- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2603

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a busy earnings season and mixed economic signals, investors are keenly observing the performance of major indices, which have mostly ended lower amid cautious corporate earnings reports and unexpected labor market data. In this context, dividend stocks can offer a compelling opportunity for those seeking steady income streams and potential resilience in volatile market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.21% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.94% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.03% | ★★★★★★ |

Click here to see the full list of 2022 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

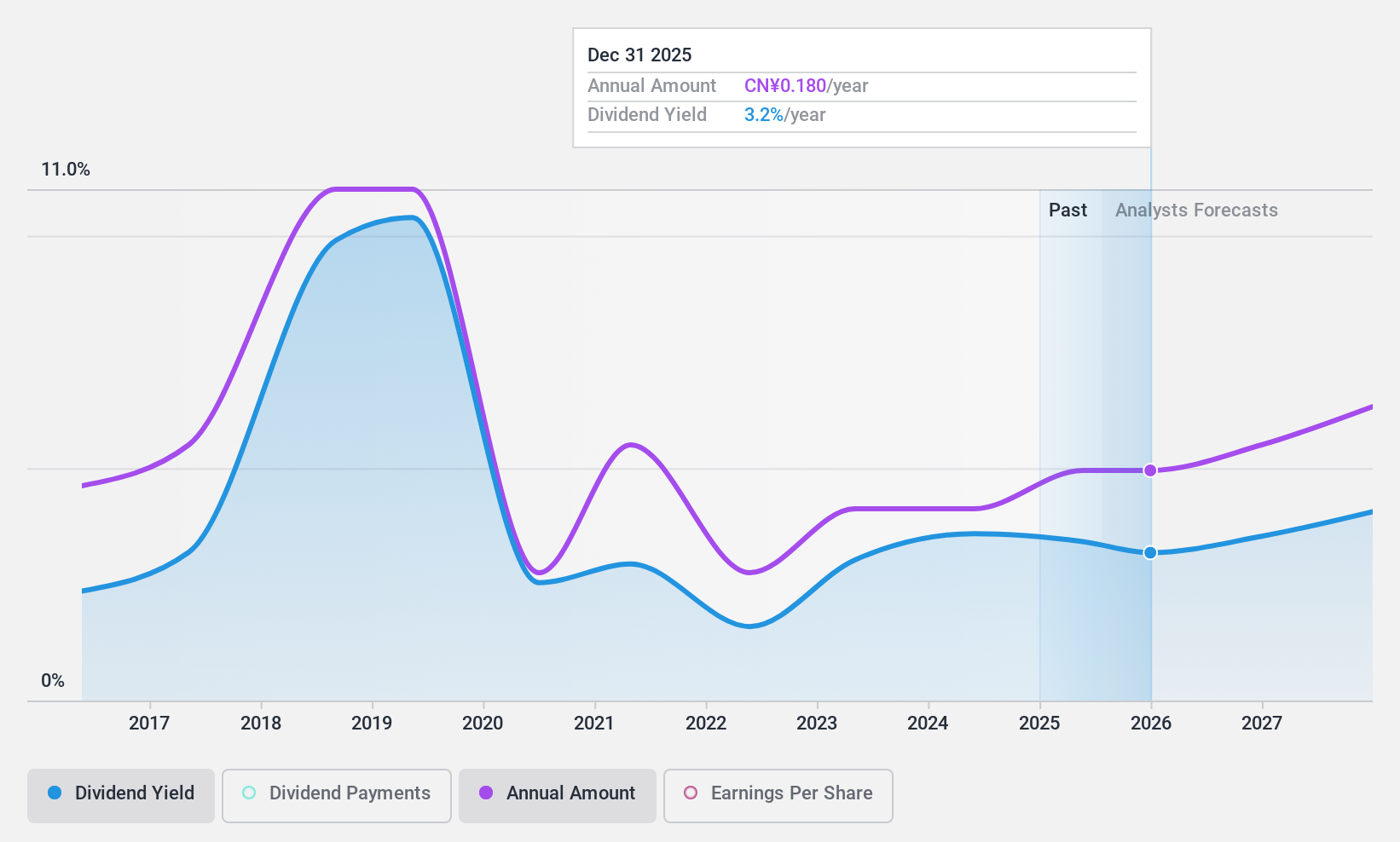

Chongqing Department StoreLtd (SHSE:600729)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Department Store Co., Ltd. operates department stores, supermarkets, and electrical appliances stores in the People's Republic of China, with a market cap of CN¥9.79 billion.

Operations: Chongqing Department Store Co., Ltd.'s revenue is derived from its operations in department stores, supermarkets, and electrical appliances stores across China.

Dividend Yield: 5.8%

Chongqing Department Store Ltd. offers a dividend yield of 5.82%, ranking in the top 25% of CN market payers, with dividends covered by earnings and cash flows at payout ratios of 49.4% and 47.1%, respectively. However, its dividend history is volatile and unreliable over the past decade, despite growth in payments during that time. Recent earnings show a decline in sales to CNY 13 billion and net income to CNY 923 million compared to last year, indicating potential challenges ahead for sustaining dividends amidst fluctuating performance.

- Click here to discover the nuances of Chongqing Department StoreLtd with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Chongqing Department StoreLtd is trading behind its estimated value.

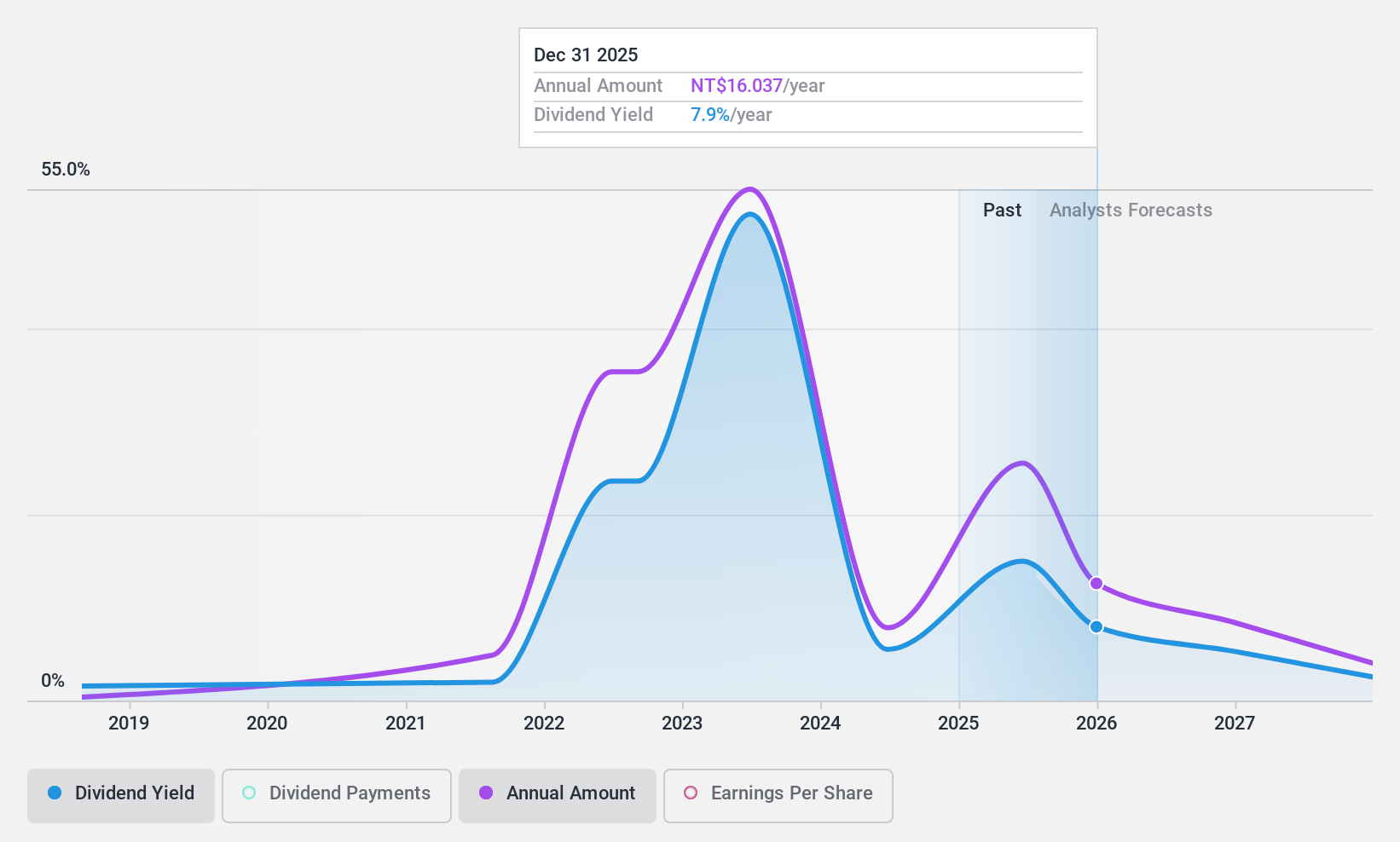

Zhejiang Hailide New MaterialLtd (SZSE:002206)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Hailide New Material Co., Ltd is involved in the research, development, production, and marketing of industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors both in China and internationally with a market cap of CN¥4.77 billion.

Operations: Zhejiang Hailide New Material Co., Ltd generates revenue through its core activities in industrial polyester yarns, plastic materials, tire cord fabrics, and plastic floors.

Dividend Yield: 3.4%

Zhejiang Hailide New Material Ltd. provides a dividend yield of 3.42%, placing it in the top 25% of CN market payers, with dividends well-covered by earnings and cash flows at payout ratios of 45.4% and 39.6%, respectively. Despite past volatility and an unstable track record, recent earnings growth—net income rising to CNY 296.46 million—suggests potential for continued dividend payments, supported by good relative value with a P/E ratio below the CN market average.

- Get an in-depth perspective on Zhejiang Hailide New MaterialLtd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Zhejiang Hailide New MaterialLtd is priced lower than what may be justified by its financials.

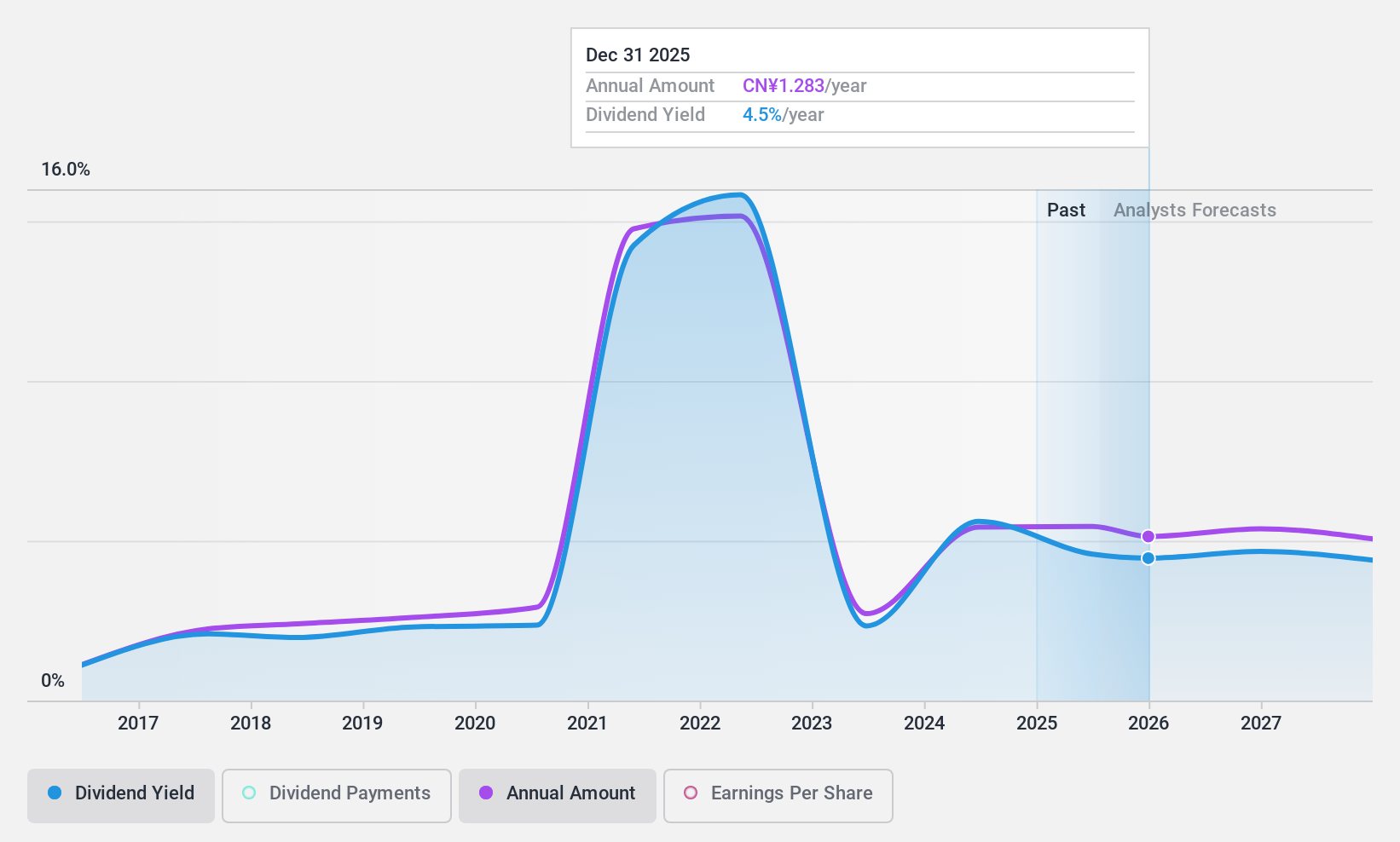

Evergreen Marine Corporation (Taiwan) (TWSE:2603)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evergreen Marine Corporation (Taiwan) Ltd. operates in marine transportation, shipping agency, and commercial port area ship repair services, with a market cap of NT$453.49 billion.

Operations: Evergreen Marine Corporation (Taiwan) Ltd.'s revenue primarily comes from its Transportation Division, which generated NT$432.05 billion.

Dividend Yield: 4.6%

Evergreen Marine Corporation offers a 4.6% dividend yield, ranking in the top 25% of Taiwan's market payers. Dividends are well-covered by earnings and cash flows with payout ratios of 29.5% and 50.5%, respectively, though past payments have been volatile over its nine-year history. Despite declining profit margins, recent earnings showed significant growth, with net income reaching TWD 46.84 billion for the first half of 2024, indicating potential support for future dividends amidst good relative value trading metrics.

- Navigate through the intricacies of Evergreen Marine Corporation (Taiwan) with our comprehensive dividend report here.

- Our valuation report here indicates Evergreen Marine Corporation (Taiwan) may be undervalued.

Next Steps

- Unlock our comprehensive list of 2022 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergreen Marine Corporation (Taiwan) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2603

Evergreen Marine Corporation (Taiwan)

Engages in the marine transportation, shipping agency, and commercial port area ship repair services.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives