- Taiwan

- /

- Entertainment

- /

- TPEX:5478

Top Global Dividend Stocks For May 2025

Reviewed by Simply Wall St

As global markets navigate through a landscape of easing trade tensions and mixed economic signals, investors have been buoyed by positive earnings reports and resilient job growth in the U.S., while Europe shows signs of accelerated economic activity. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams; these stocks are particularly appealing when market volatility prompts investors to seek stability and long-term value.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.97% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.31% | ★★★★★★ |

Click here to see the full list of 1548 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

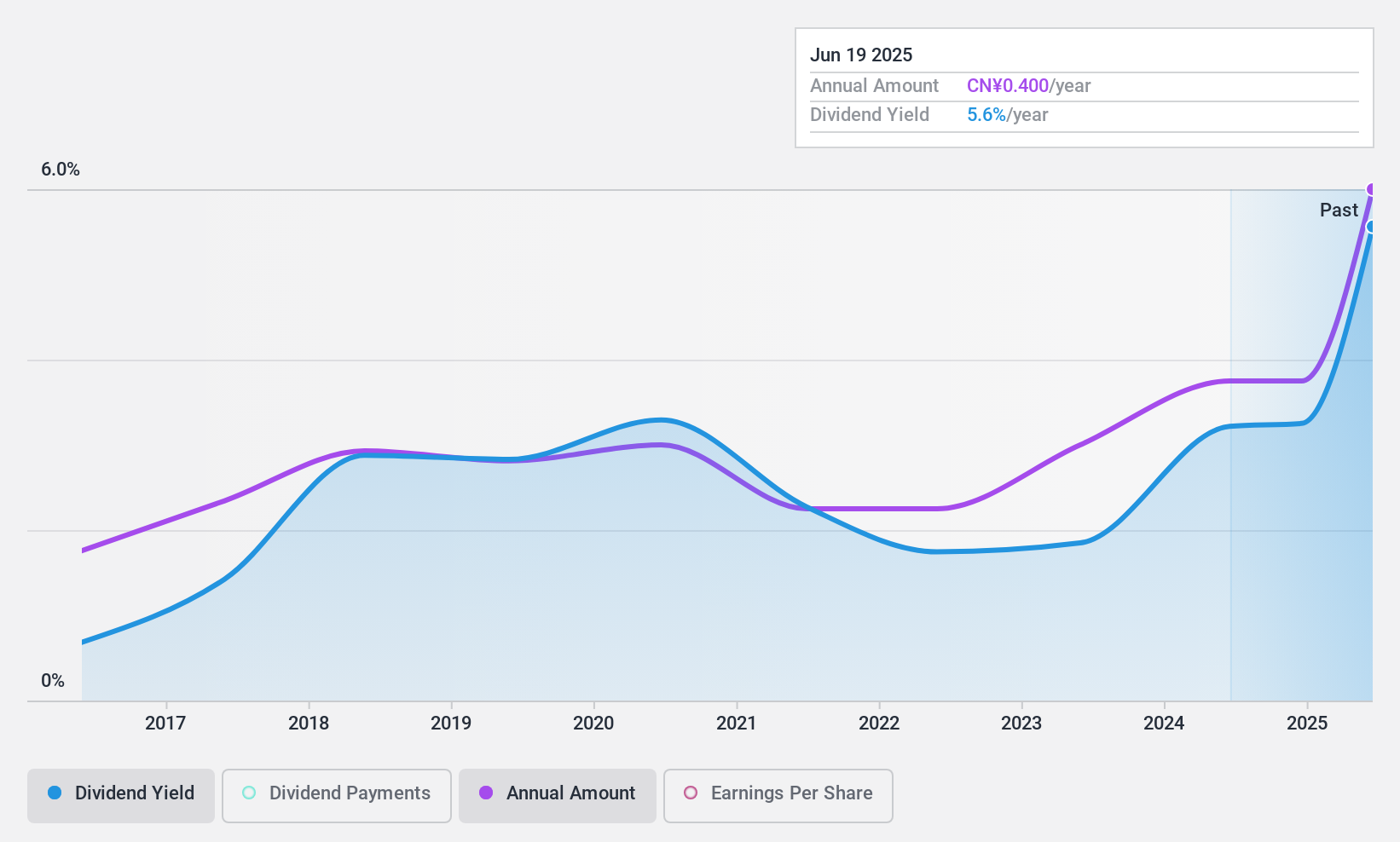

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research, development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥2.80 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd. generates its revenue through the research, development, production, and sale of bathroom products and accessories on a global scale.

Dividend Yield: 5.4%

Xiamen R&T Plumbing Technology Ltd. offers a compelling dividend yield of 5.43%, placing it among the top 25% in China's market. Despite its dividends being covered by earnings and cash flows, with payout ratios of 70.2% and 79.4% respectively, the company's dividend history is volatile over its nine-year span, with recent earnings showing a decline in net income to CNY 21.48 million for Q1 2025 from CNY 58.55 million the previous year.

- Delve into the full analysis dividend report here for a deeper understanding of Xiamen R&T Plumbing TechnologyLtd.

- Our comprehensive valuation report raises the possibility that Xiamen R&T Plumbing TechnologyLtd is priced lower than what may be justified by its financials.

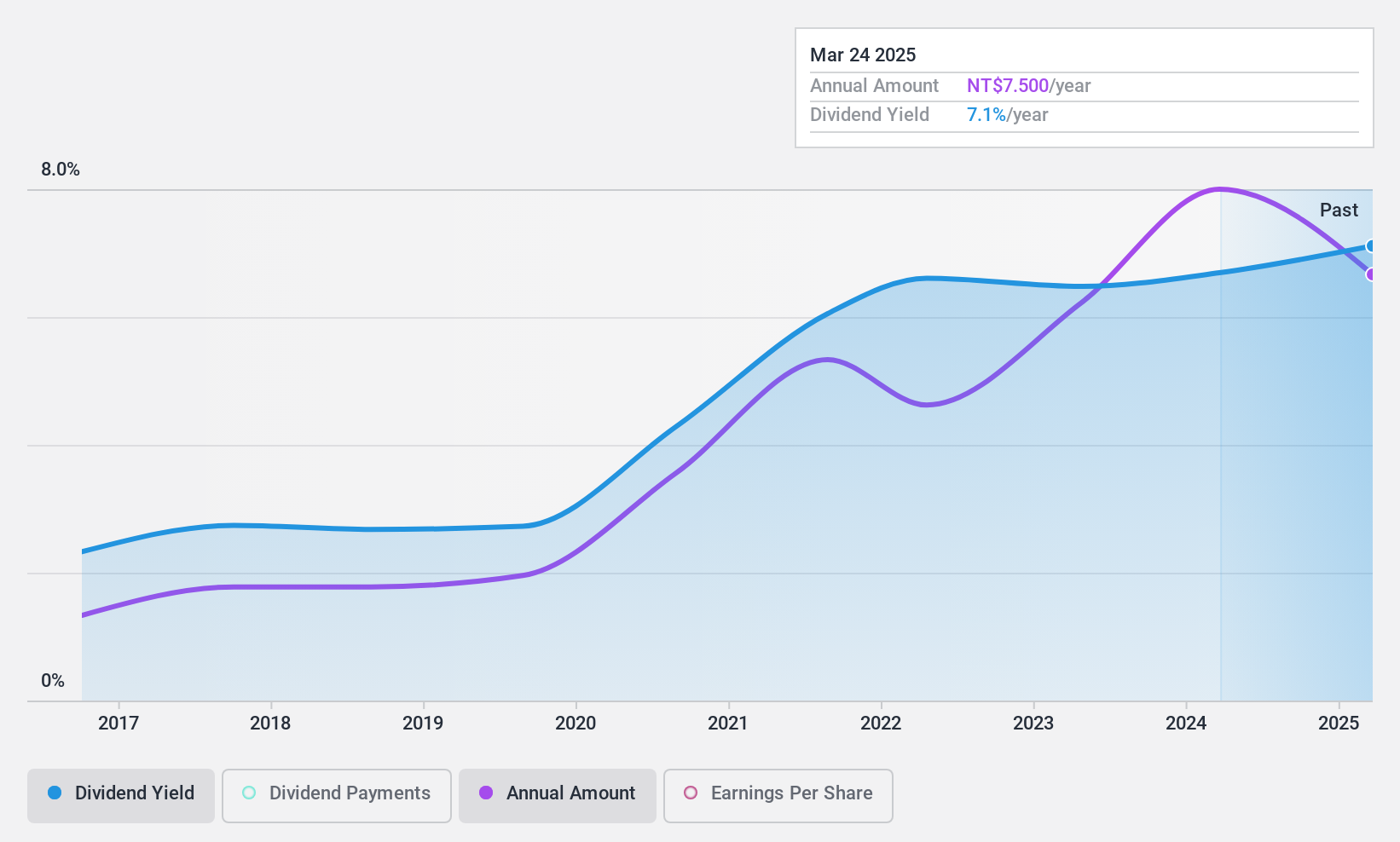

Soft-World International (TPEX:5478)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Soft-World International Corporation develops, operates, and distributes games in Taiwan and China, with a market cap of NT$16.27 billion.

Operations: Soft-World International Corporation's revenue segments include NT$938.38 million from Yifan, NT$427.56 million from Chinese Gamer International, NT$405.59 million from Xinganxian and Zhifandi, NT$1.46 billion from Neweb Technologies Co., Ltd., and NT$3.44 billion from Soft-World and Soft-World (Hong Kong).

Dividend Yield: 6.3%

Soft-World International's dividend yield of 6.28% ranks in the top 25% of Taiwan's market, but its sustainability is questionable due to a high payout ratio of 96.8%, indicating dividends are not well-covered by earnings. Despite a recent cash dividend announcement totaling NT$1.17 billion, the company's dividend history has been volatile and unreliable over the past decade. Recent legal proceedings had no financial impact, but shareholders experienced dilution last year.

- Unlock comprehensive insights into our analysis of Soft-World International stock in this dividend report.

- The analysis detailed in our Soft-World International valuation report hints at an inflated share price compared to its estimated value.

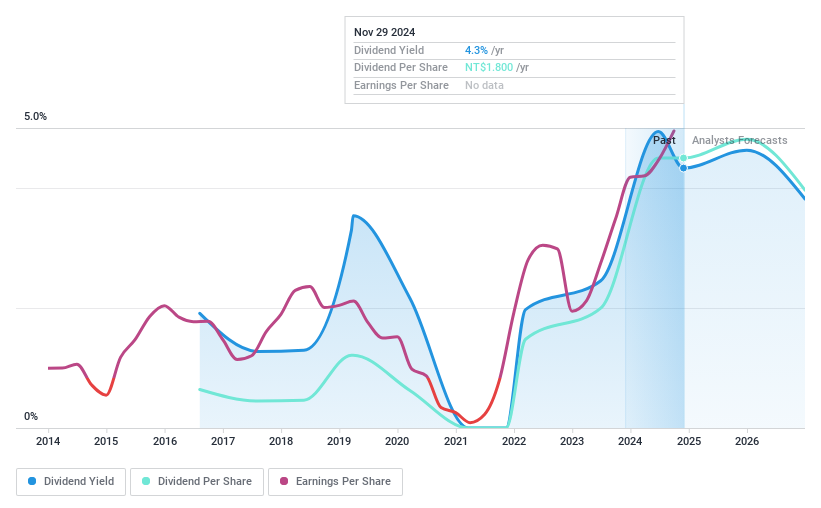

EVA Airways (TWSE:2618)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVA Airways Corp., along with its subsidiaries, operates in the aviation sector across Taiwan, Asia, Europe, North America, and internationally with a market cap of NT$222.23 billion.

Operations: EVA Airways Corp. generates revenue primarily from its Aviation Transportation Segment, which accounts for NT$206.56 billion, and its Aircraft Maintenance and Manufacturing Division, contributing NT$16.28 billion.

Dividend Yield: 5.5%

EVA Airways' dividend, with a yield of 5.52%, is among the top 25% in Taiwan, supported by a low payout ratio of 44.7%, indicating strong coverage by earnings and cash flows. Despite recent increases, the dividend history is volatile and less than a decade old, raising concerns about reliability. The company's financial health is bolstered by significant earnings growth last year and strategic expansions like new North American routes enhancing its operational footprint.

- Click here and access our complete dividend analysis report to understand the dynamics of EVA Airways.

- Insights from our recent valuation report point to the potential undervaluation of EVA Airways shares in the market.

Turning Ideas Into Actions

- Delve into our full catalog of 1548 Top Global Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Soft-World International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5478

Soft-World International

Develops, operates, and distributes games in Taiwan and China.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives