- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Exploring Undiscovered Asian Gems In May 2025

Reviewed by Simply Wall St

In May 2025, the Asian markets are experiencing a wave of optimism following the U.S.-China agreement to pause tariffs for 90 days, which has led to a rally in global equities and lifted investor sentiment. Against this backdrop, identifying promising small-cap stocks in Asia requires an eye for companies that can thrive amid easing trade tensions and exhibit resilience despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 5.53% | 8.75% | 11.19% | ★★★★★★ |

| Allmed Medical ProductsLtd | 20.96% | -1.35% | -31.57% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 8.22% | 15.89% | -9.68% | ★★★★★★ |

| Hiconics Eco-energy Technology | NA | 30.59% | 27.60% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Unitech Computer | 24.96% | 2.56% | 1.58% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| Haitian Water GroupLtd | 103.22% | 9.82% | 8.86% | ★★★★☆☆ |

| Renxin New MaterialLtd | 8.41% | 17.79% | -34.07% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

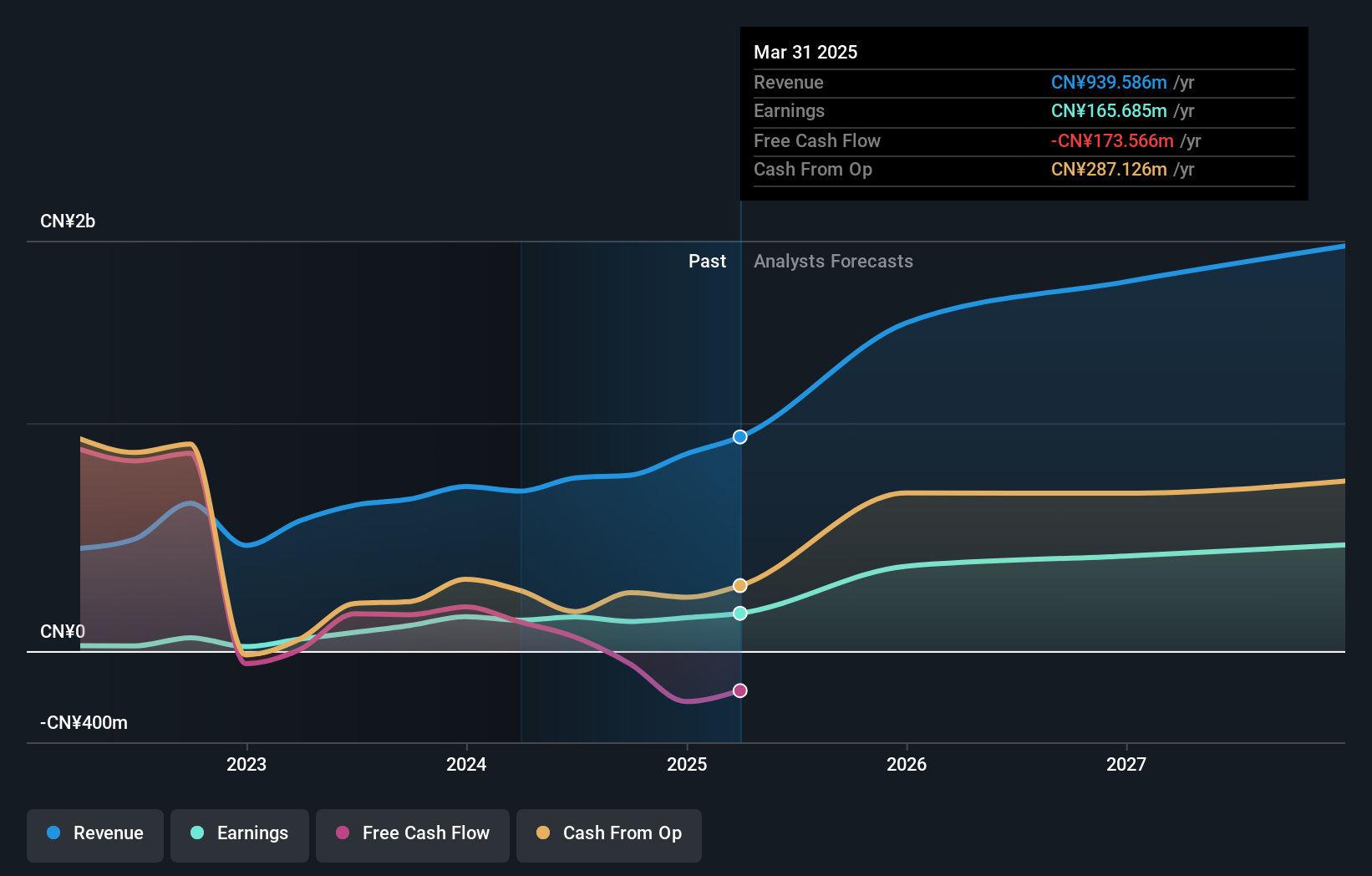

Zhejiang Sunriver Culture TourismLtd (SHSE:600576)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zhejiang Sunriver Culture Tourism Co., Ltd. operates in the cultural tourism industry, focusing on developing and managing tourism destinations, with a market cap of CN¥10.99 billion.

Operations: Zhejiang Sunriver Culture Tourism Co., Ltd. generates revenue primarily through the development and management of tourism destinations. The company has a market capitalization of CN¥10.99 billion, reflecting its presence in the cultural tourism sector.

Zhejiang Sunriver Culture Tourism Ltd. has shown promising growth, with earnings rising 22.5% over the past year, outpacing the entertainment industry's 4.2%. The company reported a net income of CNY 31.19 million for Q1 2025, a significant increase from CNY 12.06 million in the same period last year, indicating strong operational performance. Despite an increased debt to equity ratio from 5.6% to 33.9% over five years, its interest payments are well-covered by EBIT at a comfortable ratio of 9:1, suggesting manageable financial obligations and potential for continued growth in revenue and profitability.

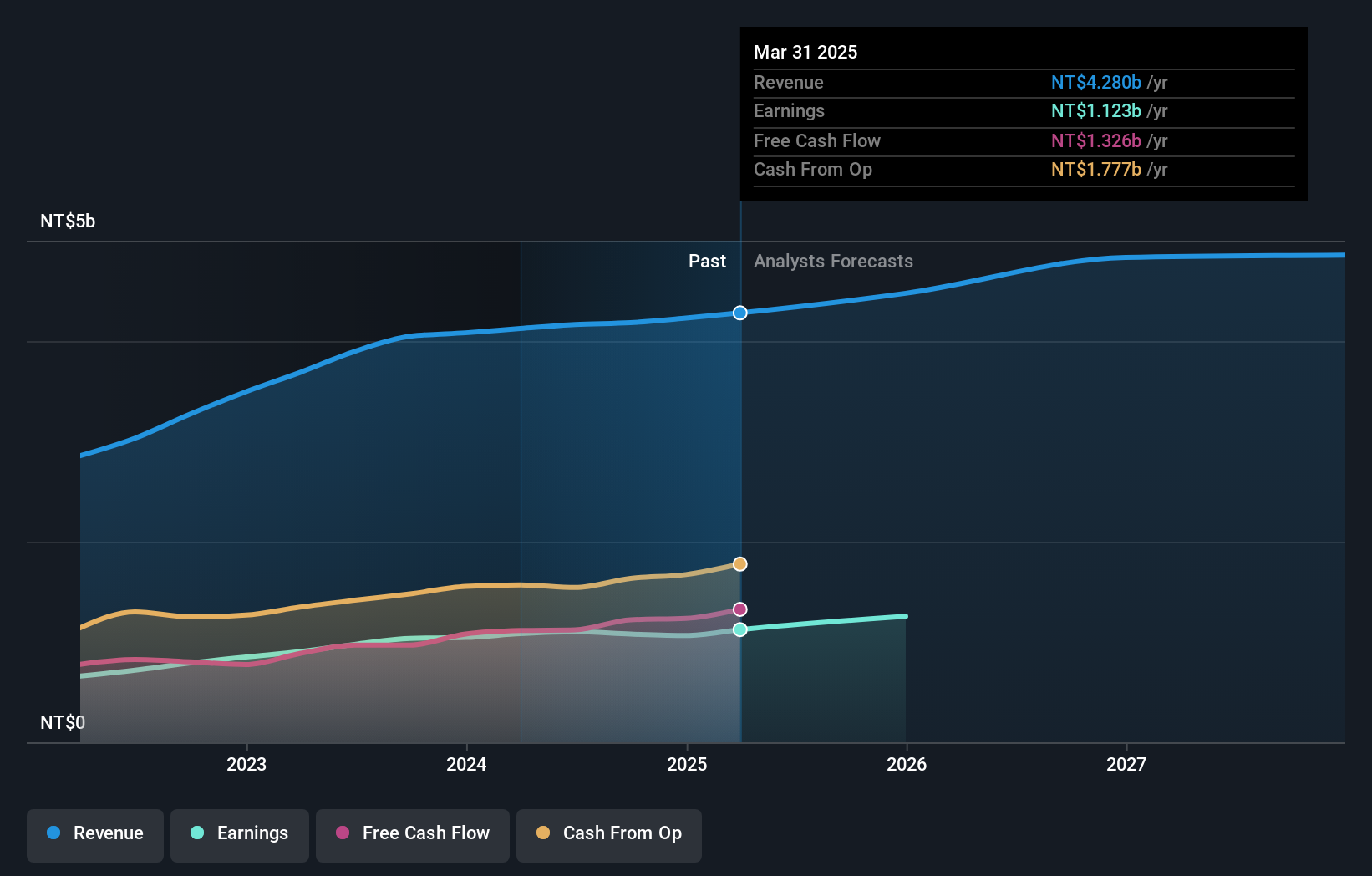

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Value Rating: ★★★★★★

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$17.96 billion.

Operations: Universal Vision Biotechnology generates revenue primarily from its chain of eye care clinics in Taiwan and China. The company's financial performance is reflected in its market capitalization of NT$17.96 billion, indicating its standing in the healthcare sector.

Universal Vision Biotechnology, a notable player in the biotech sector, has demonstrated robust financial health with earnings growing 23% annually over the past five years. The company reported a net income of TWD 362.65 million for Q1 2025, compared to TWD 303.88 million in the previous year, reflecting its strong performance trajectory. Trading at approximately 57% below its estimated fair value suggests potential upside for investors. Moreover, it boasts a debt-to-equity ratio reduction from 5% to just 1.2%, indicating prudent financial management and stability within this dynamic industry landscape.

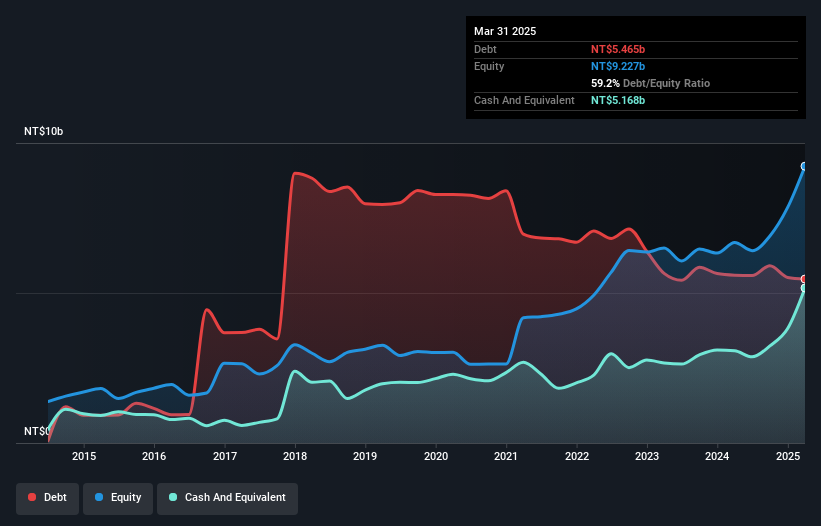

Posiflex Technology (TWSE:8114)

Simply Wall St Value Rating: ★★★★★★

Overview: Posiflex Technology, Inc. is involved in the manufacture and sale of industrial computers and peripheral equipment across Taiwan, the United States, and internationally, with a market capitalization of NT$34.71 billion.

Operations: Posiflex Technology generates revenue through the sale of industrial computers and peripheral equipment. The company's financial performance includes a net profit margin trend that shows fluctuations over recent periods.

Posiflex Technology, a nimble player in the electronics sector, has seen its earnings soar by 243.8% over the past year, outpacing industry growth. The company boasts a net debt to equity ratio of just 3.2%, indicating sound financial health, while its interest payments are comfortably covered by EBIT at 35.4 times over. Recent collaborations with Axiado Corporation highlight Posiflex's strategic push into AI-enhanced solutions for edge and enterprise deployments. With first-quarter sales jumping to TWD 5,918 million from TWD 2,216 million last year and net income rising to TWD 671 million from TWD 111 million, Posiflex demonstrates robust performance despite market volatility.

- Dive into the specifics of Posiflex Technology here with our thorough health report.

Understand Posiflex Technology's track record by examining our Past report.

Key Takeaways

- Navigate through the entire inventory of 2608 Asian Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.