- South Korea

- /

- Food

- /

- KOSE:A003230

3 Asian Growth Companies With High Insider Ownership And Up To 30% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape of trade negotiations and economic data, Asian markets are capturing attention with their unique growth stories. In this environment, companies with high insider ownership and robust earnings growth potential stand out as compelling opportunities for investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 25.7% |

| Novoray (SHSE:688300) | 23.6% | 27.1% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 41.8% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's dive into some prime choices out of the screener.

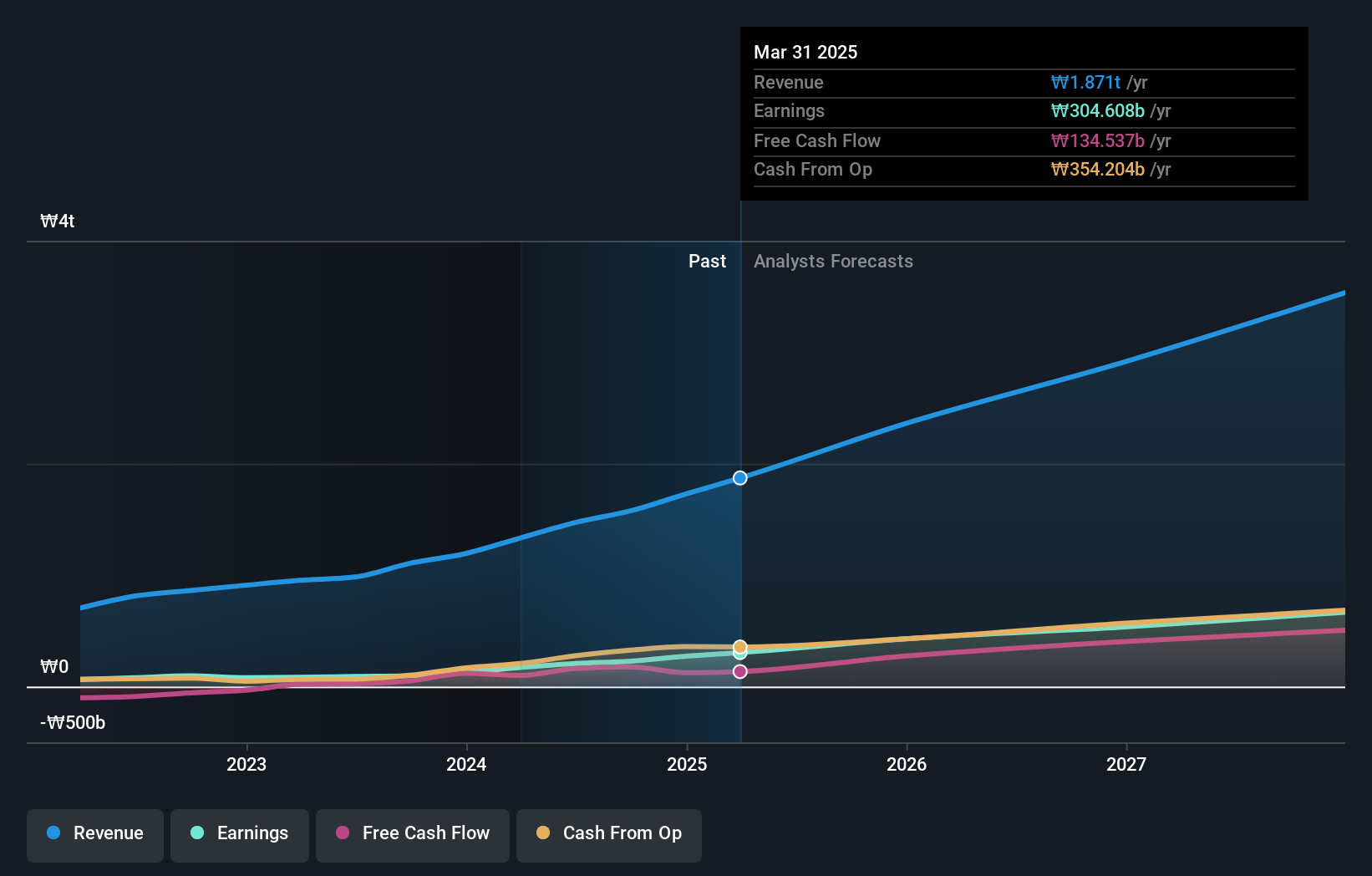

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★★★

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both in South Korea and internationally, with a market cap of ₩11.17 trillion.

Operations: Samyang Foods generates revenue through its operations in the food sector, serving both domestic and international markets.

Insider Ownership: 11.7%

Earnings Growth Forecast: 25.7% p.a.

Samyang Foods exhibits strong growth prospects, with revenue expected to increase by 21.7% annually, outpacing the Korean market. Earnings are projected to grow significantly at 25.7% per year, surpassing market averages. Recent product expansion in the U.S., including the reintroduction of Tangle instant pasta, highlights its strategic growth initiatives. The stock trades at a substantial discount to its estimated fair value and maintains high-quality earnings without significant insider trading activity in recent months.

- Click here to discover the nuances of Samyang Foods with our detailed analytical future growth report.

- The analysis detailed in our Samyang Foods valuation report hints at an inflated share price compared to its estimated value.

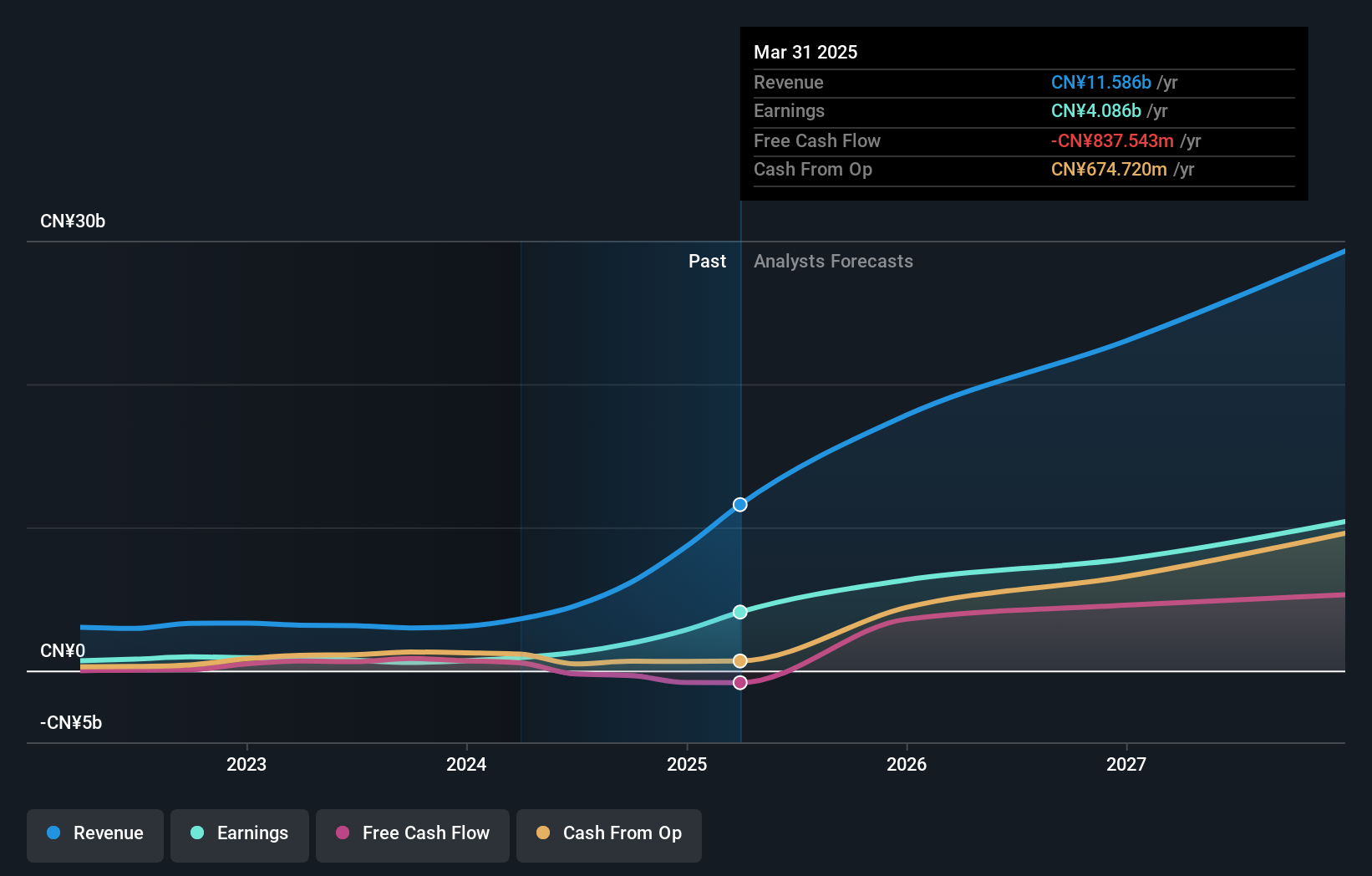

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, production, and sales of optical modules both in China and internationally, with a market cap of CN¥132.03 billion.

Operations: The company generates revenue of CN¥11.59 billion from its optical communication equipment segment.

Insider Ownership: 23%

Earnings Growth Forecast: 31% p.a.

Eoptolink Technology demonstrates robust growth potential, with earnings expected to grow significantly at 31% annually, surpassing the Chinese market. Revenue is forecast to rise by 31.5% per year, driven by strong recent performance. Despite a volatile share price, it trades at a good value relative to peers and industry standards. High insider ownership aligns interests with shareholders, though no significant insider trading occurred recently. Recent AGM approved amendments to company bylaws and increased dividends.

- Delve into the full analysis future growth report here for a deeper understanding of Eoptolink Technology.

- Insights from our recent valuation report point to the potential undervaluation of Eoptolink Technology shares in the market.

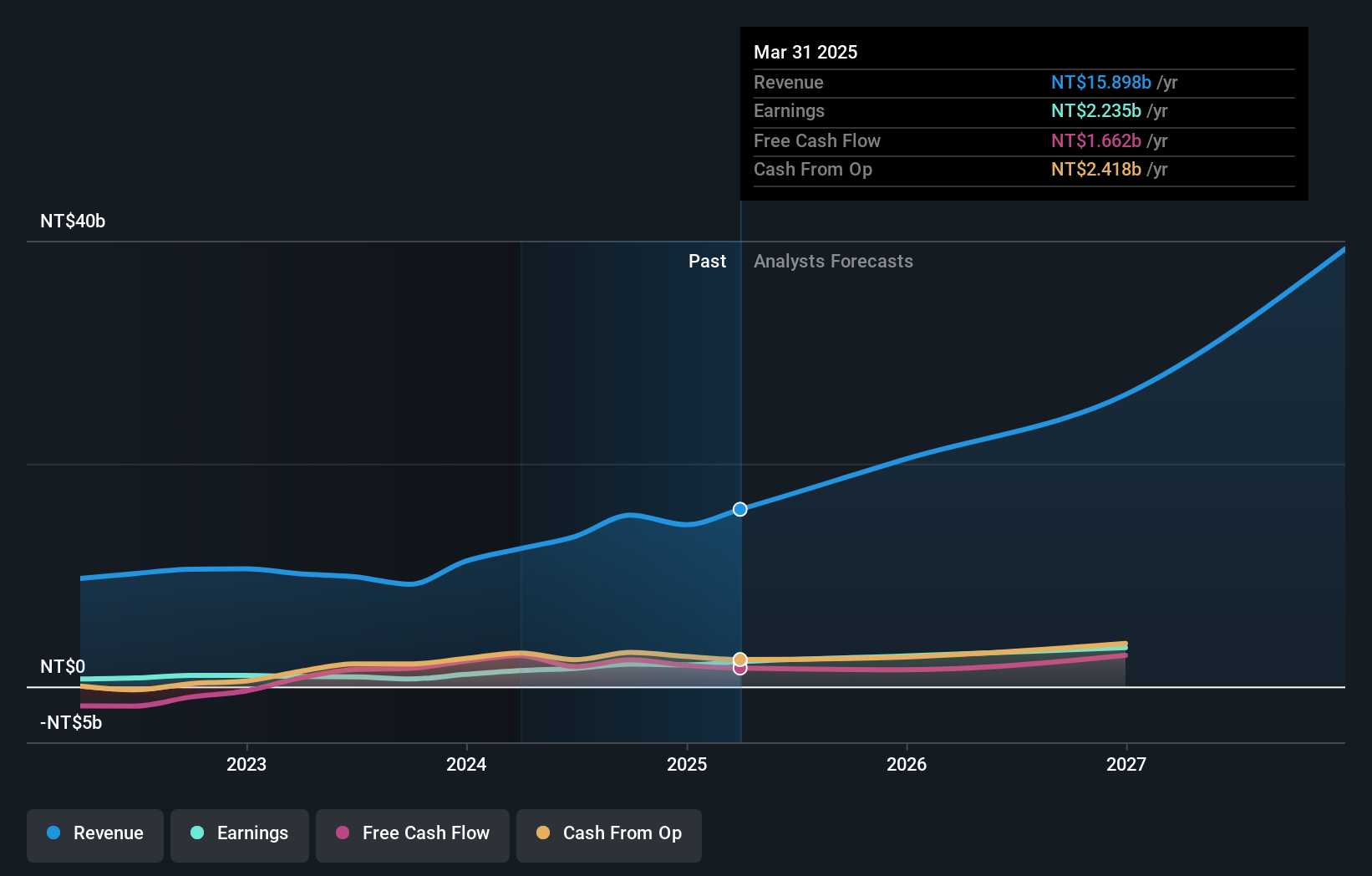

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenbro Micom Co., Ltd. specializes in the research, development, design, manufacture, processing, and trading of computer peripherals and expendable systems across the United States, China, Taiwan, Singapore, and other international markets with a market cap of NT$64.49 billion.

Operations: Chenbro Micom's revenue primarily comes from its computer peripherals segment, which generated NT$15.90 billion.

Insider Ownership: 24.9%

Earnings Growth Forecast: 25.3% p.a.

Chenbro Micom's earnings are forecast to grow significantly at 25.35% annually, outpacing the Taiwanese market, with revenue projected to increase by 27.4% per year. Recent events include a substantial dividend announcement of TWD 907 million and strategic presentations at major tech conferences highlighting its AI and server solutions. Despite recent share price volatility, strong insider ownership aligns management interests with shareholders, although no significant insider trading has been reported recently.

- Get an in-depth perspective on Chenbro Micom's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Chenbro Micom is trading beyond its estimated value.

Seize The Opportunity

- Navigate through the entire inventory of 601 Fast Growing Asian Companies With High Insider Ownership here.

- Ready To Venture Into Other Investment Styles? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003230

Samyang Foods

Engages in the food business in South Korea and internationally.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives