- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

The Kandi Technologies Group (NASDAQ:KNDI) Share Price Is Up 40% And Shareholders Are Holding On

Buying a low-cost index fund will get you the average market return. But across the board there are plenty of stocks that underperform the market. That's what has happened with the Kandi Technologies Group, Inc. (NASDAQ:KNDI) share price. It's up 40% over three years, but that is below the market return. Having said that, the 30% increase over the past year is good to see.

View our latest analysis for Kandi Technologies Group

Because Kandi Technologies Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 3 years Kandi Technologies Group saw its revenue shrink by 3.6% per year. The modest share price gain of 12% per year suggests holders are sanguine about the falling revenue. As a general rule we don't like it when a loss-making company isn't even growing revenue.

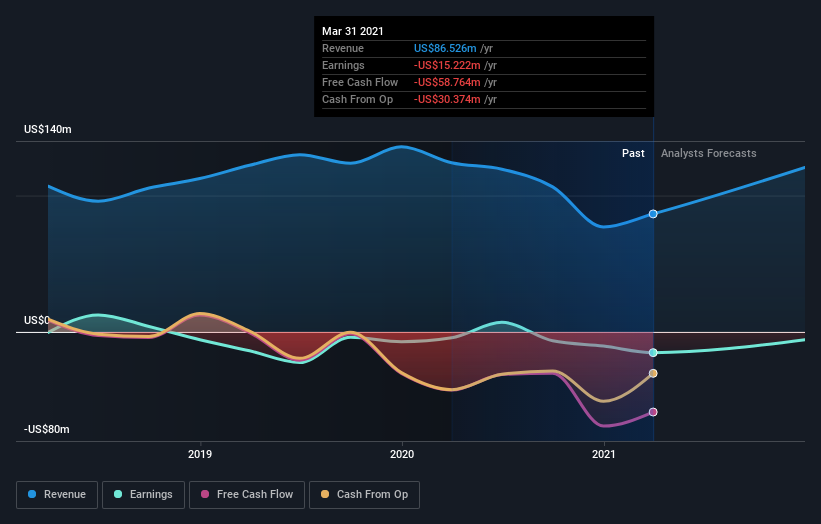

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Kandi Technologies Group

A Different Perspective

Kandi Technologies Group shareholders gained a total return of 30% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 3% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Kandi Technologies Group better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Kandi Technologies Group you should be aware of.

Of course Kandi Technologies Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Kandi Technologies Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kandi Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:KNDI

Kandi Technologies Group

Produces and sells electric off-road vehicles and associated parts in the People’s Republic of China, the United States, and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives