- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

Imagine Owning Kandi Technologies Group (NASDAQ:KNDI) While The Price Tanked 69%

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example the Kandi Technologies Group, Inc. (NASDAQ:KNDI) share price dropped 69% over five years. That is extremely sub-optimal, to say the least. And we doubt long term believers are the only worried holders, since the stock price has declined 48% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days.

Check out our latest analysis for Kandi Technologies Group

Kandi Technologies Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Kandi Technologies Group saw its revenue shrink by 14% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 21% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

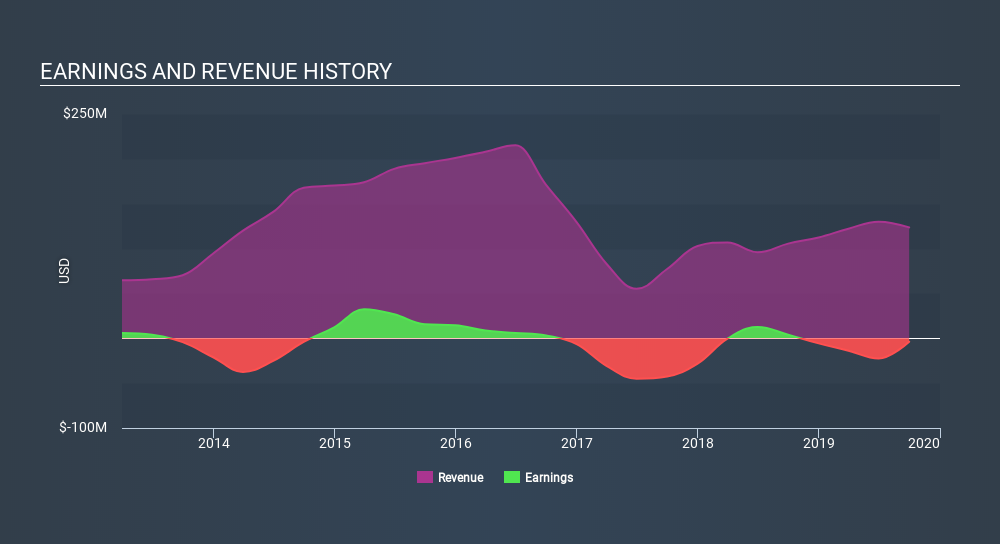

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Kandi Technologies Group's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 20% in the last year, Kandi Technologies Group shareholders lost 48%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Kandi Technologies Group (of which 2 are a bit concerning!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:KNDI

Kandi Technologies Group

Engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People’s Republic of China, the United States and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives