- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

Marimekko Oyj And 2 Other Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape of record-high indexes and geopolitical uncertainties, investors are increasingly focused on dividend stocks as a potential source of stability and income. With U.S. jobless claims at their lowest in months and positive sentiment driven by strong labor market data, identifying reliable dividend-paying companies like Marimekko Oyj becomes crucial for those looking to balance growth with consistent returns in today's dynamic economic environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

Click here to see the full list of 1947 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

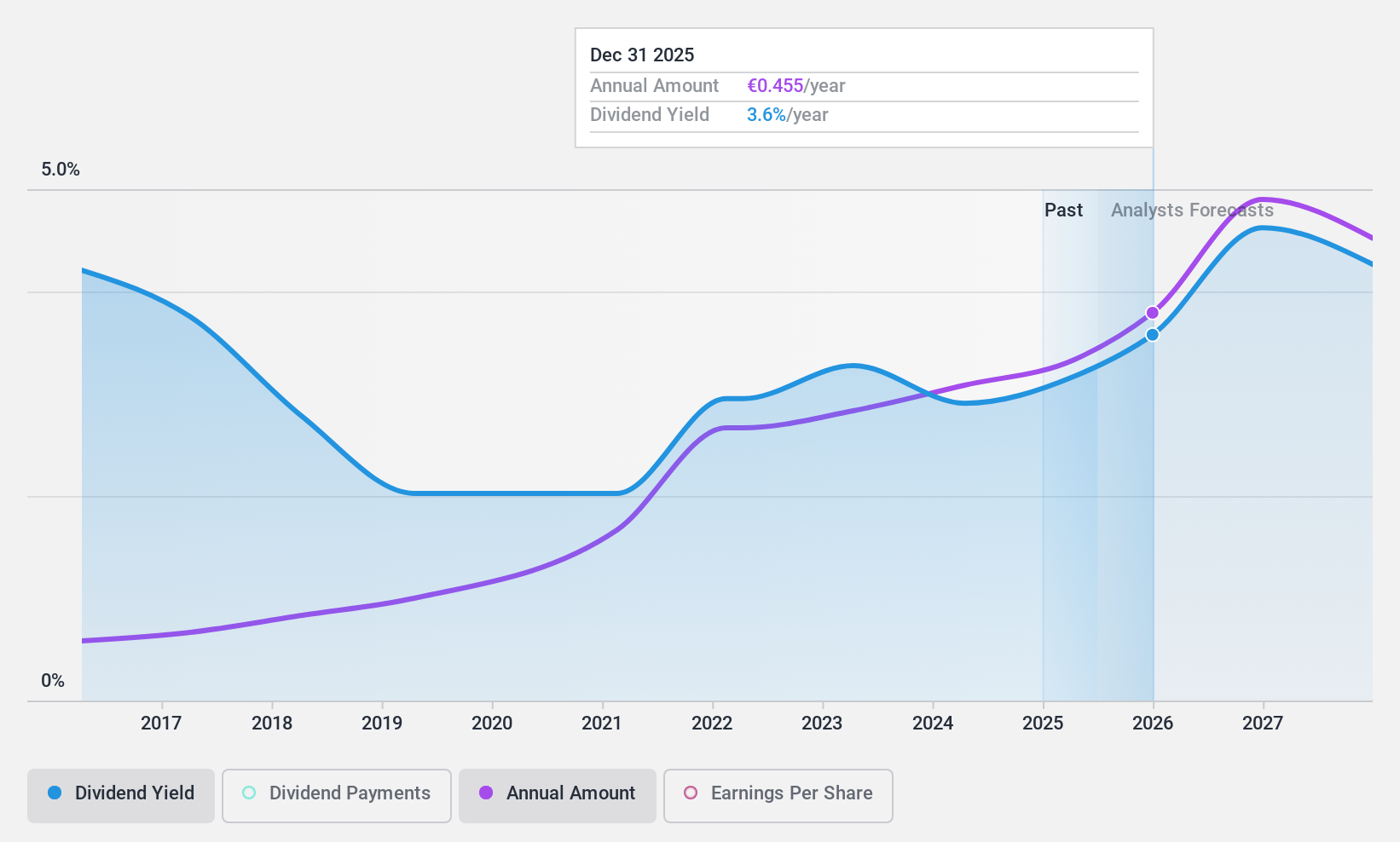

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally with a market cap of €477.93 million.

Operations: Marimekko Oyj generates its revenue primarily from its business operations, amounting to €179.21 million.

Dividend Yield: 3.1%

Marimekko Oyj offers a stable dividend with a payout ratio of 64.9%, ensuring dividends are well-covered by earnings and cash flows (45.3% cash payout ratio). Over the past decade, dividends have grown consistently, though the current yield of 3.14% is below Finland's top quartile. Despite recent earnings declines in Q3 2024, Marimekko expects sales growth and maintains reliable dividend payments supported by their financial strategy and fair value trading position.

- Click to explore a detailed breakdown of our findings in Marimekko Oyj's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Marimekko Oyj shares in the market.

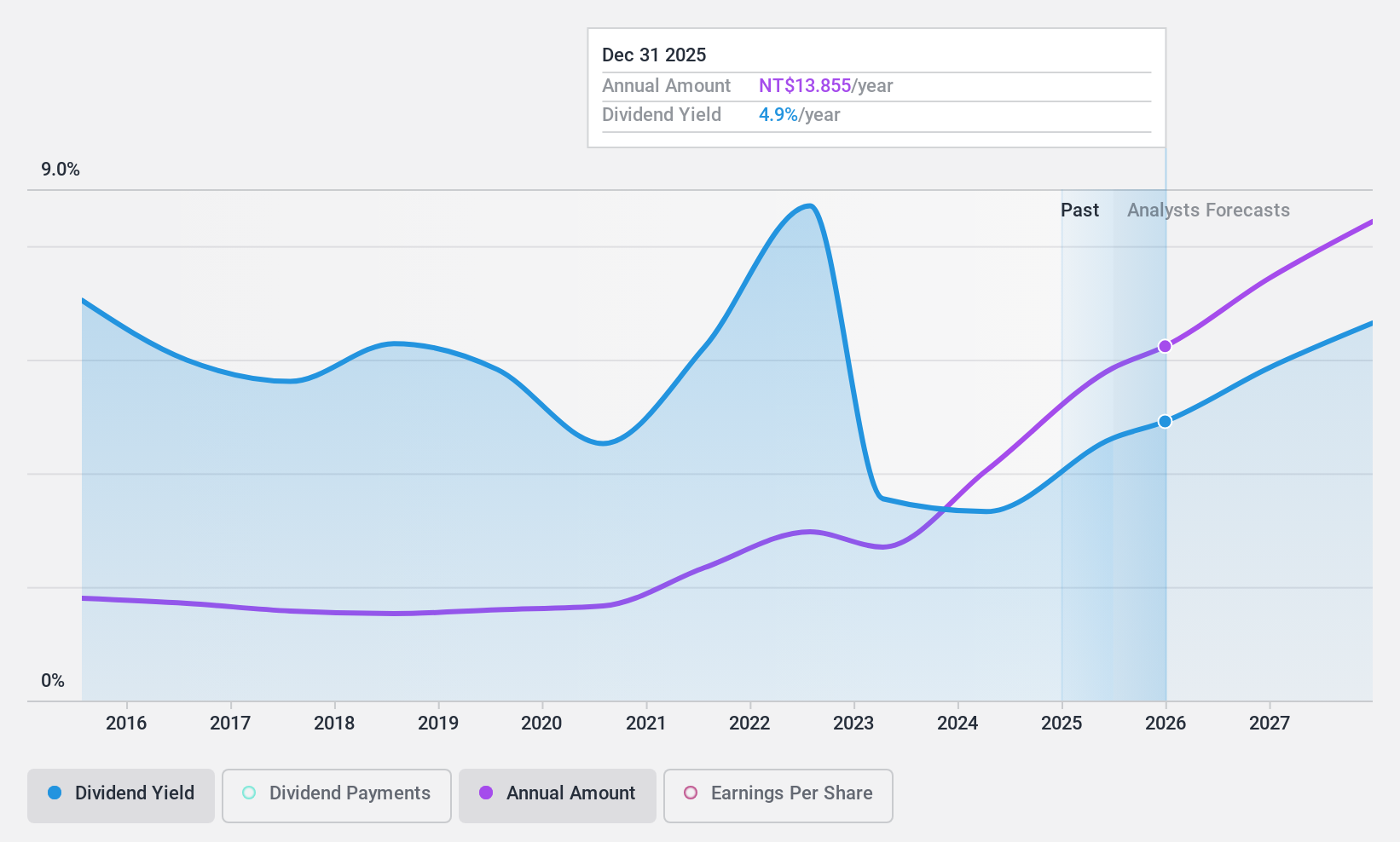

Quanta Computer (TWSE:2382)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Quanta Computer Inc. is a company that manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally with a market cap of NT$1.15 trillion.

Operations: Quanta Computer Inc.'s revenue from The Electronics Sector amounts to NT$2.78 billion.

Dividend Yield: 3%

Quanta Computer's dividend is supported by a reasonable payout ratio of 64.1%, though it lacks free cash flow coverage, raising sustainability concerns. Despite this, dividends have grown reliably over the last decade with stable payments. Recent earnings growth of 41% and improved Q3 results highlight strong performance, yet the current yield of 3.01% remains below Taiwan's top quartile. The company trades at a good value relative to peers and analysts expect further price appreciation.

- Get an in-depth perspective on Quanta Computer's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Quanta Computer's share price might be too pessimistic.

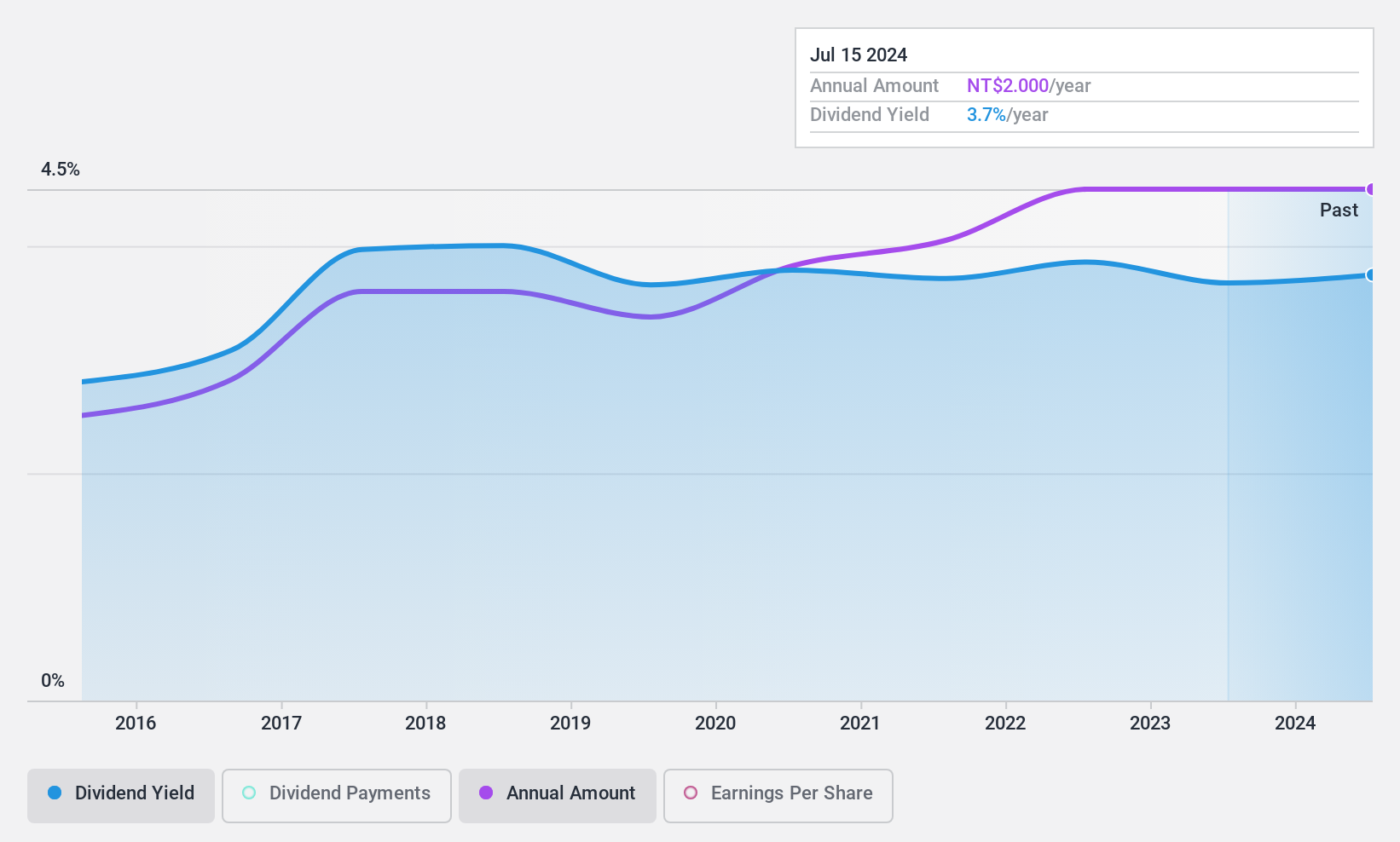

Shin Hai Gas (TWSE:9926)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shin Hai Gas Corporation is involved in the supply of natural gas in Taiwan and has a market capitalization of NT$9.60 billion.

Operations: Shin Hai Gas Corporation's revenue is primarily derived from its Gas Supply segment, which accounts for NT$1.74 billion, followed by the Installation Segment at NT$378.45 million and the Telecommunication Segment at NT$16.75 million.

Dividend Yield: 3.7%

Shin Hai Gas's dividend, with a payout ratio of 73.3%, is covered by earnings but not by free cash flow, indicating potential sustainability issues. Despite this, dividends have grown steadily over the past decade without volatility. Recent earnings improvements show net income rising to TWD 134.73 million in Q3 2024 from TWD 119.55 million a year ago. The current yield of 3.74% is below Taiwan's top quartile, and its price-to-earnings ratio of 19.6x suggests reasonable valuation compared to the market average.

- Delve into the full analysis dividend report here for a deeper understanding of Shin Hai Gas.

- Our expertly prepared valuation report Shin Hai Gas implies its share price may be too high.

Next Steps

- Click this link to deep-dive into the 1947 companies within our Top Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures, processes, and sells laptop computers and telecommunication products in the United States, Mainland China, the Netherlands, Japan, and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives