- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2615

Even With A 31% Surge, Cautious Investors Are Not Rewarding Wan Hai Lines Ltd.'s (TWSE:2615) Performance Completely

Wan Hai Lines Ltd. (TWSE:2615) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

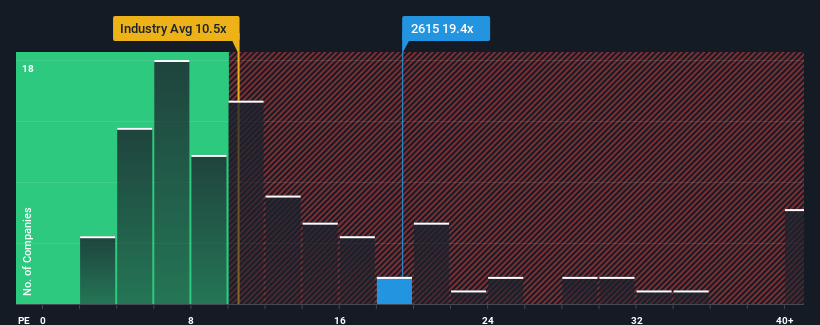

Although its price has surged higher, Wan Hai Lines' price-to-earnings (or "P/E") ratio of 19.4x might still make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 22x and even P/E's above 40x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Wan Hai Lines could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Wan Hai Lines

How Is Wan Hai Lines' Growth Trending?

In order to justify its P/E ratio, Wan Hai Lines would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 66% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 118% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it odd that Wan Hai Lines is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Wan Hai Lines' stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Wan Hai Lines' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Wan Hai Lines (including 1 which is potentially serious).

If you're unsure about the strength of Wan Hai Lines' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Wan Hai Lines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wan Hai Lines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2615

Wan Hai Lines

Operates as a fully containerized shipping company in Asia, the Middle East, India, Red Sea, the United States, and South America.

Flawless balance sheet and fair value.

Market Insights

Community Narratives