one-year total shareholder return showing a substantial 25% decline. While recent trading could be a sign investors are reassessing near-term risks, it also highlights lingering uncertainty around the company’s growth story and ability to deliver on expectations in a competitive EV landscape.

If Lucid's latest moves have you eyeing the wider auto sector, it might be the perfect time to explore See the full list for free.

With shares trading well below analyst targets and the company still posting sizable losses, investors are left to decide: is Lucid Group currently undervalued, or is the market already accounting for all future growth potential?

Most Popular Narrative: 17.5% Undervalued

With the current stock price trailing the most popular narrative’s fair value by a sizeable margin, the discussion centers on whether Lucid’s strategic vision will deliver the upside projected by analysts.

The newly announced Uber and Nuro partnership, including a planned $300 million Uber investment and a commitment to deploy at least 20,000 Lucid Gravity vehicles as robotaxis over six years, is expected to open a large and fast-growing autonomous fleet market to Lucid. This development could drive significant revenue expansion and potential margin improvement through technology licensing and high-volume fleet sales.

What bold projections power this valuation spike? The narrative hints at game-changing revenue acceleration and ambitious margin targets. Curious to see which assumptions shape this fair value and what sets Lucid’s outlook apart from competitors? Don’t miss the full breakdown behind these numbers.

Result: Fair Value of $23.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly negative gross margins and ongoing reliance on external capital could disrupt Lucid’s path to profitability and test investors’ patience.

Find out about the key risks to this Lucid Group narrative.

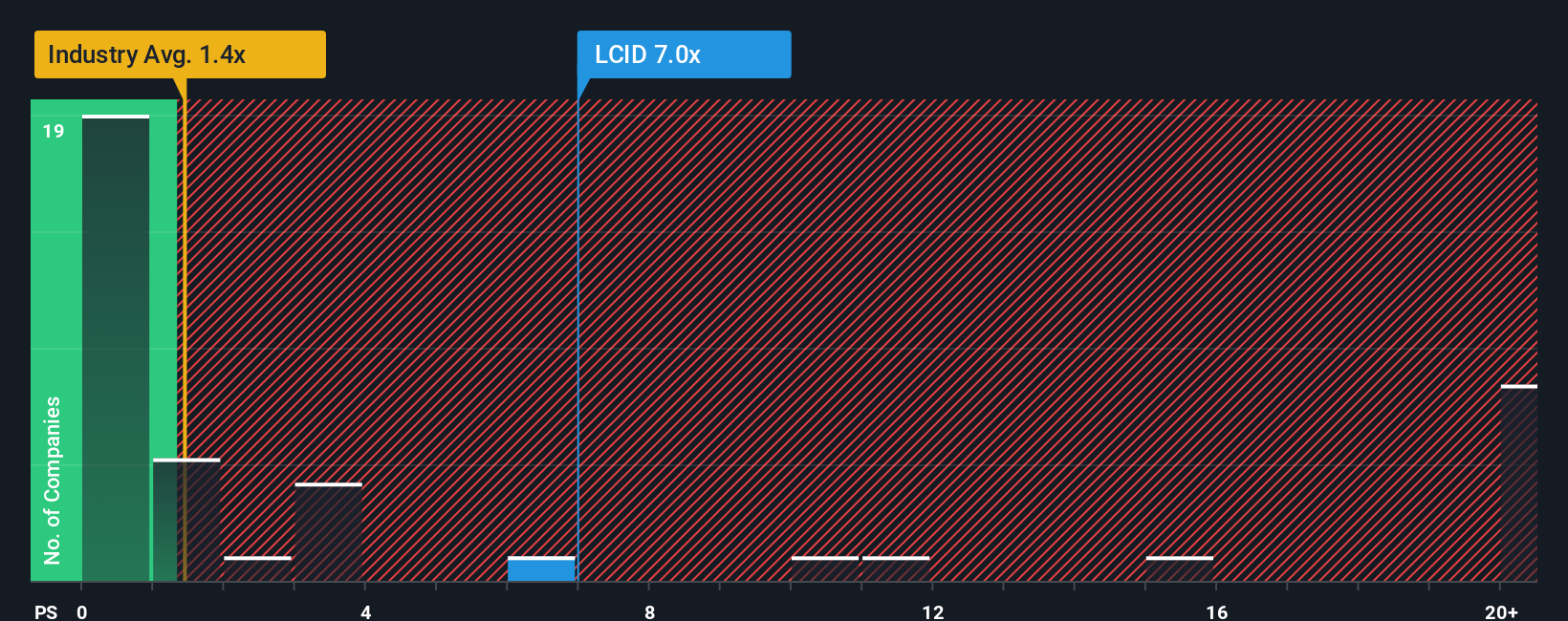

Another View: Multiples Tell a Different Story

Looking at Lucid's price-to-sales ratio of 6.5x, the stock stands out as much pricier than its industry peers, which trade closer to 1.3x, and compared to a fair ratio of just 0.1x. This suggests that the market has priced in very high expectations, raising questions about valuation risk versus future reward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lucid Group Narrative

If the current viewpoint does not align with your instincts or you would rather dig into the numbers firsthand, you can easily shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Lucid Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Stay ahead by handpicking stocks that match your strategy; there are countless ways to build your winning portfolio.

- Boost your income goals by tapping into stable companies offering attractive yields with these 18 dividend stocks with yields > 3%.

- Take charge of the future with breakthrough innovations and growth stories found through these 24 AI penny stocks.

- Secure your edge and spot value opportunities that the market might be missing via these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LCID

Lucid Group

A technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives