- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8114

Are Robust Financials Driving The Recent Rally In Posiflex Technology, Inc.'s (TWSE:8114) Stock?

Posiflex Technology's (TWSE:8114) stock is up by a considerable 60% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Posiflex Technology's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Posiflex Technology

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Posiflex Technology is:

11% = NT$750m ÷ NT$6.7b (Based on the trailing twelve months to March 2024).

The 'return' is the yearly profit. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.11 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

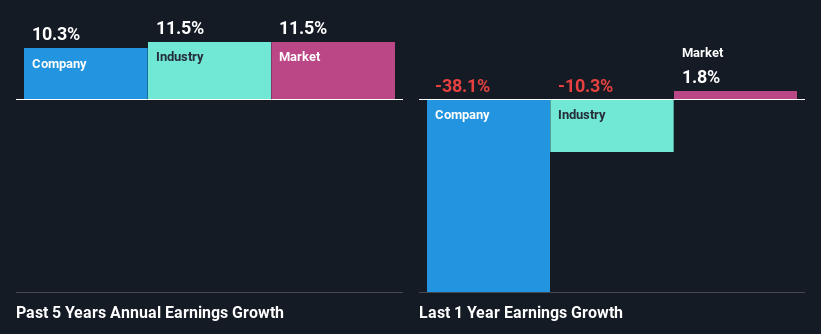

A Side By Side comparison of Posiflex Technology's Earnings Growth And 11% ROE

To begin with, Posiflex Technology seems to have a respectable ROE. On comparing with the average industry ROE of 8.5% the company's ROE looks pretty remarkable. This certainly adds some context to Posiflex Technology's decent 10% net income growth seen over the past five years.

As a next step, we compared Posiflex Technology's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 12% in the same period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for 8114? You can find out in our latest intrinsic value infographic research report.

Is Posiflex Technology Efficiently Re-investing Its Profits?

Posiflex Technology has a significant three-year median payout ratio of 72%, meaning that it is left with only 28% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Besides, Posiflex Technology has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

Overall, we are quite pleased with Posiflex Technology's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8114

Posiflex Technology

Engages in the manufacture and sale of industrial computers and peripheral equipment in Taiwan, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion