- United States

- /

- Auto Components

- /

- NasdaqGS:HSAI

Earnings Beat: Hesai Group Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Models

There's been a notable change in appetite for Hesai Group (NASDAQ:HSAI) shares in the week since its quarterly report, with the stock down 11% to US$19.78. It looks to have been a decent result overall - while revenue fell marginally short of analyst estimates at CN¥795m, statutory earnings beat expectations by a notable 150%, coming in at CN¥1.79 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

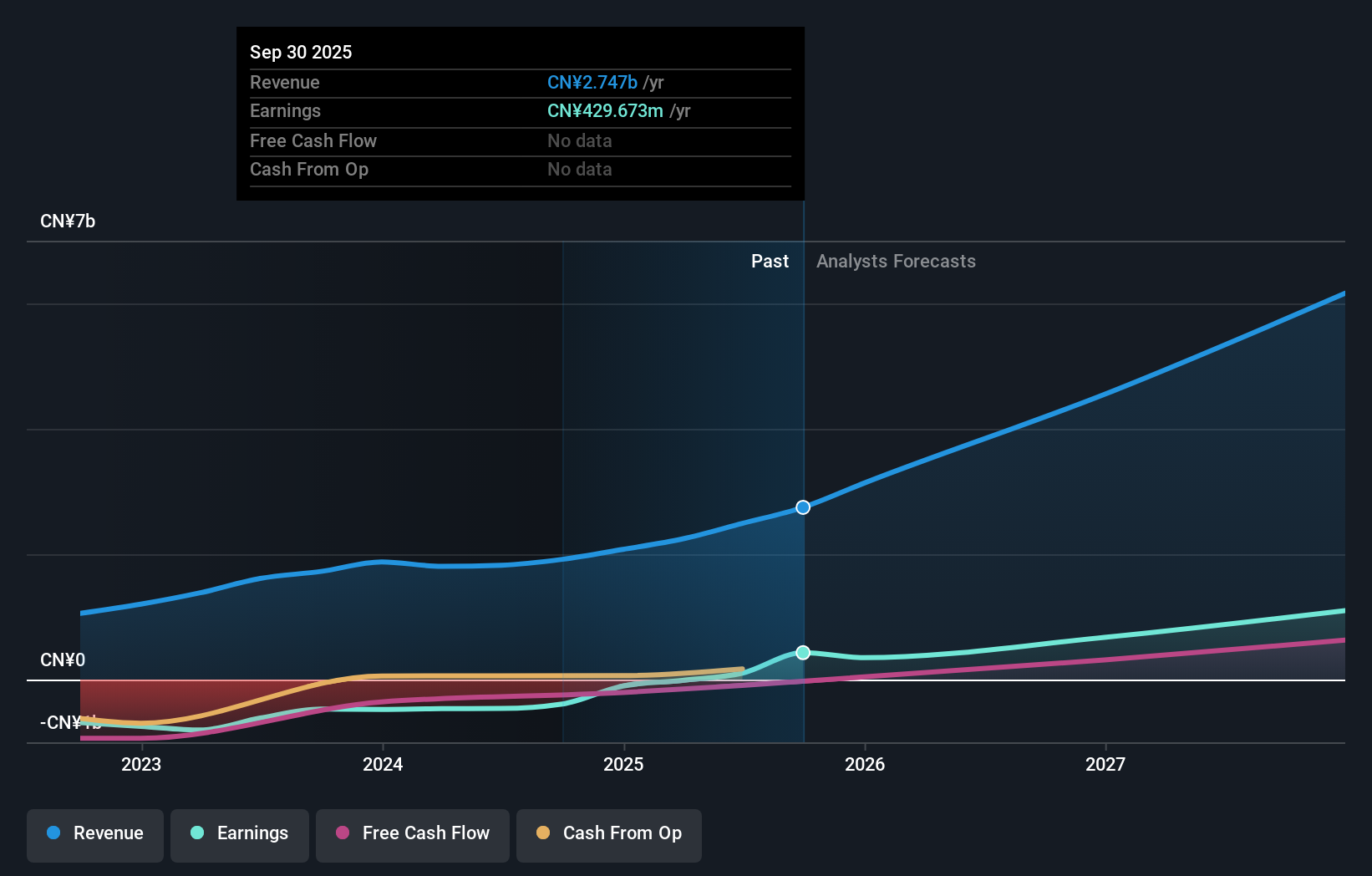

Taking into account the latest results, the most recent consensus for Hesai Group from 17 analysts is for revenues of CN¥4.55b in 2026. If met, it would imply a sizeable 66% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to shoot up 75% to CN¥4.83. Before this earnings report, the analysts had been forecasting revenues of CN¥4.68b and earnings per share (EPS) of CN¥5.05 in 2026. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a minor downgrade to earnings per share estimates.

See our latest analysis for Hesai Group

The analysts made no major changes to their price target of US$30.02, suggesting the downgrades are not expected to have a long-term impact on Hesai Group's valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Hesai Group, with the most bullish analyst valuing it at US$38.20 and the most bearish at US$24.31 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Hesai Group's growth to accelerate, with the forecast 50% annualised growth to the end of 2026 ranking favourably alongside historical growth of 33% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 15% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Hesai Group to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Hesai Group. They also downgraded Hesai Group's revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Hesai Group going out to 2027, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for Hesai Group that we have uncovered.

Valuation is complex, but we're here to simplify it.

Discover if Hesai Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HSAI

Hesai Group

Through with its subsidiaries, engages in the development, manufacture, and sale of three-dimensional light detection and ranging solutions (LiDAR) in Mainland China, Europe, North America, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives