Chien Shing Harbour ServiceLtd (TPE:8367) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Chien Shing Harbour Service Co.,Ltd. (TPE:8367) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chien Shing Harbour ServiceLtd

What Is Chien Shing Harbour ServiceLtd's Debt?

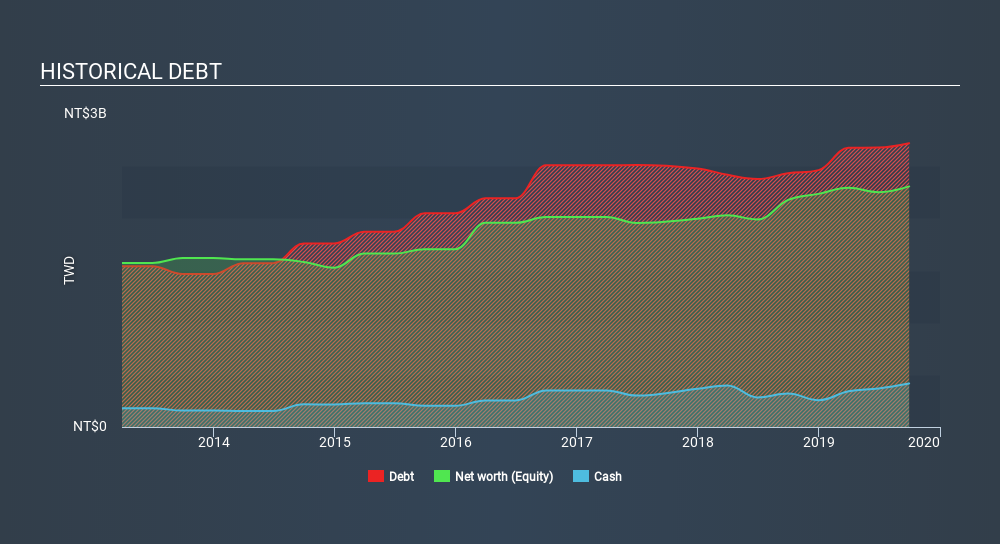

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Chien Shing Harbour ServiceLtd had NT$2.72b of debt, an increase on NT$2.43b, over one year. However, it also had NT$417.7m in cash, and so its net debt is NT$2.30b.

A Look At Chien Shing Harbour ServiceLtd's Liabilities

We can see from the most recent balance sheet that Chien Shing Harbour ServiceLtd had liabilities of NT$967.1m falling due within a year, and liabilities of NT$3.30b due beyond that. Offsetting these obligations, it had cash of NT$417.7m as well as receivables valued at NT$832.8m due within 12 months. So its liabilities total NT$3.01b more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of NT$2.03b, we think shareholders really should watch Chien Shing Harbour ServiceLtd's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chien Shing Harbour ServiceLtd's debt is 4.6 times its EBITDA, and its EBIT cover its interest expense 4.6 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. It is well worth noting that Chien Shing Harbour ServiceLtd's EBIT shot up like bamboo after rain, gaining 32% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chien Shing Harbour ServiceLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Chien Shing Harbour ServiceLtd recorded free cash flow worth 76% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

We feel some trepidation about Chien Shing Harbour ServiceLtd's difficulty level of total liabilities, but we've got positives to focus on, too. For example, its EBIT growth rate and conversion of EBIT to free cash flow give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Chien Shing Harbour ServiceLtd is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Chien Shing Harbour ServiceLtd (including 1 which is shouldn't be ignored) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:8367

Chien Shing Harbour Service

Engages in the provision of customs declaration, transportation, warehousing, ship stevedoring, container terminal, and B2B platform services in Taiwan.

Solid track record second-rate dividend payer.

Market Insights

Community Narratives