- United States

- /

- Auto Components

- /

- NasdaqGS:GT

Does the Recent Dividend Suspension Signal a New Era for Goodyear’s Share Price in 2025?

Reviewed by Bailey Pemberton

If you are thinking about buying, selling, or holding Goodyear Tire & Rubber stock right now, you are definitely not alone. Investors have been watching closely as the company’s share price has taken some sharp turns in recent months. After closing at $7.53 most recently, Goodyear’s stock is down 4.4% over the past week and off by a notable 10.3% for the last 30 days. Looking further back, the year-to-date return is negative at 13.9%, and even the one- and three-year timeframes show the stock lagging behind with returns of -7.6% and -32.9%, respectively. That paints a stark long-term picture, but it may also hint at opportunity, especially when you consider that Goodyear is undervalued in 5 out of 6 commonly used checks, earning it a tough-to-ignore value score of 5. Recent market shifts and changing perceptions of cyclical industries like tires could be throwing some curveballs, but they also open the door to re-evaluating what the stock is truly worth. Up next, we will break down how various valuation methods stack up for Goodyear. If you are searching for the best way to judge value, stick around for the conclusion, where we will highlight a smarter, more holistic approach you will not want to miss.

Why Goodyear Tire & Rubber is lagging behind its peers

Approach 1: Goodyear Tire & Rubber Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value. For Goodyear Tire & Rubber, this method relies on projecting the company’s Free Cash Flow (FCF) based on current performance and expert estimates, then adjusting for time and risk.

Currently, Goodyear’s Free Cash Flow sits at a negative $533.1 Million, reflecting recent industry pressures. However, analysts expect a recovery. Projections for 2026 and 2027 put annual cash flows at $310.3 Million and $373.1 Million, respectively. Simply Wall St projects ten-year FCF growth reaching $633.8 Million by 2035. These forward-looking figures suggest a return to stronger operational performance over the long run.

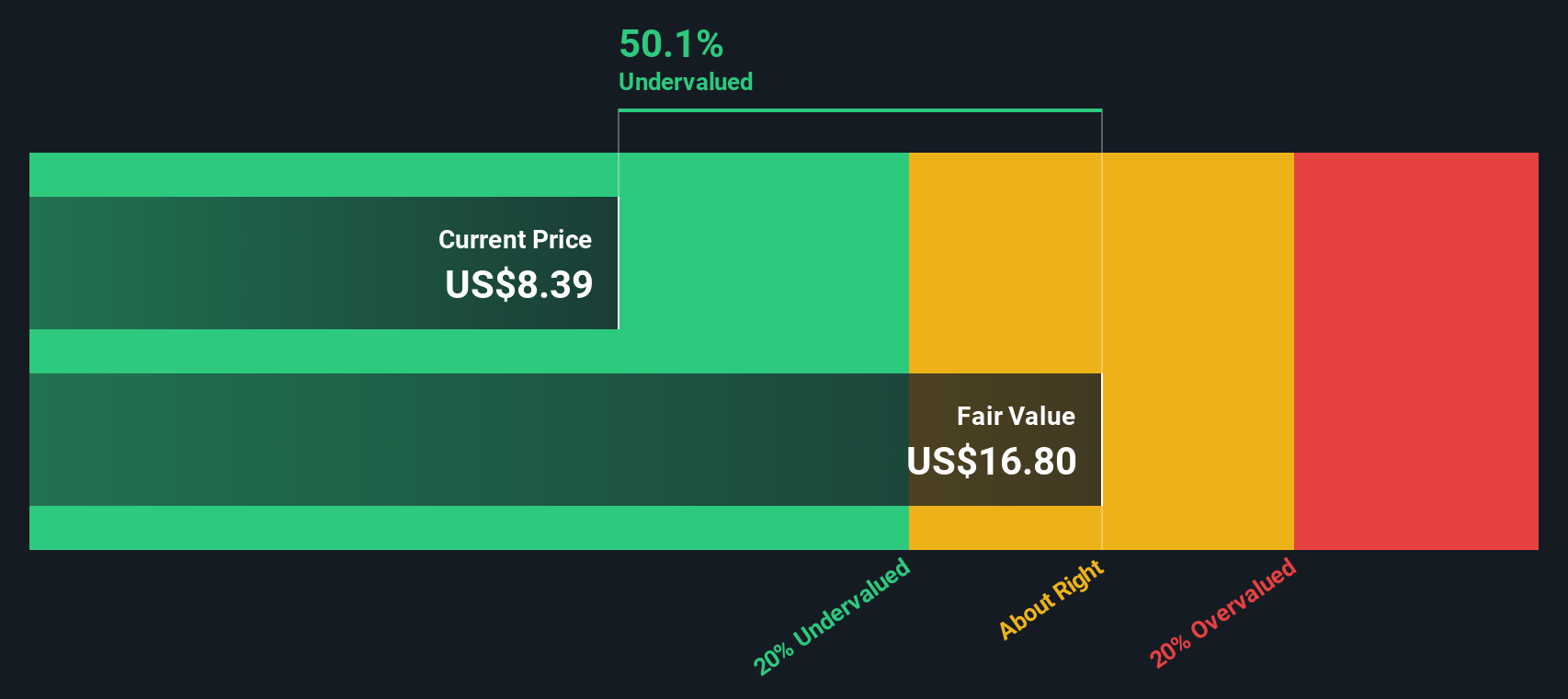

Using the two-stage Free Cash Flow to Equity model, the DCF calculation results in an estimated intrinsic value of $16.80 per share, significantly higher than the current market price of $7.53. This suggests the stock is trading at a 55.2% discount to its fair value, indicating potential upside if projections are met.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Goodyear Tire & Rubber is undervalued by 55.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Goodyear Tire & Rubber Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is commonly used to value established, profitable companies. It captures how much investors are willing to pay for each dollar of current earnings, reflecting both growth expectations and perceived risk. A higher PE can point to optimism about future profits or lower risk. In contrast, a lower PE may indicate market skepticism or heightened challenges.

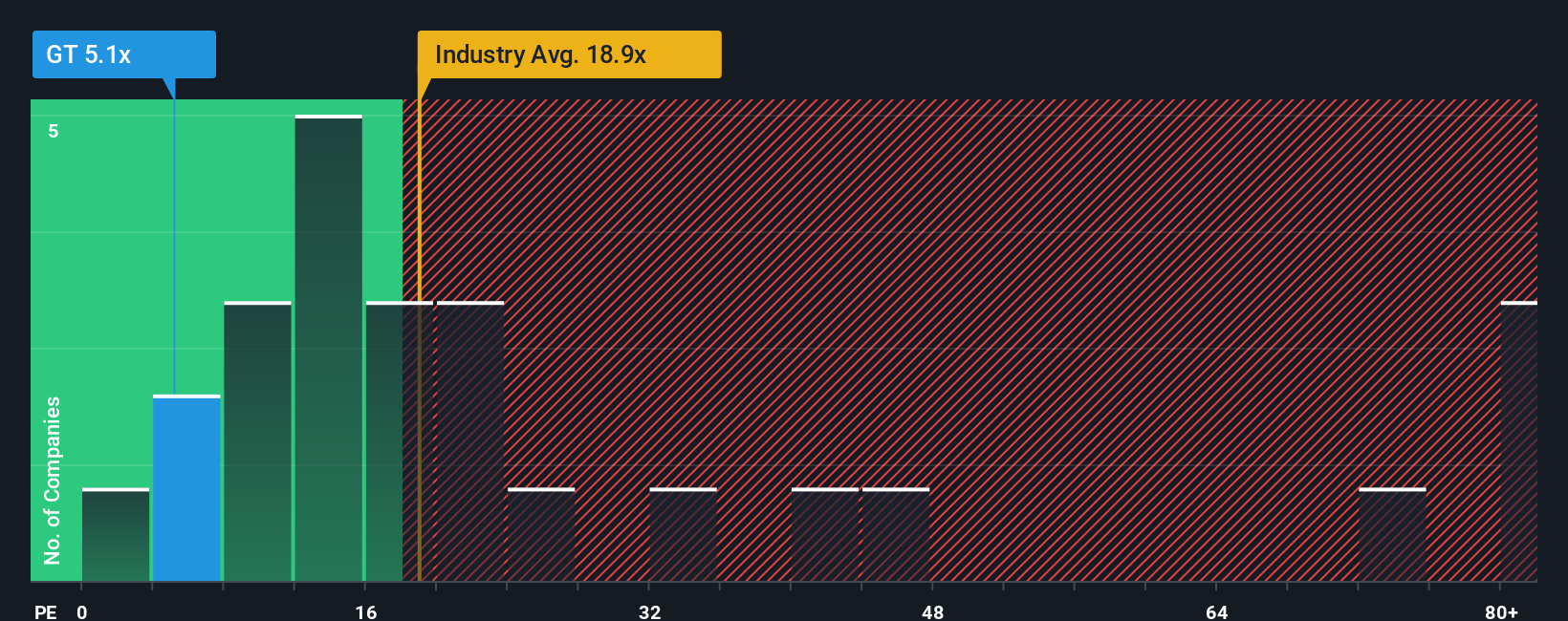

Goodyear Tire & Rubber currently trades at a PE ratio of just 5.0x, which is dramatically below both the Auto Components industry average of 18.8x and the broader peer group average of 34.6x. At first glance, this sizeable discount could indicate undervaluation. However, it is important to dig deeper to understand whether this gap is justified or if it represents a real opportunity for investors.

To provide more context, the Simply Wall St “Fair Ratio” for Goodyear is 11.3x. Unlike simple comparisons to industry or peers, the Fair Ratio is tailored to the company’s own growth outlook, margins, risk profile, industry conditions, and market capitalization. This proprietary metric presents a more comprehensive benchmark for what Goodyear’s PE should be, instead of relying on broad averages that may not reflect its specific situation.

With Goodyear’s actual PE ratio at 5.0x compared to the 11.3x Fair Ratio, there is a meaningful gap suggesting the stock remains undervalued by this measure as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Goodyear Tire & Rubber Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story, a way to connect Goodyear Tire & Rubber’s actual business context and prospects to a clear, numbers-backed forecast and a specific fair value. Unlike simply applying ratios or models, Narratives empower you to lay out your perspective on how factors like industry changes, new products, competitive risks, and management strategy will shape future revenue, margins, and ultimately, what the company should be worth.

Available in the Simply Wall St Community page used by millions of investors, Narratives are an accessible tool that lets you update your thesis and assumptions anytime new news or results emerge. By translating your view into numbers, Narratives show exactly when the gap between Fair Value and Price becomes large enough to consider a buy or sell decision, and they refresh dynamically as new information arrives. For example, a more optimistic investor might forecast Goodyear rebounding, justifying a fair value near $15 per share, while a more cautious view factors in industry headwinds and lands closer to $9 per share. Narratives help you quantify your story, compare it with others, and decide with clarity and confidence.

Do you think there's more to the story for Goodyear Tire & Rubber? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GT

Goodyear Tire & Rubber

Develops, manufactures, distributes, and sells tires and related products and services worldwide.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives