- United States

- /

- Auto Components

- /

- NasdaqGS:GNTX

Gentex Corporation (NASDAQ:GNTX) Looks Like A Good Stock, And It's Going Ex-Dividend Soon

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Gentex Corporation (NASDAQ:GNTX) is about to trade ex-dividend in the next 4 days. You will need to purchase shares before the 8th of April to receive the dividend, which will be paid on the 22nd of April.

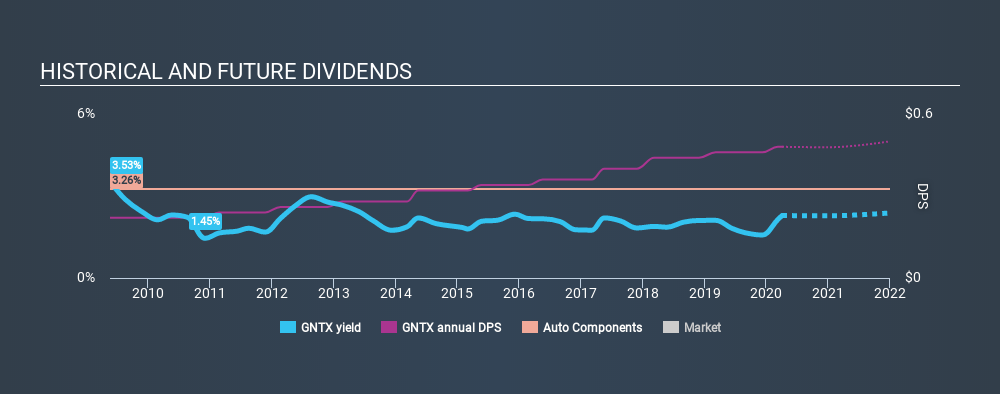

Gentex's upcoming dividend is US$0.12 a share, following on from the last 12 months, when the company distributed a total of US$0.46 per share to shareholders. Based on the last year's worth of payments, Gentex has a trailing yield of 2.3% on the current stock price of $21.01. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Gentex

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Gentex's payout ratio is modest, at just 28% of profit. A useful secondary check can be to evaluate whether Gentex generated enough free cash flow to afford its dividend. Thankfully its dividend payments took up just 28% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, Gentex's earnings per share have been growing at 11% a year for the past five years. The company has managed to grow earnings at a rapid rate, while reinvesting most of the profits within the business. This will make it easier to fund future growth efforts and we think this is an attractive combination - plus the dividend can always be increased later.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, ten years ago, Gentex has lifted its dividend by approximately 8.1% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

From a dividend perspective, should investors buy or avoid Gentex? Gentex has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. Gentex looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

On that note, you'll want to research what risks Gentex is facing. For example - Gentex has 1 warning sign we think you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:GNTX

Gentex

Designs, develops, manufactures, markets, and supplies digital vision, connected car, dimmable glass, and fire protection products in the United States, China, Germany, Japan, Mexico, the Republic of Korea, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives