- China

- /

- Semiconductors

- /

- SHSE:688270

3 Asian Growth Companies With High Insider Ownership Growing Earnings Up To 55%

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and ongoing trade negotiations, the Asian market remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 23.7% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's uncover some gems from our specialized screener.

Great Microwave Technology (SHSE:688270)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Great Microwave Technology Co., Ltd. focuses on the R&D, production, and sale of integrated circuit chips and microsystems in China, with a market cap of CN¥10.29 billion.

Operations: The company's revenue is primarily derived from its activities in research and development, production, and sale of integrated circuit chips and microsystems within China.

Insider Ownership: 21%

Earnings Growth Forecast: 55.3% p.a.

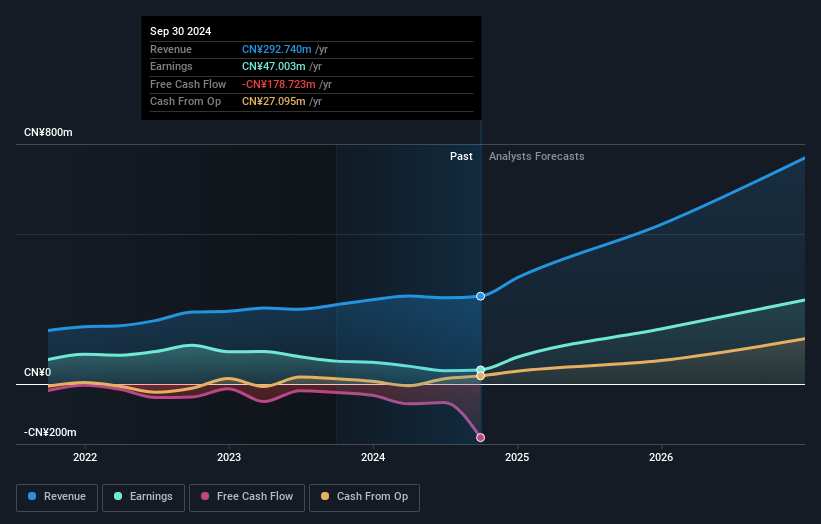

Great Microwave Technology demonstrates significant growth potential, with revenue expected to increase by 33.8% annually, outpacing the Chinese market's 12.5%. Earnings are forecast to grow at a robust 55.3% per year. Despite no recent insider trading activity, the company reported strong Q1 results with sales of CNY 72.63 million and net income of CNY 22.47 million, reversing a loss from last year. A recent share buyback further underscores management's confidence in future prospects.

- Unlock comprehensive insights into our analysis of Great Microwave Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that Great Microwave Technology is trading beyond its estimated value.

BMC Medical (SZSE:301367)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BMC Medical Co., Ltd. focuses on the research, development, manufacturing, and supply of medical equipment and consumables for respiratory health in China, with a market cap of CN¥7.19 billion.

Operations: Revenue Segments (in millions of CN¥):

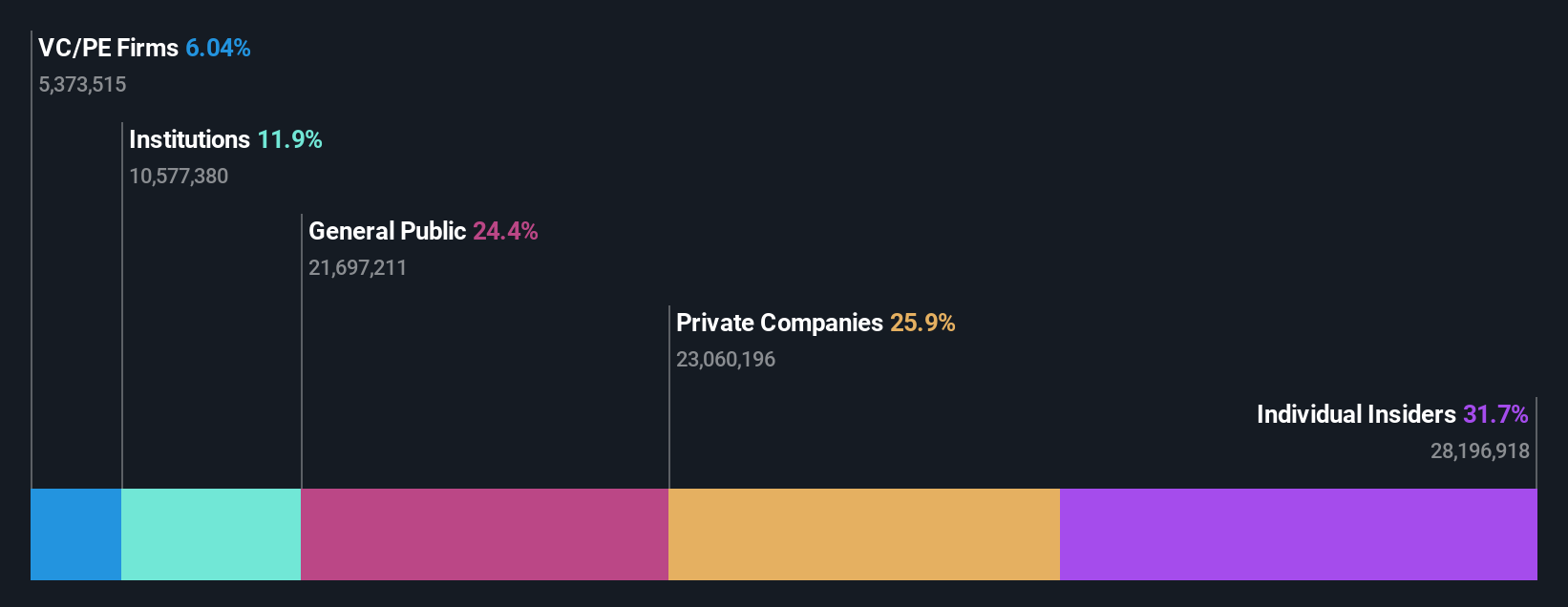

Insider Ownership: 31.7%

Earnings Growth Forecast: 33.1% p.a.

BMC Medical shows promising growth potential, with revenue and earnings expected to grow at 20.9% and 33.1% annually, respectively, surpassing the Chinese market averages. Recent Q1 results highlighted a strong performance with sales of CNY 265.29 million and net income of CNY 71.93 million, up from last year. Despite no recent insider trading activity or share buybacks in April, the company continues to trade below estimated fair value by 35.7%.

- Click here and access our complete growth analysis report to understand the dynamics of BMC Medical.

- Insights from our recent valuation report point to the potential undervaluation of BMC Medical shares in the market.

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chenbro Micom Co., Ltd. specializes in the research, design, manufacture, and trading of computer peripherals and systems across various international markets, with a market cap of NT$34.72 billion.

Operations: Revenue Segments (in millions of NT$):

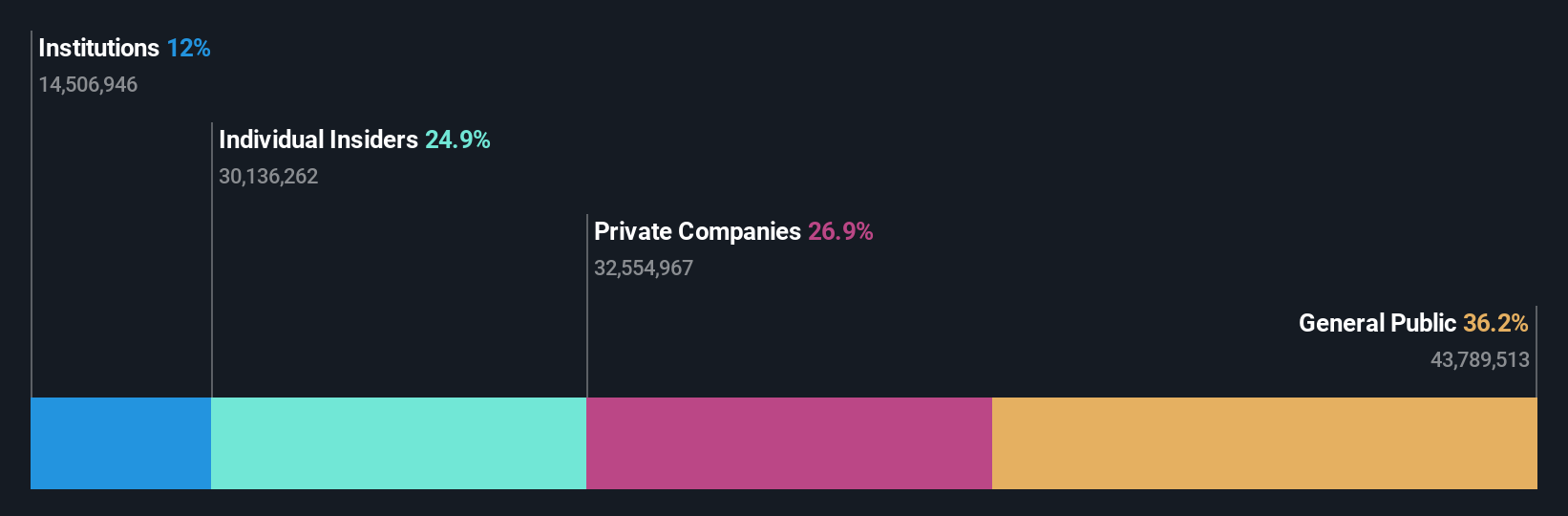

Insider Ownership: 24.9%

Earnings Growth Forecast: 16.5% p.a.

Chenbro Micom demonstrates robust growth potential, with revenue and earnings forecasted to grow at 21.9% and 16.5% annually, outpacing the Taiwan market averages. Recent Q1 results showed significant improvement, with sales of TWD 4.15 billion and net income of TWD 666.8 million, compared to last year’s figures. Despite high share price volatility and an unstable dividend track record, the company trades at a favorable P/E ratio of 15.5x against the market average of 18.5x.

- Dive into the specifics of Chenbro Micom here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Chenbro Micom's share price might be too pessimistic.

Turning Ideas Into Actions

- Delve into our full catalog of 618 Fast Growing Asian Companies With High Insider Ownership here.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688270

Great Microwave Technology

Engages in the research and development, production, and sale of integrated circuit chips and microsystems in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives