- United States

- /

- Auto Components

- /

- NasdaqGS:LAZR

Is Luminar (LAZR) Prioritizing Prestigious Partnerships Over Near-Term Financial Stability?

Reviewed by Sasha Jovanovic

- Earlier this week, Luminar Technologies announced that its lidar technology is now integrated into Volvo’s EX90 and is being included on platforms from Mercedes-Benz, NVIDIA, and Mobileye, while it also provided updates on its next-generation “Halo” chipset and production plans for late 2025 and early 2026.

- An interesting takeaway is that despite these prominent partnerships and advancements, the company revised its full-year 2025 guidance downward due to slower automotive ramp-up, winding down of legacy contracts, and ongoing financial challenges.

- We’ll examine how management’s revised outlook and focus on new automotive partnerships shape Luminar’s current investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Luminar Technologies Investment Narrative Recap

To be a shareholder in Luminar Technologies, you need to believe that lidar adoption by major automakers will drive exceptional long-term growth, even if profits remain elusive for some time. The recent news of integrations with Volvo, Mercedes-Benz, NVIDIA, and Mobileye highlights Luminar’s technological relevance, but the surprise downward revision to 2025 guidance signals that the pace of scaling up automotive production remains the most important short-term catalyst and risk; the announcement does not materially alter this dynamic.

Among the recent company updates, the progress on Luminar’s “Halo” chipset and production line stands out. If the next-generation technology launches as planned in late 2025 and meets automaker timelines, it could enable the cost efficiency and product consolidation that management is counting on to improve margins and strengthen Luminar’s competitive position.

Yet despite the optimism around new platform wins, it’s important for investors to be aware of the contrast presented by Luminar’s persistent financial challenges, especially…

Read the full narrative on Luminar Technologies (it's free!)

Luminar Technologies' outlook anticipates $235.6 million in revenue and $10.7 million in earnings by 2028. This scenario implies a 46.2% annual revenue growth rate and a $283.8 million increase in earnings from the current level of -$273.1 million.

Uncover how Luminar Technologies' forecasts yield a $2.67 fair value, a 20% upside to its current price.

Exploring Other Perspectives

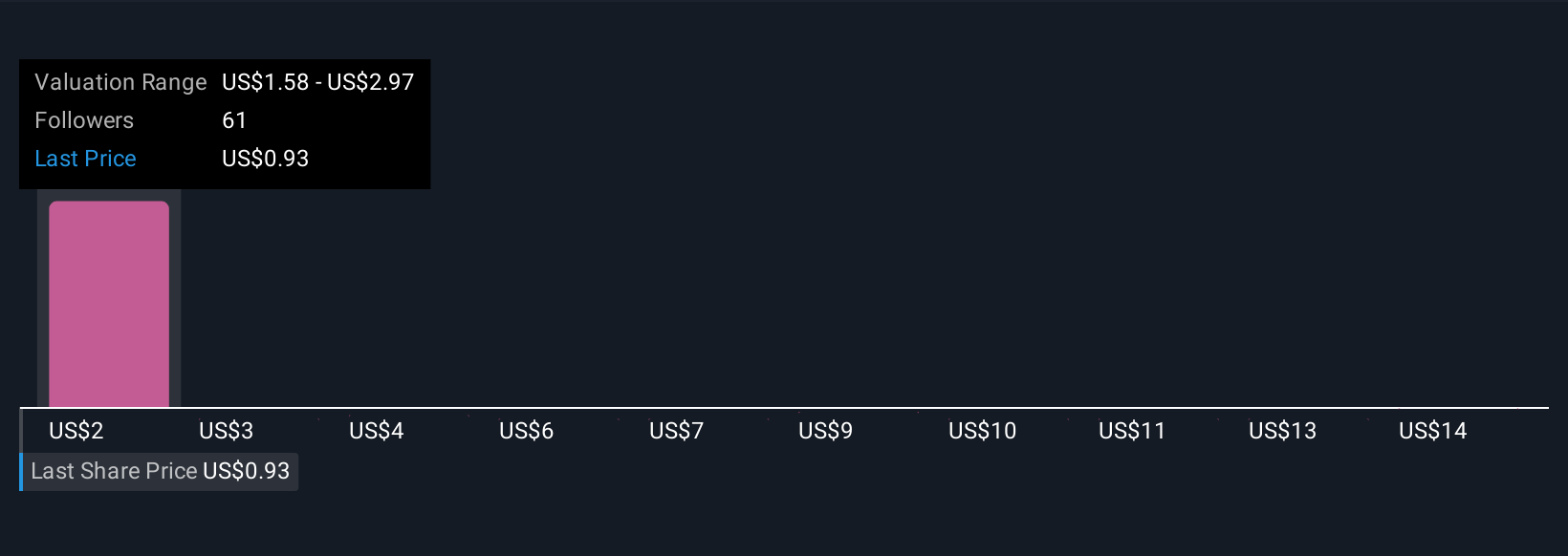

Eight fair value estimates from the Simply Wall St Community span a wide range, from US$1.58 to US$15.50 per share. While some see upside, others flag that ongoing losses and a slow automotive ramp could keep pressure on the company’s performance, review several viewpoints to understand this diverse outlook.

Explore 8 other fair value estimates on Luminar Technologies - why the stock might be worth over 6x more than the current price!

Build Your Own Luminar Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luminar Technologies research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Luminar Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luminar Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAZR

Luminar Technologies

An automotive technology company, provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion