- United States

- /

- Auto Components

- /

- NasdaqGM:CREV

Positive Sentiment Still Eludes Carbon Revolution Public Limited Company (NASDAQ:CREV) Following 39% Share Price Slump

Carbon Revolution Public Limited Company (NASDAQ:CREV) shareholders that were waiting for something to happen have been dealt a blow with a 39% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 92% loss during that time.

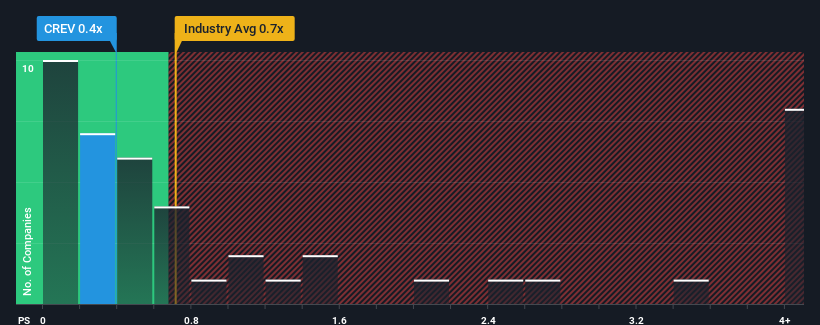

In spite of the heavy fall in price, there still wouldn't be many who think Carbon Revolution's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in the United States' Auto Components industry is similar at about 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Carbon Revolution

How Has Carbon Revolution Performed Recently?

Carbon Revolution certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Carbon Revolution's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Carbon Revolution's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 42%. Pleasingly, revenue has also lifted 59% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 31% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 8.9%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Carbon Revolution's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Carbon Revolution's P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Carbon Revolution looks to be in line with the rest of the Auto Components industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Carbon Revolution's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Carbon Revolution (3 don't sit too well with us!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CREV

Carbon Revolution

Manufactures and sells carbon fibre wheels to original equipment vehicle manufacturers for the automotive industry worldwide.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives