- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

Subdued Growth No Barrier To Hesai Group (NASDAQ:HSAI) With Shares Advancing 42%

Despite an already strong run, Hesai Group (NASDAQ:HSAI) shares have been powering on, with a gain of 42% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 90% in the last year.

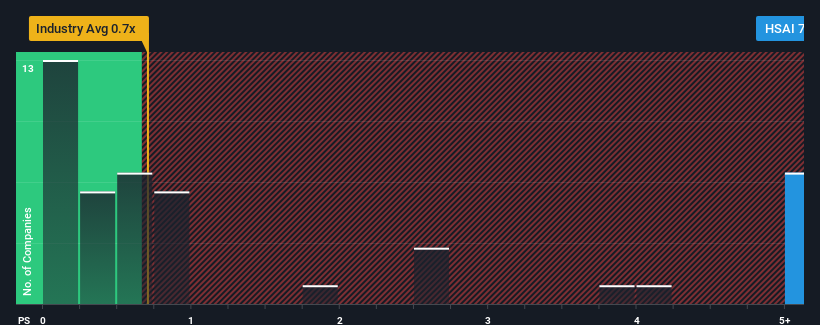

Following the firm bounce in price, when almost half of the companies in the United States' Auto Components industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Hesai Group as a stock not worth researching with its 7.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Hesai Group

How Hesai Group Has Been Performing

Recent times have been pleasing for Hesai Group as its revenue has risen in spite of the industry's average revenue going into reverse. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hesai Group.Is There Enough Revenue Growth Forecasted For Hesai Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hesai Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 208% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 44% per annum as estimated by the ten analysts watching the company. That's shaping up to be similar to the 47% each year growth forecast for the broader industry.

With this information, we find it interesting that Hesai Group is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Hesai Group's P/S Mean For Investors?

Hesai Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Hesai Group currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Hesai Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives