- United States

- /

- Auto Components

- /

- NasdaqGS:FOXF

Fox Factory Holding Corp.'s (NASDAQ:FOXF) Share Price Could Signal Some Risk

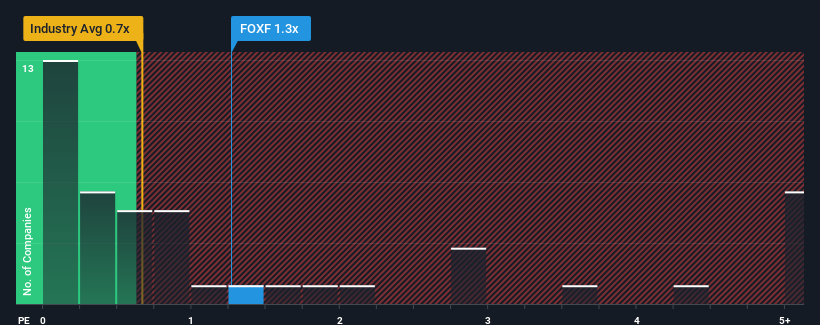

When close to half the companies in the Auto Components industry in the United States have price-to-sales ratios (or "P/S") below 0.7x, you may consider Fox Factory Holding Corp. (NASDAQ:FOXF) as a stock to potentially avoid with its 1.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Fox Factory Holding

How Fox Factory Holding Has Been Performing

Fox Factory Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Fox Factory Holding's future stacks up against the industry? In that case, our free report is a great place to start.How Is Fox Factory Holding's Revenue Growth Trending?

In order to justify its P/S ratio, Fox Factory Holding would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 19% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 12% over the next year. That's shaping up to be materially lower than the 20% growth forecast for the broader industry.

In light of this, it's alarming that Fox Factory Holding's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Fox Factory Holding trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

You need to take note of risks, for example - Fox Factory Holding has 3 warning signs (and 1 which is concerning) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FOXF

Fox Factory Holding

Designs, engineers, manufactures, and markets performance-defining products and system worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives