- United States

- /

- Auto Components

- /

- NasdaqGS:GTX

Will Leadership Changes at Garrett Motion (GTX) Shape Its Zero-Emission Ambitions?

Reviewed by Sasha Jovanovic

- On September 25, 2025, Garrett Motion announced that Jerome Maironi, Senior Vice President, General Counsel & Corporate Secretary, will retire on March 31, 2026, stepping down from his executive roles on October 1, 2025, and assisting with the transition until his departure.

- Recent analyst initiations and commentary have focused on the company's pursuit of US$1 billion in zero-emission revenue by 2030, underscoring growing market interest in Garrett Motion’s transformation toward advanced emissions technologies.

- Given the heightened analyst optimism on zero-emission growth, we'll assess how this influences Garrett Motion’s long-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Garrett Motion Investment Narrative Recap

The core investment thesis for Garrett Motion centers on its ability to balance stable cash flow from legacy turbocharger products with early-stage but fast-developing zero-emission technologies. The recent retirement notice from Jerome Maironi, while an important organizational change, does not appear to materially impact near-term catalysts such as program wins in electrified systems, nor does it alter the immediate risk surrounding the pace of the company’s electrification transition.

Among recent developments, the launch of the Wuhan Innovation Center in China is most relevant: this facility aims to accelerate Garrett’s zero-emission R&D. While this reinforces the company’s stated pivot toward electrified and fuel cell technologies, key drivers for future growth, the progress of these innovations remains crucial for mitigating exposure to the declining addressable market for traditional internal combustion engine components.

Yet, in contrast to growth optimism, investors should be aware of how persistent margin pressure from the changing sales mix may continue to affect...

Read the full narrative on Garrett Motion (it's free!)

Garrett Motion's outlook anticipates $3.8 billion in revenue and $339.1 million in earnings by 2028. This scenario implies a 3.1% annual revenue growth rate and a $38.1 million earnings increase from current earnings of $301.0 million.

Uncover how Garrett Motion's forecasts yield a $15.83 fair value, a 14% upside to its current price.

Exploring Other Perspectives

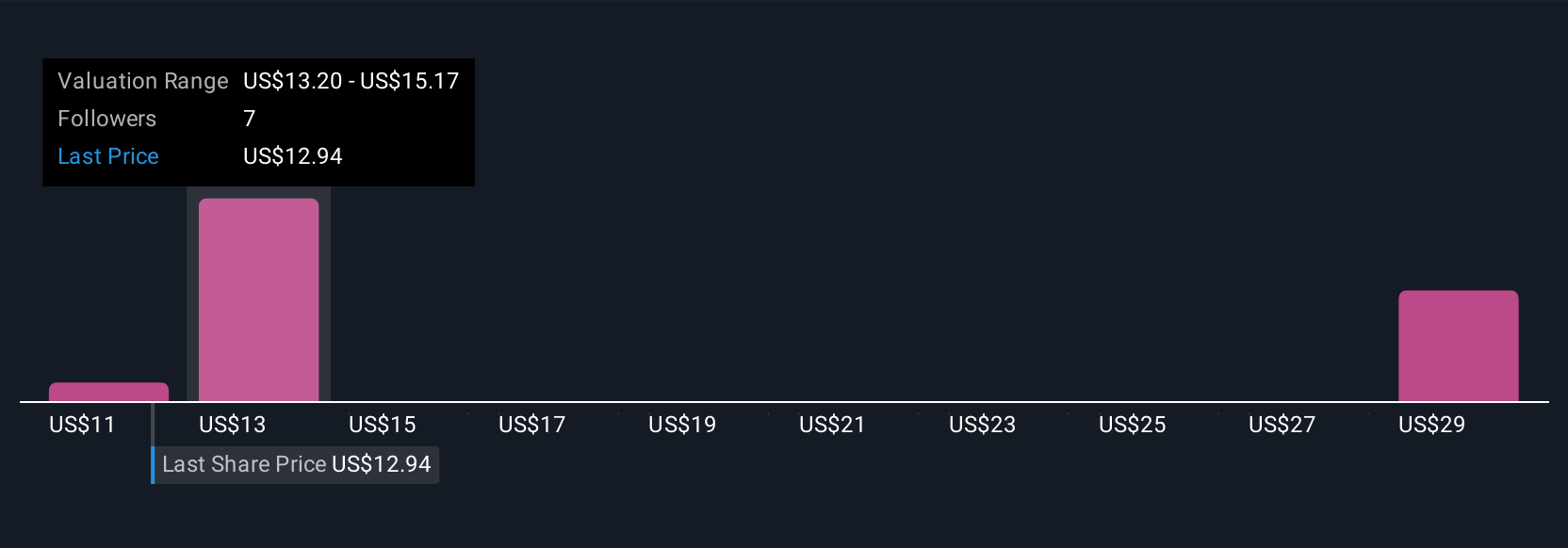

Simply Wall St Community members posted three fair value estimates for Garrett Motion ranging from US$11.24 to US$30.49. Against this diversity of opinions, the company’s continued focus on zero-emission initiatives underscores differing views on how successfully future revenue streams could offset legacy ICE declines.

Explore 3 other fair value estimates on Garrett Motion - why the stock might be worth over 2x more than the current price!

Build Your Own Garrett Motion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Garrett Motion research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Garrett Motion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Garrett Motion's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GTX

Garrett Motion

Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives