- Taiwan

- /

- Construction

- /

- TWSE:6691

Exploring ZheJiang Haers Vacuum ContainersLtd And 2 Other Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets show resilience with easing inflation and strong earnings reports, small-cap stocks are gaining attention amidst a backdrop of improving economic indicators. In this environment, identifying undiscovered gems like ZheJiang Haers Vacuum Containers Ltd can provide investors with unique opportunities to diversify their portfolios by focusing on companies that demonstrate strong fundamentals and potential for growth in niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Xiangtan Electrochemical ScientificLtd | 44.62% | 13.70% | 36.55% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

ZheJiang Haers Vacuum ContainersLtd (SZSE:002615)

Simply Wall St Value Rating: ★★★★★★

Overview: ZheJiang Haers Vacuum Containers Co., Ltd. operates in the manufacturing sector, specializing in the production of vacuum containers, with a market capitalization of approximately CN¥3.65 billion.

Operations: Haers Vacuum Containers generates revenue primarily from the manufacturing of vacuum containers, with a focus on optimizing its production processes. The company has reported varying net profit margins over recent periods, reflecting changes in cost management and pricing strategies.

ZheJiang Haers Vacuum Containers Ltd. showcases a solid financial profile, with earnings growing 80% over the past year, significantly outpacing the Consumer Durables industry's -0.2%. The company's debt-to-equity ratio has improved from 92.3% to 35.5% in five years, indicating effective debt management and likely contributing to its profitability. Trading at nearly 20% below estimated fair value suggests potential undervaluation relative to peers. Recent earnings reported for nine months ending September 2024 show net income of CNY 224.93 million compared to CNY 152.98 million last year, reflecting robust performance despite a dividend decrease announced recently for Q3 of 2024 at CNY1 per share.

- Take a closer look at ZheJiang Haers Vacuum ContainersLtd's potential here in our health report.

Learn about ZheJiang Haers Vacuum ContainersLtd's historical performance.

Dong Fang Offshore (TPEX:7786)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dong Fang Offshore Co., Ltd. provides comprehensive vessel solutions for offshore wind projects, including services such as guard, MMO, CTV, HDD, transportation, berth, and cargo transfer; it has a market capitalization of NT$33.58 billion.

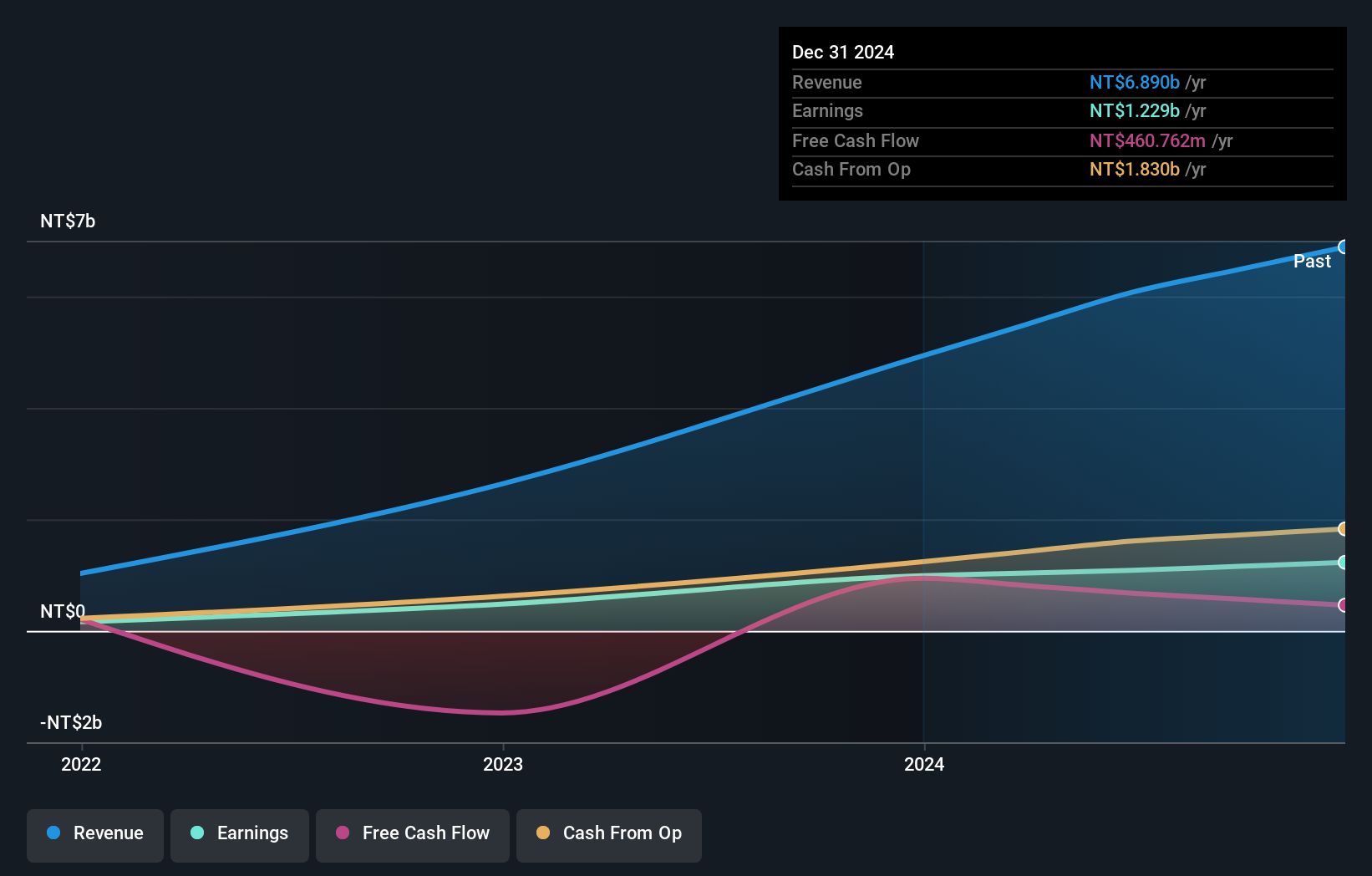

Operations: Dong Fang generates revenue primarily from its transportation and shipping services, amounting to NT$6.08 billion. The company's financial performance is reflected in its net profit margin trends, which provide insights into profitability relative to total revenue.

Dong Fang Offshore, a small player in the infrastructure sector, has shown impressive financial strength with earnings growth of 48% over the past year, outpacing the industry average of 19.7%. The company boasts high-quality earnings and maintains a net debt to equity ratio of 2.9%, which is considered satisfactory. Its interest payments are well covered by EBIT at an impressive 129 times coverage. Despite recent share price volatility, Dong Fang remains free cash flow positive with a robust cash runway that supports its operations without concern for liquidity issues.

- Dive into the specifics of Dong Fang Offshore here with our thorough health report.

Examine Dong Fang Offshore's past performance report to understand how it has performed in the past.

Yankey Engineering (TWSE:6691)

Simply Wall St Value Rating: ★★★★★★

Overview: Yankey Engineering Co., Ltd. provides engineering services across Taiwan, China, and Thailand with a market capitalization of NT$50.15 billion.

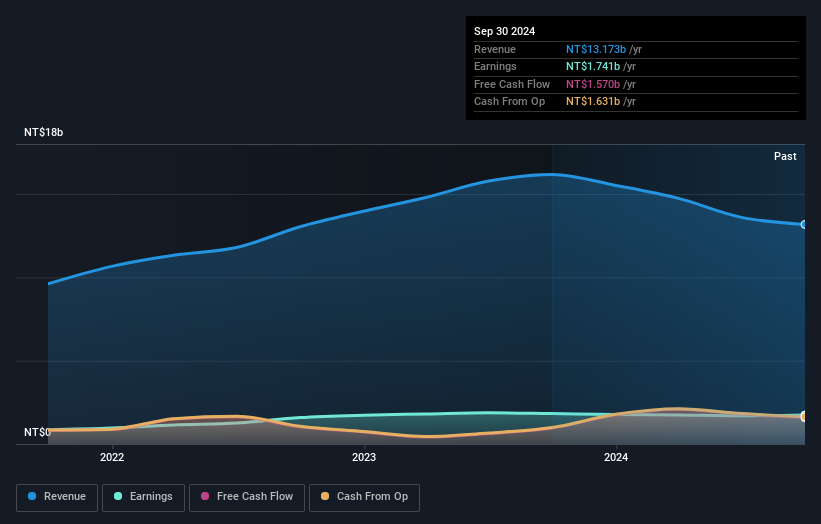

Operations: Yankey Engineering's revenue primarily comes from its Building Materials - HVAC Equipment segment, generating NT$13.17 billion.

Yankey Engineering, a nimble player in its field, recently showcased an intriguing mix of financial dynamics. Despite facing a negative earnings growth of 4.6% over the past year, contrasting with the industry average of 9.3%, it's notable that Yankey is debt-free and has successfully reduced its debt from a 10.4% debt-to-equity ratio five years ago to zero now. The company also reported high-quality earnings and positive free cash flow, highlighting its operational efficiency. Recent quarterly results saw net income climb to TWD 549 million from TWD 503 million year-over-year despite sales dipping to TWD 3,767 million from TWD 4,192 million.

- Unlock comprehensive insights into our analysis of Yankey Engineering stock in this health report.

Assess Yankey Engineering's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4639 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6691

Yankey Engineering

Offers engineering services in Taiwan, China, and Thailand.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives