- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

Gentex (GNTX): Evaluating Current Valuation After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

Gentex (GNTX) shares have seen some movement recently, prompting investors to take a closer look at the company’s latest performance. While there is no major headline or significant event this week, valuation and recent returns have sparked some renewed interest.

See our latest analysis for Gentex.

Gentex’s share price has tested investors’ nerves lately, sliding 7% over the last month and down nearly 6.7% since the start of the year. At the same time, a 13.7% gain over the past three months hints at periods of encouraging momentum. Looking longer term, the 1-year total shareholder return sits at -8.5%, yet three-year returns remain solidly positive at 14.4%. This shows that while the pace has cooled, Gentex has still rewarded patient investors.

If you’re curious about what’s driving growth and strong insider confidence in other corners of the market, consider exploring fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst price targets, but recent returns mixed, investors now face a key question: Is Gentex undervalued, or is the market already factoring in future growth?

Most Popular Narrative: 14.2% Undervalued

Gentex’s most widely followed valuation narrative sets a fair value above the last close price. The market appears to discount growth and margin gains expected over the next several years.

Gentex is experiencing robust growth in Full Display Mirror and other advanced feature content, with multiple new nameplate launches and rising OEM take rates. This positions the company to capitalize on the accelerating adoption of in-cabin electronic vision and safety systems, which may drive higher average selling prices and future revenue growth.

Want to know which bold projections underpin this valuation? The real story reveals ambitious targets for future sales, margin expansion, and a lower earnings multiple. See what’s fueling those expectations.

Result: Fair Value of $30.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unanticipated supply chain disruptions or a prolonged slump in China’s auto market could quickly change the company’s optimistic outlook.

Find out about the key risks to this Gentex narrative.

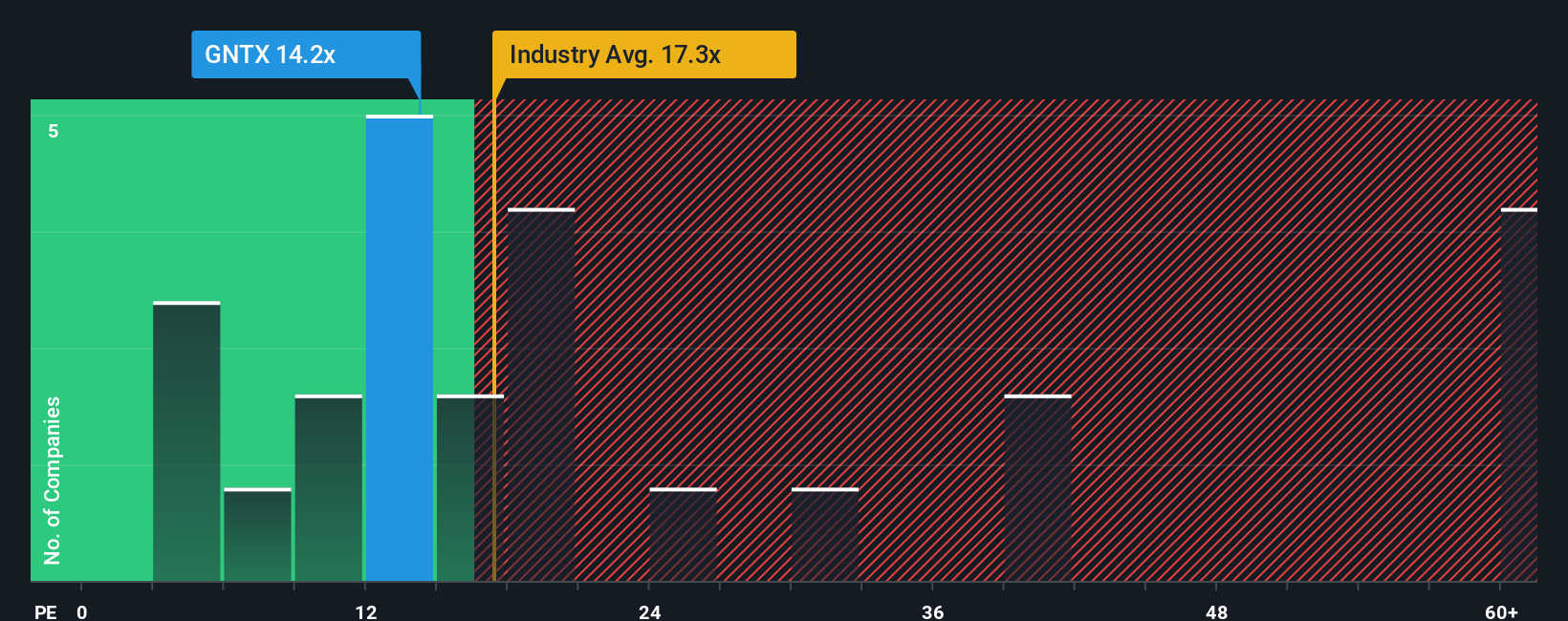

Another View: Looking Through the Earnings Lens

While analysts see Gentex’s shares as undervalued based on future earnings growth, a quick look at its current price-to-earnings ratio tells a more mixed story. The company trades at 14.6x earnings, which is cheaper than peers but pricier than its “fair ratio” of 12.2x. This leaves some valuation risk on the table if investor enthusiasm fades or expectations reset. Which perspective is more reliable when charting Gentex’s next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gentex Narrative

If you want to challenge these views or dig into the numbers for yourself, you can quickly create your own perspective in under three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gentex.

Looking for more investment ideas?

Don’t let great opportunities pass by. Our powerful screener can help you uncover stocks that match your strategy and spot hidden gems every investor wants to find.

- Unlock potential gains by searching for these 891 undervalued stocks based on cash flows based on real cash flow analysis. This approach puts undervalued opportunities front and center for your next move.

- Tap into steady income streams and boost your yield by checking out these 18 dividend stocks with yields > 3%, which features high-paying stocks yielding over 3%.

- Ride the future of healthcare breakthroughs by targeting these 32 healthcare AI stocks, where innovation meets robust financials in AI-powered medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.