- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8249

3 Dividend Stocks In Global Yielding Up To 5.5%

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape marked by cooling labor markets, trade tensions, and fluctuating economic indicators, investors are seeking stability in dividend stocks that offer reliable income streams. In this environment, selecting dividend stocks with strong fundamentals and attractive yields can provide a measure of resilience against market volatility while potentially delivering steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.10% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.17% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.41% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.35% | ★★★★★★ |

| Daicel (TSE:4202) | 4.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

Click here to see the full list of 1565 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

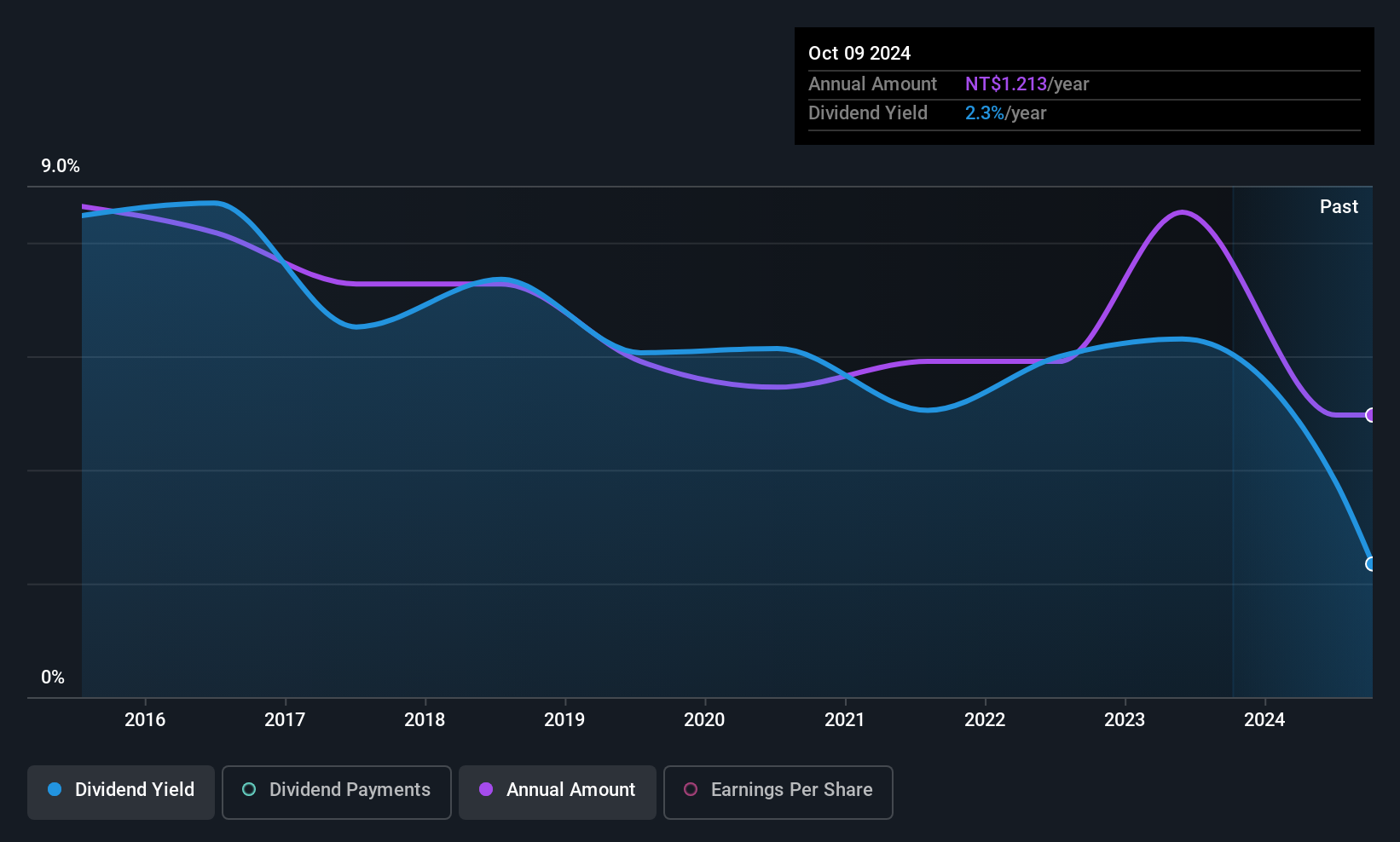

Shieh Yih Machinery Industry (TPEX:4533)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shieh Yih Machinery Industry Co., Ltd. designs, develops, manufactures, and sells machinery across China, Taiwan, America, Europe, and other international markets with a market cap of NT$4.38 billion.

Operations: The company's revenue primarily comes from the research, development, production, and sales of products such as punch presses, totaling NT$3.85 billion.

Dividend Yield: 4.3%

Shieh Yih Machinery Industry has maintained reliable and stable dividend payments over the past decade, with growth and minimal volatility. However, its high payout ratio of 104% indicates dividends are not well covered by earnings, raising sustainability concerns. Despite a reasonable cash payout ratio of 58.2%, recent declines in profit margins from 8.4% to 4.7% could pressure future payouts. The current dividend yield of 4.33% is below the top tier in Taiwan's market at 5.18%.

- Click to explore a detailed breakdown of our findings in Shieh Yih Machinery Industry's dividend report.

- Our valuation report unveils the possibility Shieh Yih Machinery Industry's shares may be trading at a premium.

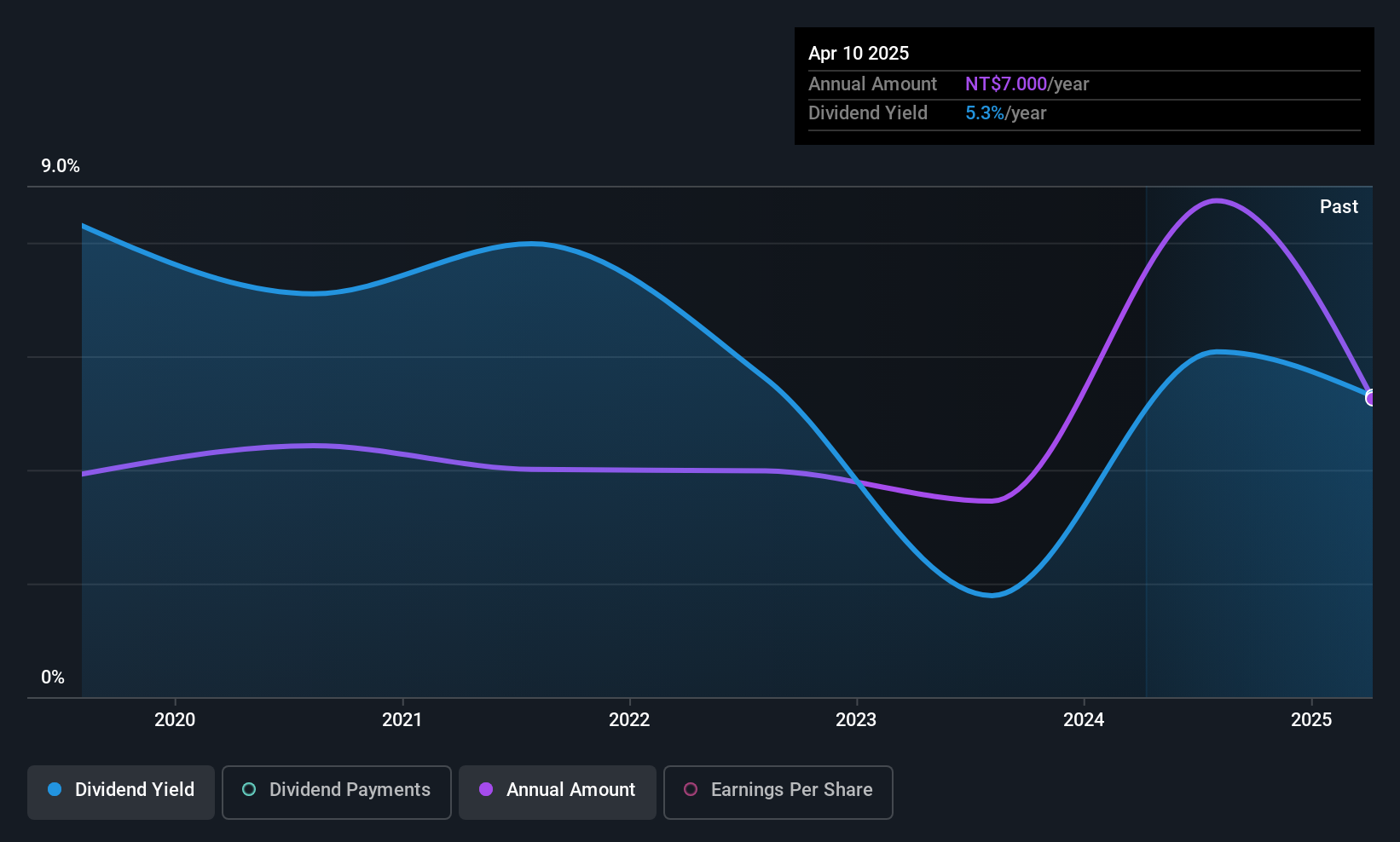

Shiny Brands Group (TPEX:6703)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shiny Brands Group Co., Ltd. focuses on the research, development, and production of skincare products in Taiwan and internationally, with a market cap of NT$3.50 billion.

Operations: Shiny Brands Group Co., Ltd. generates revenue primarily from its Beauty Care Products and Biotechnology Health Food segment, amounting to NT$3.46 billion.

Dividend Yield: 5.6%

Shiny Brands Group's dividend yield of 5.58% ranks in the top 25% of Taiwan's market, yet its track record is unstable with volatile payments over six years. The payout ratio stands at 81.8%, indicating dividends are covered by earnings, while a cash payout ratio of 63% suggests coverage by cash flows as well. Recent financials show declining sales and net income, which could affect future dividend stability despite the current reasonable valuation below estimated fair value.

- Click here to discover the nuances of Shiny Brands Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Shiny Brands Group's current price could be quite moderate.

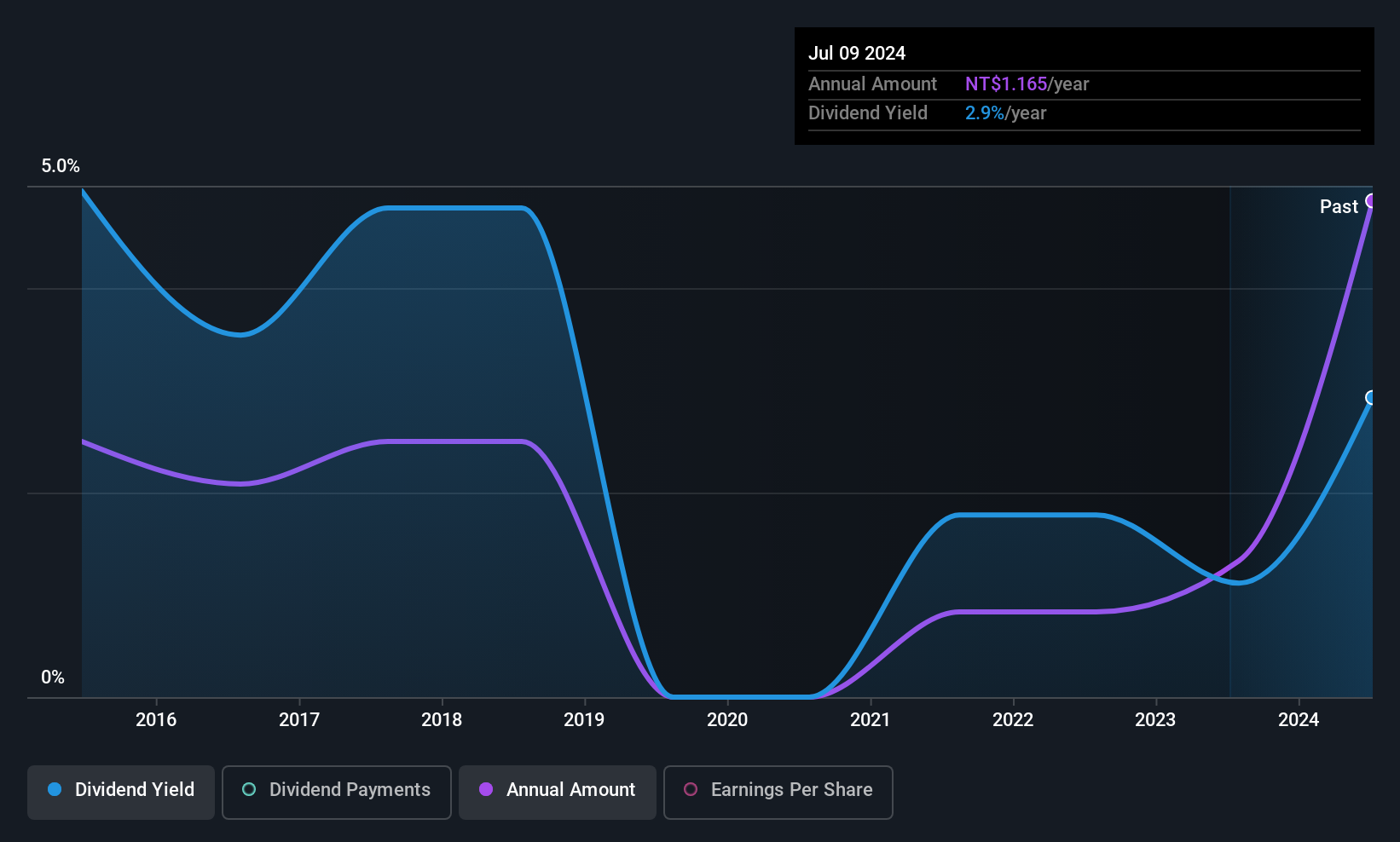

Creative Sensor (TWSE:8249)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Creative Sensor Inc. manufactures and trades image sensors and electronic components across China, Thailand, the Philippines, and internationally, with a market cap of NT$6.53 billion.

Operations: Creative Sensor Inc.'s revenue from its Electronic Components & Parts segment is NT$4.60 billion.

Dividend Yield: 4%

Creative Sensor's dividend payments are covered by earnings with a payout ratio of 52.1% and supported by cash flows at 42.6%, though the dividend yield of 3.97% is lower than Taiwan's top quartile. Despite a volatile share price and an unstable dividend history over the past decade, recent financials show robust growth with Q1 net income rising significantly to TWD 108.07 million from TWD 23.86 million year-over-year, indicating potential for future stability if maintained.

- Dive into the specifics of Creative Sensor here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Creative Sensor is priced lower than what may be justified by its financials.

Next Steps

- Access the full spectrum of 1565 Top Global Dividend Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8249

Creative Sensor

Manufactures and trades in image sensors and its electronic components in China, Thailand, the Philippines, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success