- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2605

Unveiling 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have been buoyant, with small-cap indices like the Russell 2000 experiencing notable gains despite not reaching record highs. This surge reflects investor optimism about potential economic growth and tax reforms, creating a fertile environment for discovering promising small-cap stocks that may have been overlooked. In such dynamic market conditions, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities that align well with evolving economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ramco Industries | 3.16% | 9.84% | -14.15% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| Shree Pushkar Chemicals & Fertilisers | 22.85% | 17.68% | 3.50% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Nippon Soda (TSE:4041)

Simply Wall St Value Rating: ★★★★☆☆

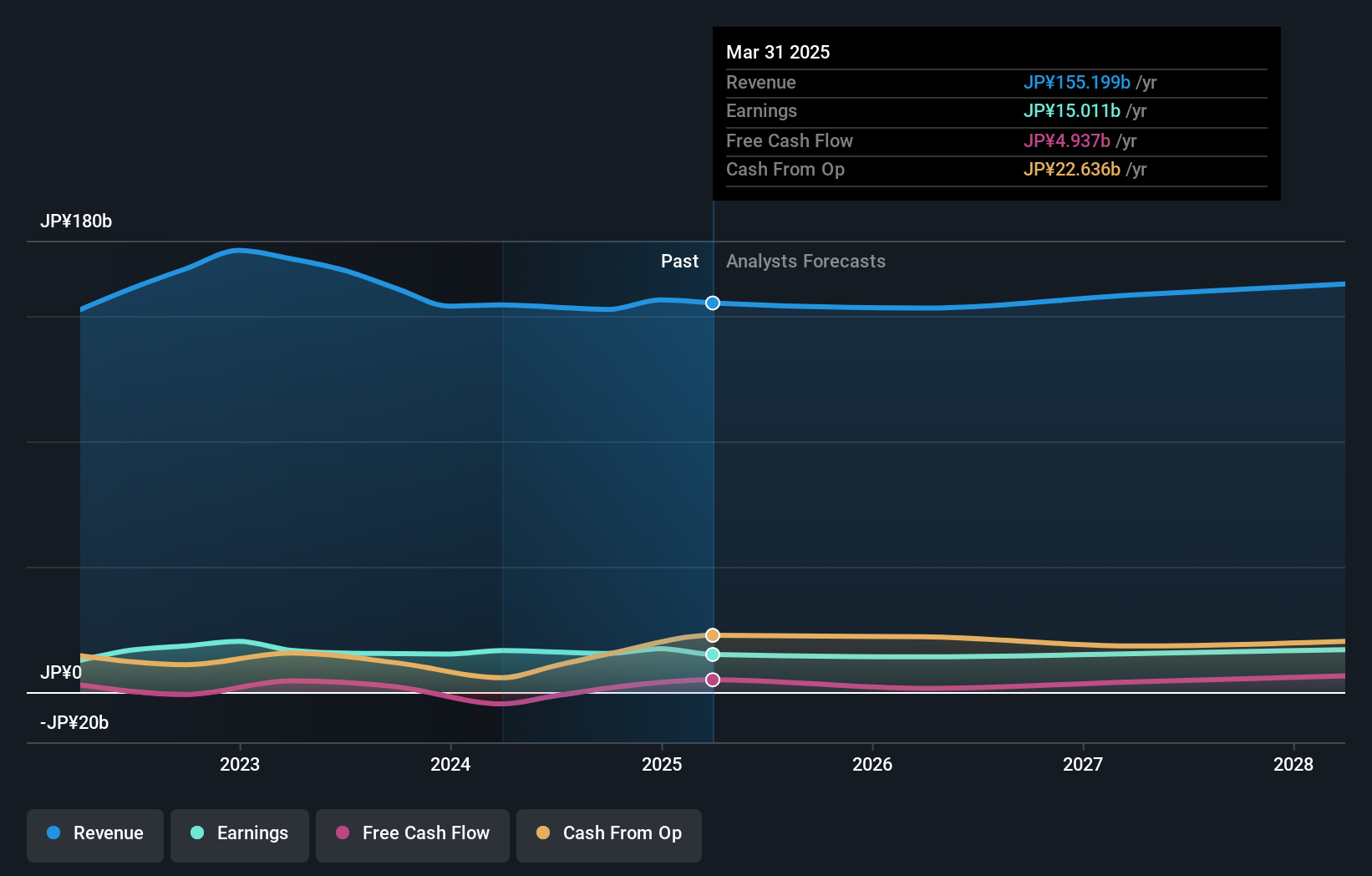

Overview: Nippon Soda Co., Ltd. is engaged in the development, production, processing, importation, marketing, sales, and exportation of chemicals and agrochemicals both in Japan and globally with a market cap of ¥141.97 billion.

Operations: Nippon Soda generates revenue primarily from its chemicals and agrochemicals segments. The company has a market cap of ¥141.97 billion, reflecting its significant presence in both domestic and international markets.

Nippon Soda, a player in the chemicals industry, showcases high-quality earnings with a robust 25% annual growth over the past five years. Despite this, its recent 4% earnings growth lagged behind the broader industry's 15%. Trading at a price-to-earnings ratio of 8.8x, it offers good value compared to Japan's market average of 13.4x. The company’s debt-to-equity ratio has risen from 18% to 27%, indicating increased leverage but remains within satisfactory limits with net debt at just over 15%. However, free cash flow is not positive and future earnings are projected to dip by about 2.7% annually for three years.

- Dive into the specifics of Nippon Soda here with our thorough health report.

Review our historical performance report to gain insights into Nippon Soda's's past performance.

Formosa Taffeta (TWSE:1434)

Simply Wall St Value Rating: ★★★★★☆

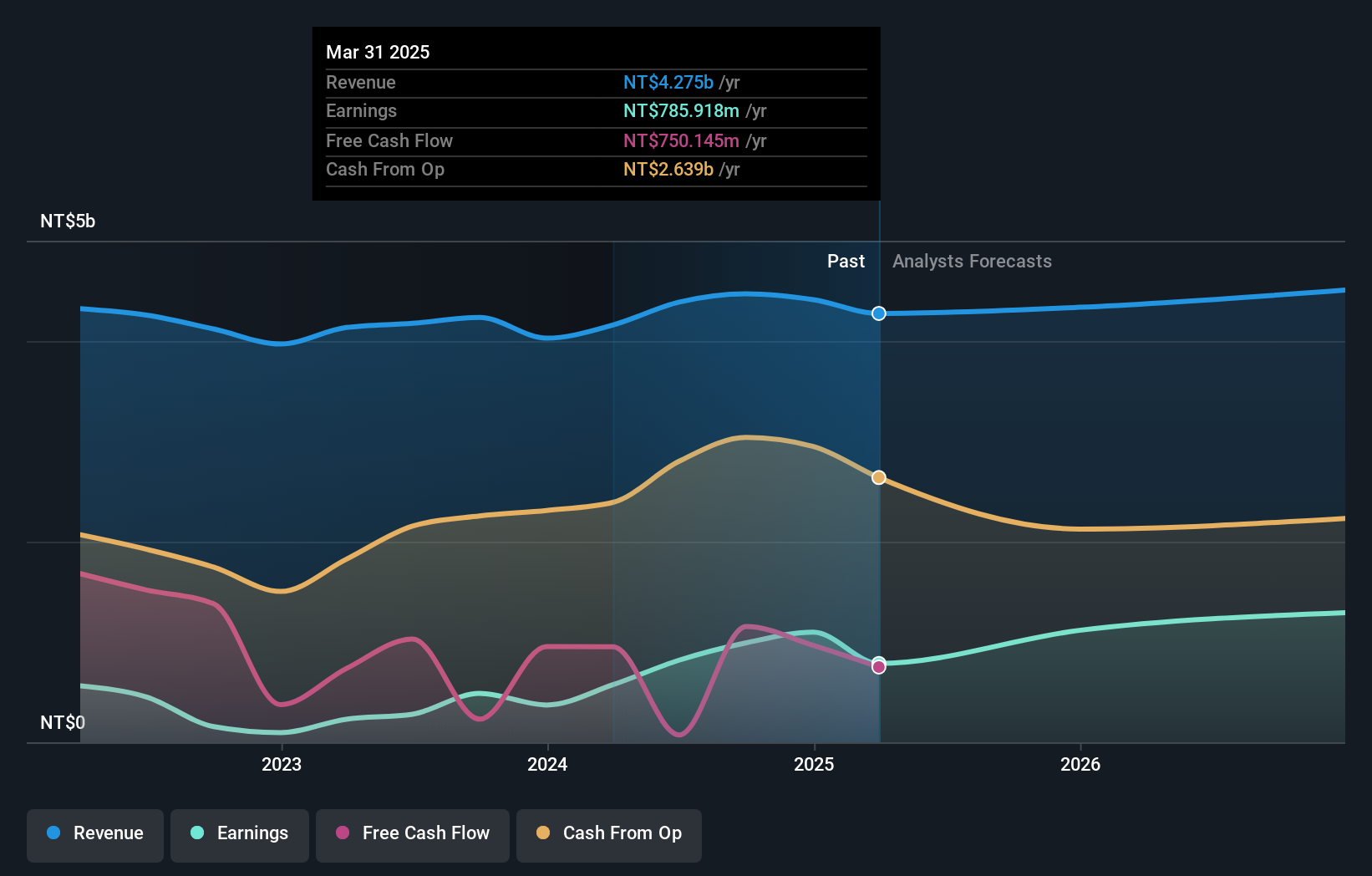

Overview: Formosa Taffeta Co., Ltd. is a Taiwanese company operating in the textile industry across Taiwan and Asia, with a market capitalization of NT$33.82 billion.

Operations: Formosa Taffeta generates revenue primarily from its textile operations across Taiwan and Asia. The company's financial performance is influenced by various factors, including cost of goods sold and operating expenses. Notably, the gross profit margin has shown fluctuations over recent periods, reflecting changes in production costs and pricing strategies.

Formosa Taffeta, a textile player with a knack for innovation, has seen its net income skyrocket to TWD 962.47 million in the recent quarter from just TWD 50.11 million last year, indicating a robust turnaround. Despite sales dipping slightly to TWD 7,089.7 million from TWD 7,143.5 million year-over-year, earnings per share surged to TWD 0.57 from TWD 0.03 due to improved operational efficiency and cost management strategies likely contributing positively. The company's debt-to-equity ratio increased over five years but remains manageable at an acceptable net level of 13.5%, reflecting prudent financial management amidst industry challenges and opportunities for growth in luxury textiles.

- Navigate through the intricacies of Formosa Taffeta with our comprehensive health report here.

Assess Formosa Taffeta's past performance with our detailed historical performance reports.

Sincere Navigation (TWSE:2605)

Simply Wall St Value Rating: ★★★★★★

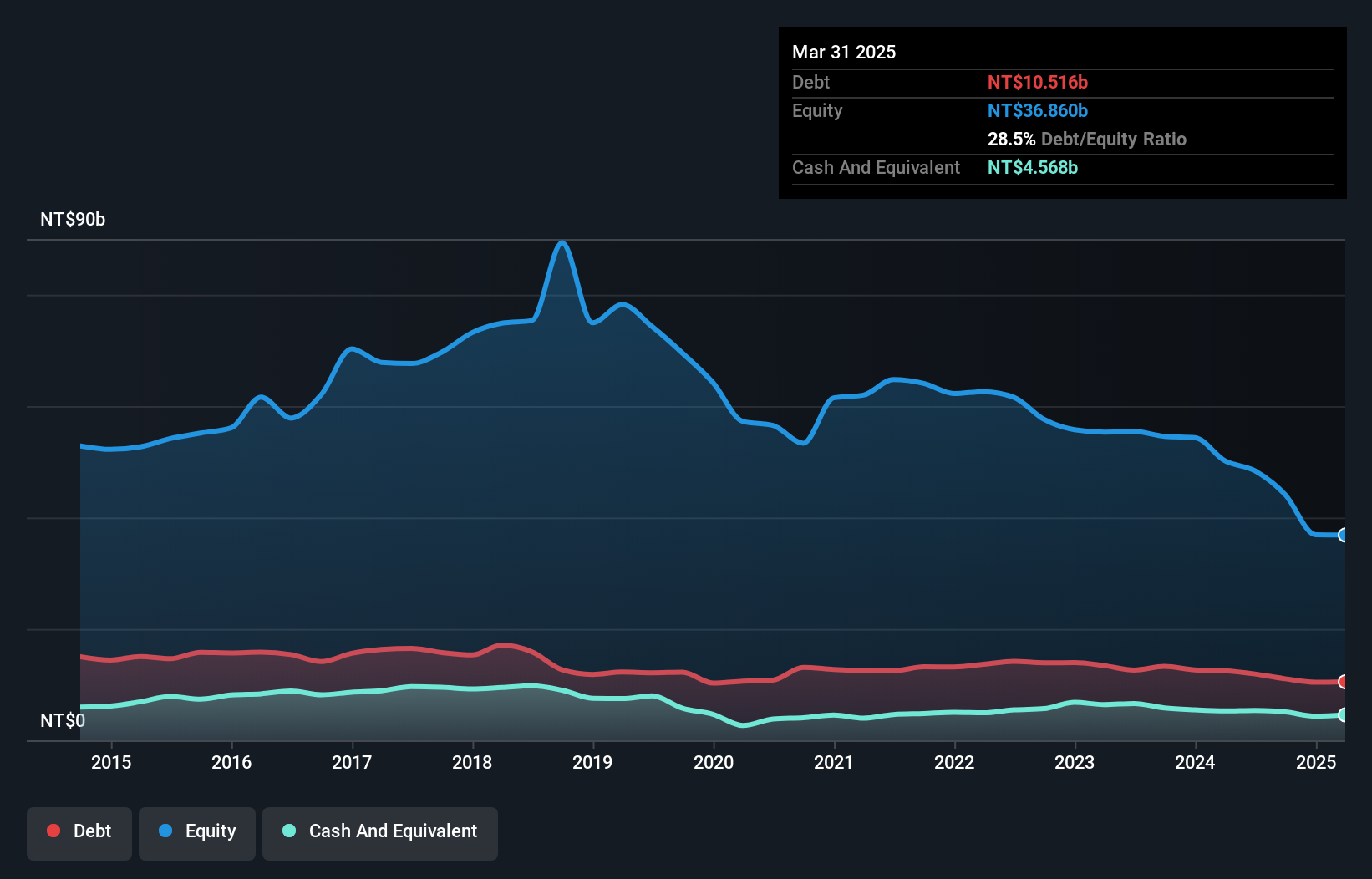

Overview: Sincere Navigation Corporation is a shipping transportation company that owns and operates bulk cargo vessels in Taiwan, with a market cap of NT$16.33 billion.

Operations: The company generates revenue primarily through the operation of bulk cargo vessels. It has a market capitalization of NT$16.33 billion, reflecting its scale in the shipping transportation sector.

Sincere Navigation, a relatively small player in the shipping sector, has shown impressive financial performance recently. Over the past year, earnings surged by 102.1%, outpacing the shipping industry's -16.8% growth rate. The company reported third-quarter sales of TWD 1,100 million and net income of TWD 244 million, a significant increase from last year's figures. Its debt to equity ratio improved from 38.1% to 21% over five years, indicating better financial health. Trading at about 79% below estimated fair value suggests potential undervaluation in the market, while its positive free cash flow and high-quality earnings add further appeal for investors seeking growth opportunities.

- Delve into the full analysis health report here for a deeper understanding of Sincere Navigation.

Evaluate Sincere Navigation's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Discover the full array of 4659 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2605

Sincere Navigation

A shipping transportation company, owns and operates bulk cargo vessels in Taiwan.

Flawless balance sheet and good value.

Market Insights

Community Narratives