As global markets navigate the complexities of easing trade tensions and fluctuating economic indicators, small-cap stocks have shown resilience with consecutive weeks of gains. In this environment, identifying undiscovered gems requires a keen eye for companies that demonstrate strong fundamentals and adaptability to current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Tianjin Port Holdings | 17.03% | -3.88% | 9.77% | ★★★★★★ |

| Shandong Sinoglory Health Food | 1.80% | 2.21% | 5.77% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 10.42% | -9.07% | ★★★★★★ |

| Zhejiang Hengwei Battery | NA | 9.07% | 10.81% | ★★★★★★ |

| Jiangsu Lianfa TextileLtd | 24.89% | 2.63% | -28.52% | ★★★★★☆ |

| Hefei Gocom Information TechnologyLtd | 1.51% | 9.89% | -9.50% | ★★★★★☆ |

| JinXianDai Information IndustryLtd | 16.54% | -0.60% | -32.74% | ★★★★★☆ |

| Jinlihua Electric | 48.71% | 7.36% | 31.30% | ★★★★★☆ |

| Sinomag Technology | 68.98% | 16.59% | 3.83% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Toread Holdings Group (SZSE:300005)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toread Holdings Group Co., Ltd. focuses on the research, development, operation, and sales of outdoor products in China with a market cap of CN¥8.58 billion.

Operations: Toread Holdings generates revenue primarily from the sale of outdoor products. The company's cost structure includes expenses related to research, development, and operations. It has a market cap of CN¥8.58 billion.

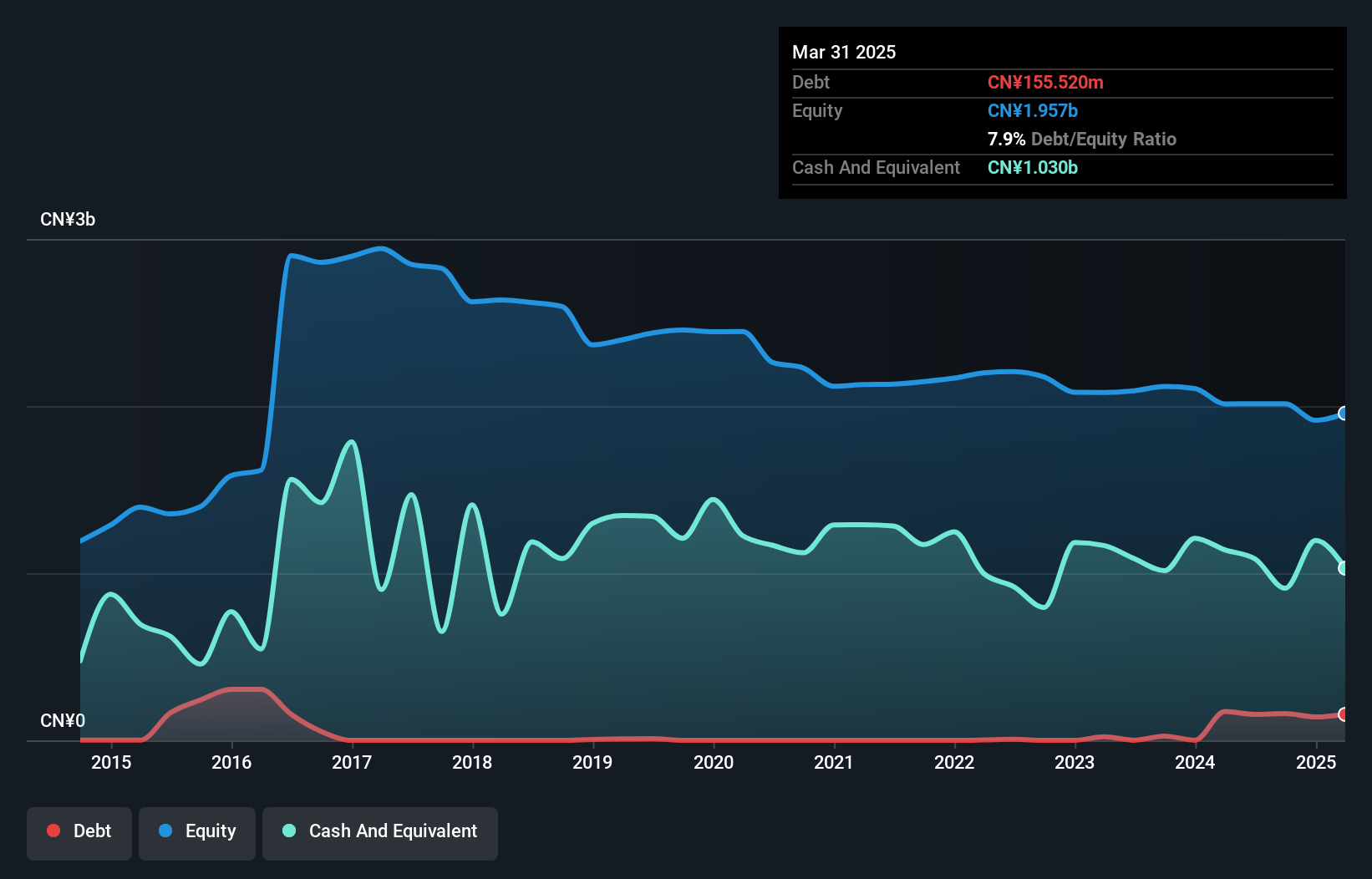

Toread Holdings, a small cap entity in the leisure industry, has shown mixed financial results recently. Despite a volatile share price and net income dropping to CNY 49.32 million from CNY 71.18 million year-on-year, it remains profitable with more cash than total debt. The debt-to-equity ratio rose to 7.9% over five years, indicating increased leverage but manageable risk given its cash position of CNY 631.20 million as of September 2024. Earnings grew by an impressive 21.8% last year and are expected to rise by another 17.82%, outpacing industry growth rates significantly despite recent challenges in revenue performance.

- Delve into the full analysis health report here for a deeper understanding of Toread Holdings Group.

Dong Fang Offshore (TPEX:7786)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dong Fang Offshore Co., Ltd. provides comprehensive vessel solutions for offshore wind projects, including guard, MMO, CTV, HDD, transportation, berth, and cargo transfer services; the company has a market cap of NT$29.43 billion.

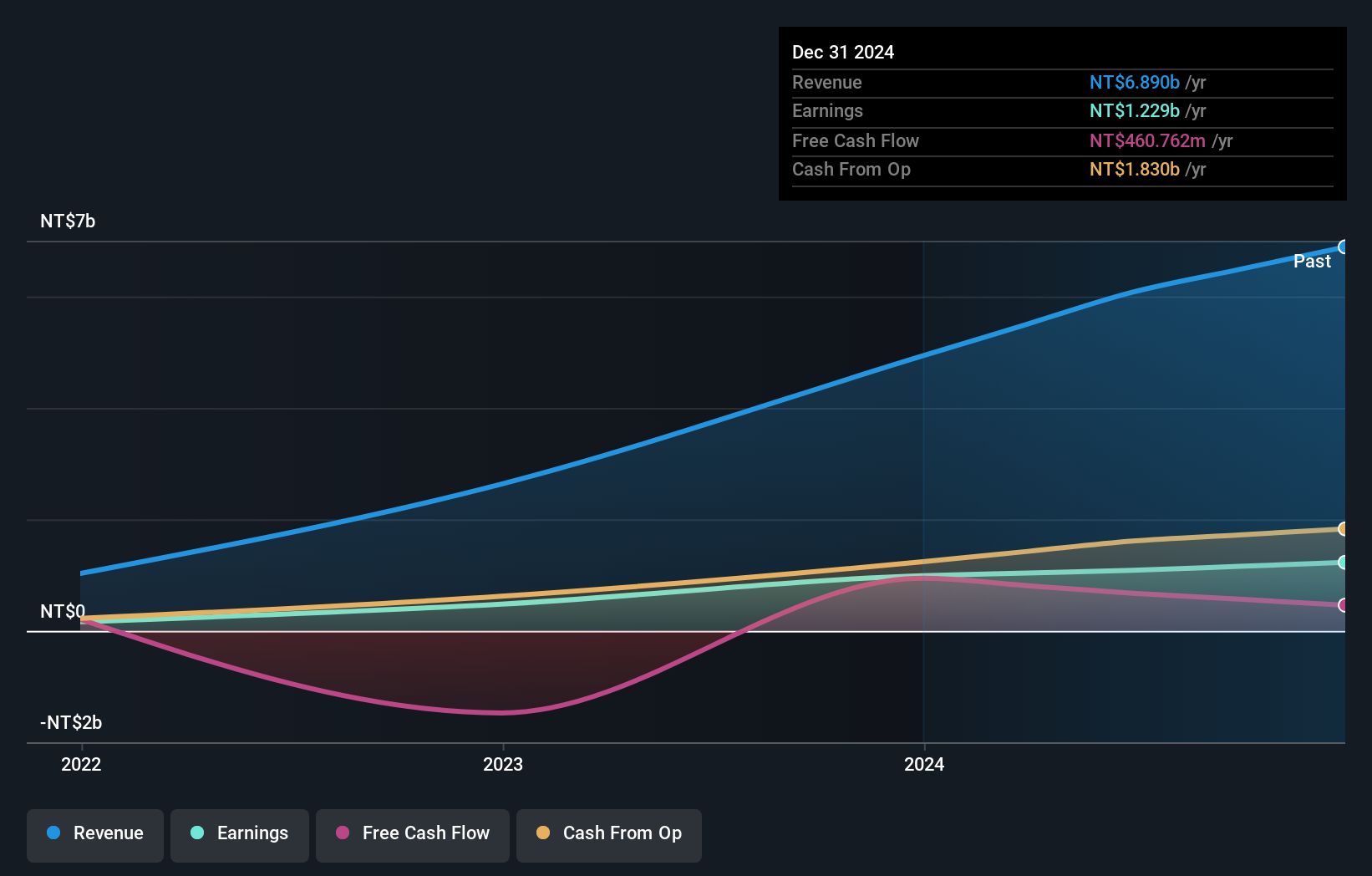

Operations: Revenue for Dong Fang Offshore primarily stems from its transportation-shipping segment, which generated NT$6.08 billion. The company's market cap stands at NT$29.43 billion, reflecting its significant presence in the offshore wind project sector.

Dong Fang Offshore, a small-cap player in the infrastructure sector, has shown impressive earnings growth of 48% over the past year, outpacing its industry peers. The company's high-quality earnings are complemented by a satisfactory net debt to equity ratio of 2.9%, indicating solid financial health. Interest payments are comfortably covered by EBIT at 129 times coverage, reflecting robust operational efficiency. Despite recent volatility in share price and outdated financial reports beyond six months, Dong Fang's inclusion in the S&P Global BMI Index suggests recognition and potential for increased visibility among investors.

- Click here to discover the nuances of Dong Fang Offshore with our detailed analytical health report.

Assess Dong Fang Offshore's past performance with our detailed historical performance reports.

Aica Kogyo Company (TSE:4206)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aica Kogyo Company, Limited engages in the development, production, and sale of chemical products as well as laminates and building materials both in Japan and internationally, with a market capitalization of ¥209.71 billion.

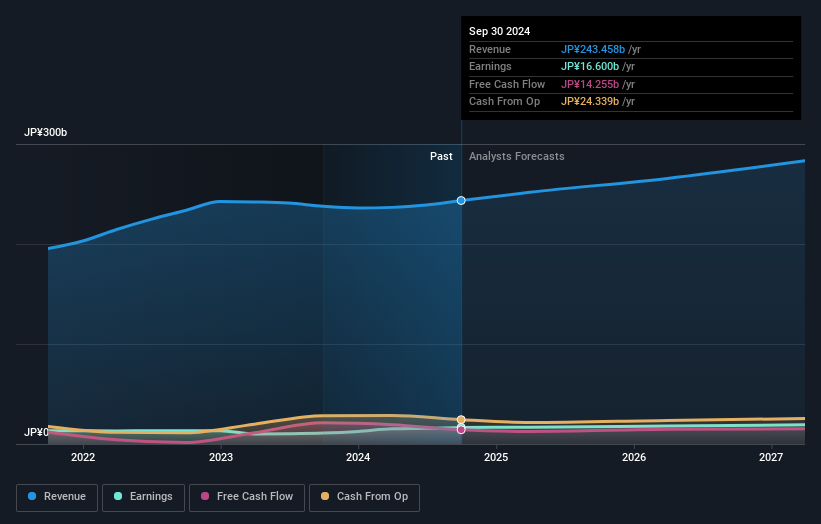

Operations: Aica Kogyo generates revenue through its chemical products and laminates and building materials segments. The company's net profit margin is 8.5%, reflecting its efficiency in converting sales into actual profit.

Aica Kogyo, a nimble player in the chemicals sector, has shown steady earnings growth of 7.6% annually over the past five years, though its recent 11.6% rise lagged behind industry peers at 17.9%. The company is trading attractively at about 10.6% below its fair value estimate and boasts high-quality earnings with more cash than debt on hand. A share repurchase program aims to buy back up to ¥6 billion worth of shares by year-end, enhancing shareholder returns and capital efficiency while planning strategic expansion through acquiring TAKARAINC CO., Ltd as a subsidiary further underscores its growth ambitions.

Taking Advantage

- Delve into our full catalog of 3278 Global Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4206

Aica Kogyo Company

Develops, produces, and sells chemical products, and laminates and building materials in Japan and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives