- Taiwan

- /

- Infrastructure

- /

- TPEX:7786

Three Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by declines across most major stock indexes, the technology-heavy Nasdaq Composite managed to hit a record high, while small-cap stocks underperformed against their larger counterparts. As markets brace for potential rate cuts from the Federal Reserve amid cooling labor market indicators and stalled inflation progress, investors may find opportunities in lesser-known stocks that exhibit resilience and growth potential in such volatile environments. Identifying these "undiscovered gems" often involves looking for companies with strong fundamentals that can thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Balady Poultry (SASE:9559)

Simply Wall St Value Rating: ★★★★★☆

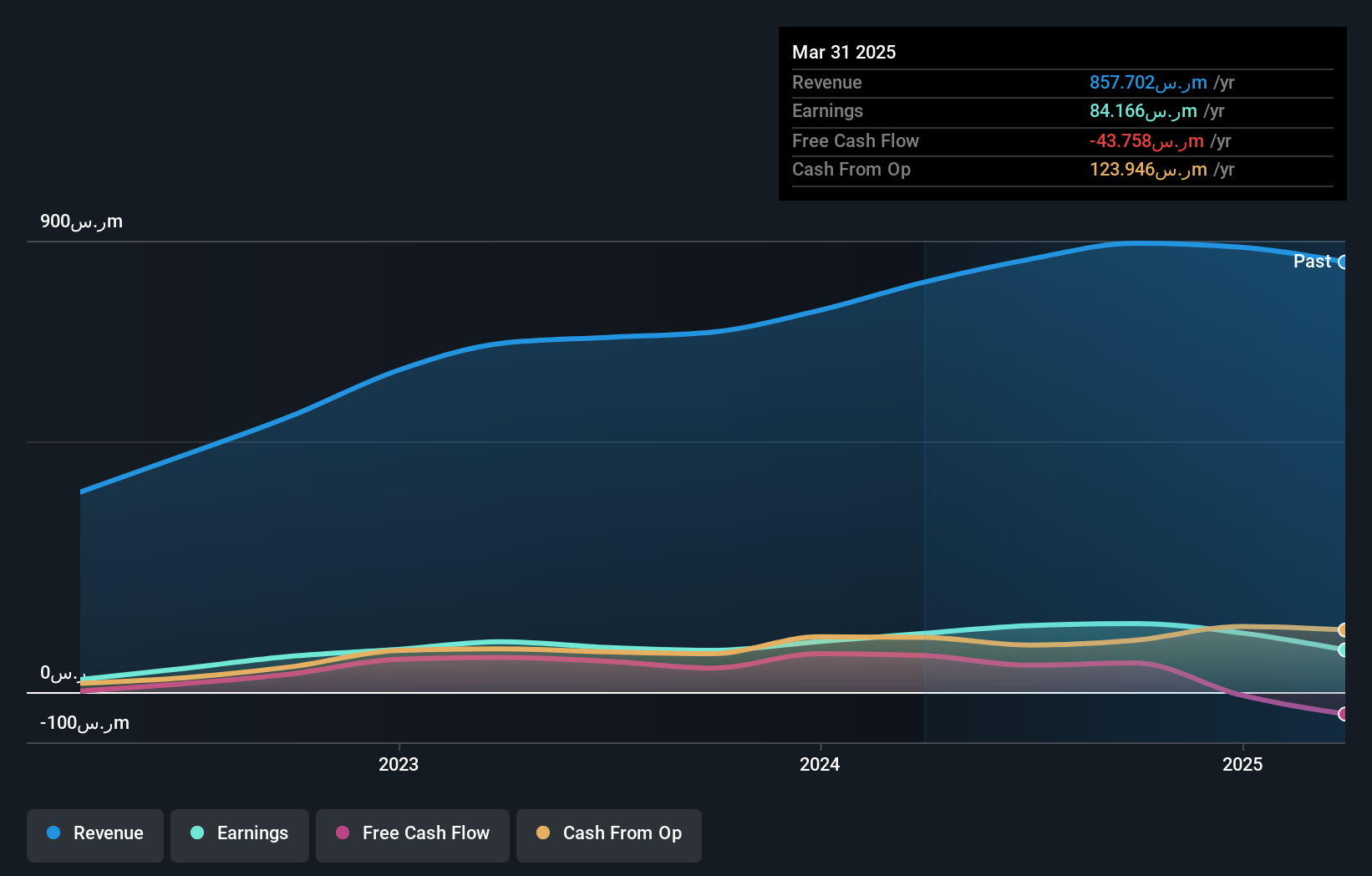

Overview: Balady Poultry Company is involved in the production of poultry products in Saudi Arabia and has a market capitalization of SAR2.62 billion.

Operations: Balady Poultry generates revenue primarily from its food processing segment, totaling SAR895.05 million.

Balady Poultry, a small player in the food sector, has shown impressive earnings growth of 64% over the past year, outpacing the industry's 25%. This growth is supported by high-quality non-cash earnings and a robust EBIT coverage of interest payments at 828 times. The company seems to be managing its debt well, with more cash than total debt on hand. Additionally, Balady's price-to-earnings ratio stands at 19.6x, which is appealing compared to the SA market average of 23.7x. These factors suggest it could have promising potential within its industry niche moving forward.

- Get an in-depth perspective on Balady Poultry's performance by reading our health report here.

Assess Balady Poultry's past performance with our detailed historical performance reports.

Boyaa Interactive International (SEHK:434)

Simply Wall St Value Rating: ★★★★★★

Overview: Boyaa Interactive International Limited is an investment holding company that develops and operates online card and board games in the People’s Republic of China and internationally, with a market cap of HK$3.80 billion.

Operations: The company generates revenue primarily from its online card and board games. It has a market capitalization of approximately HK$3.80 billion.

Boyaa Interactive, a small player in the entertainment sector, has shown impressive earnings growth of 116.5% over the past year, outpacing industry averages. Despite this robust performance, recent results for Q3 2024 revealed a net loss of CNY 72.05 million compared to last year's profit of CNY 29.55 million, with sales slightly increasing to CNY 104.83 million from CNY 100.04 million. The company's nine-month figures tell a brighter story with net income rising significantly to CNY 212.33 million from CNY 85.13 million in the previous year, driven by gains in digital assets and optimized gaming operations.

Dong Fang Offshore (TPEX:7786)

Simply Wall St Value Rating: ★★★★★☆

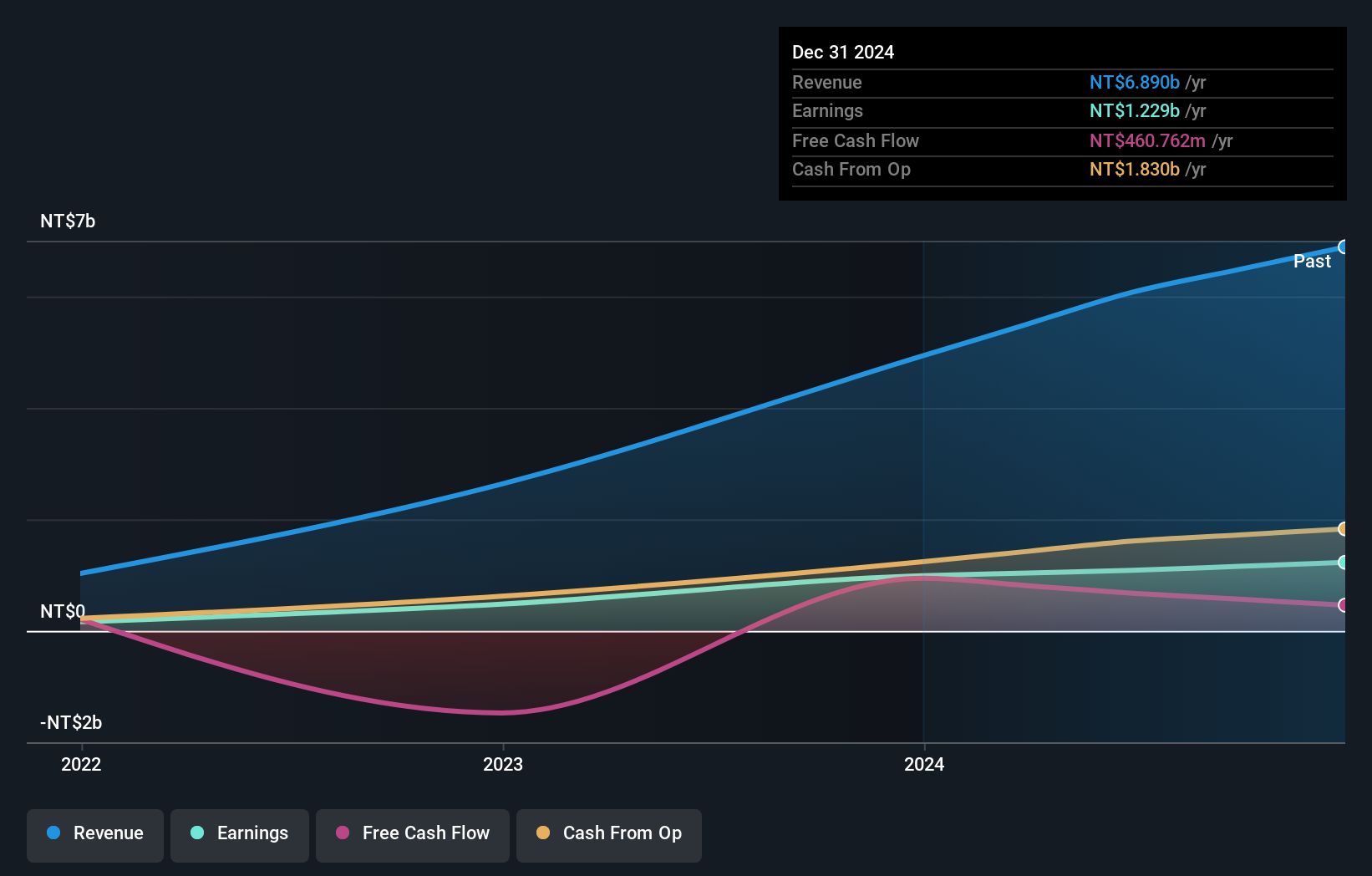

Overview: Dong Fang Offshore Co., Ltd. provides vessel solutions for offshore wind projects, including services such as guard, MMO, CTV, HDD, transportation, berth, and cargo transfer with a market cap of NT$27.48 billion.

Operations: The company's primary revenue stream is derived from its transportation-shipping segment, generating NT$4.93 billion.

Dong Fang Offshore, a lesser-known player in the infrastructure sector, has demonstrated impressive earnings growth of 106% over the past year, significantly outpacing the industry's 4.8% increase. This company is trading at a substantial discount of 53% below its estimated fair value, suggesting potential undervaluation. With a net debt to equity ratio of 13.9%, Dong Fang maintains satisfactory leverage levels, ensuring financial stability. The firm's interest payments are well covered by EBIT at 53 times coverage, indicating strong operational efficiency and capacity to manage debt obligations effectively despite recent share price volatility.

Where To Now?

- Unlock our comprehensive list of 4502 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:7786

Proven track record with adequate balance sheet.

Market Insights

Community Narratives