- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8046

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

As February 2025 unfolds, global markets are navigating a complex landscape marked by fluctuating corporate earnings and competitive pressures in the technology sector, particularly influenced by advancements in artificial intelligence. With the Federal Reserve maintaining interest rates and geopolitical tensions impacting trade policies, investors are keenly observing how these dynamics affect small-cap stocks, especially within high-growth tech sectors. In such an environment, identifying promising tech stocks often involves evaluating their innovation potential and resilience to market volatility while considering broader economic indicators that could impact growth trajectories.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

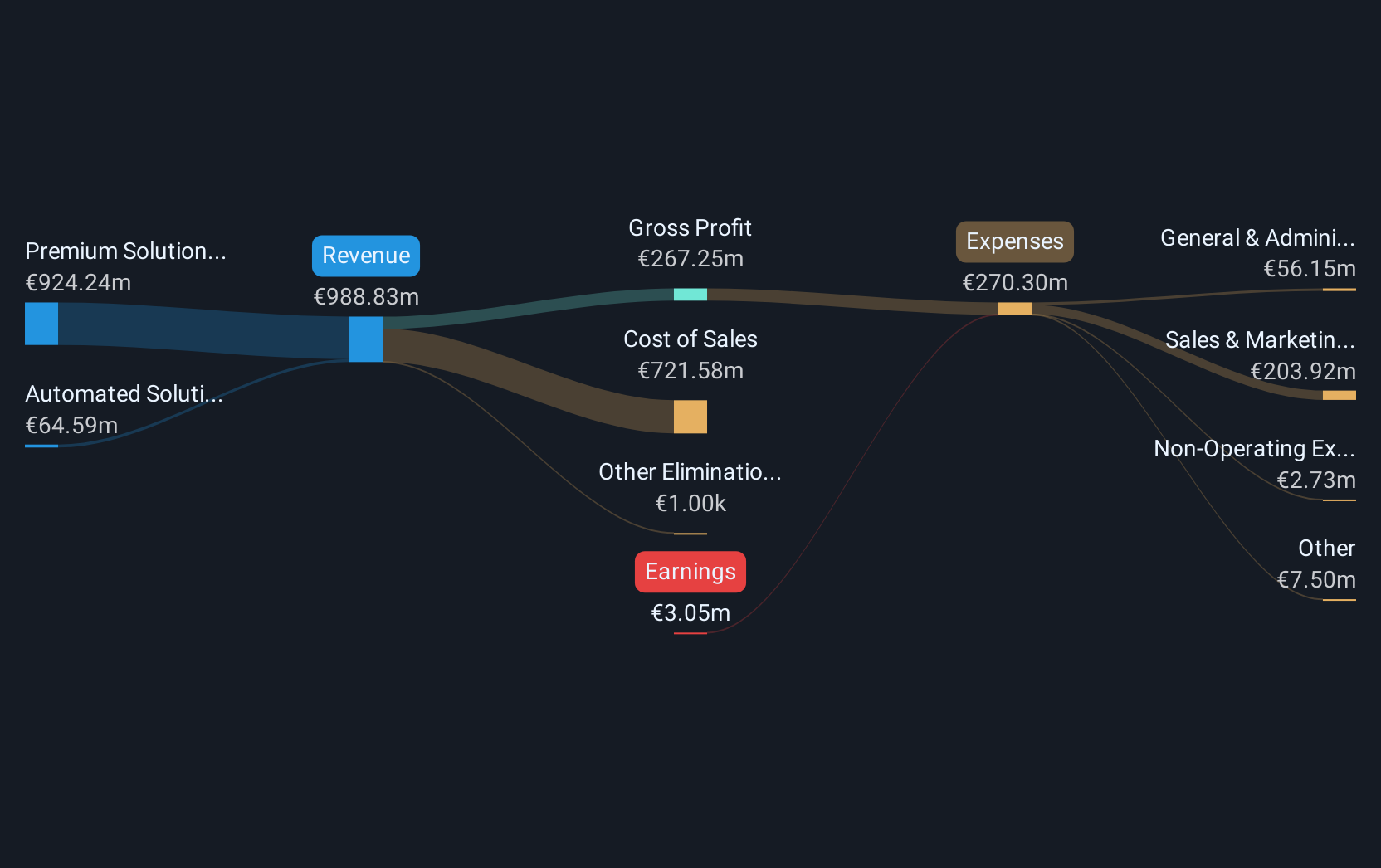

Overview: Believe S.A. offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of €1.44 billion.

Operations: The company generates revenue primarily through its Premium Solutions, which account for €877.53 million, and Automated Solutions, contributing €61.50 million.

Believe, navigating through a challenging tech landscape, demonstrates resilience with its revenue forecast to outpace the French market at 12.7% annually compared to 5.6%. Despite current unprofitability, the firm is on a trajectory towards profitability within three years, bolstered by an impressive projected earnings growth rate of 56.72% per year. This growth is underpinned by significant R&D investments that not only fuel innovation but also align with broader industry shifts towards digital and streaming platforms in entertainment technology.

- Click here to discover the nuances of Believe with our detailed analytical health report.

Explore historical data to track Believe's performance over time in our Past section.

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

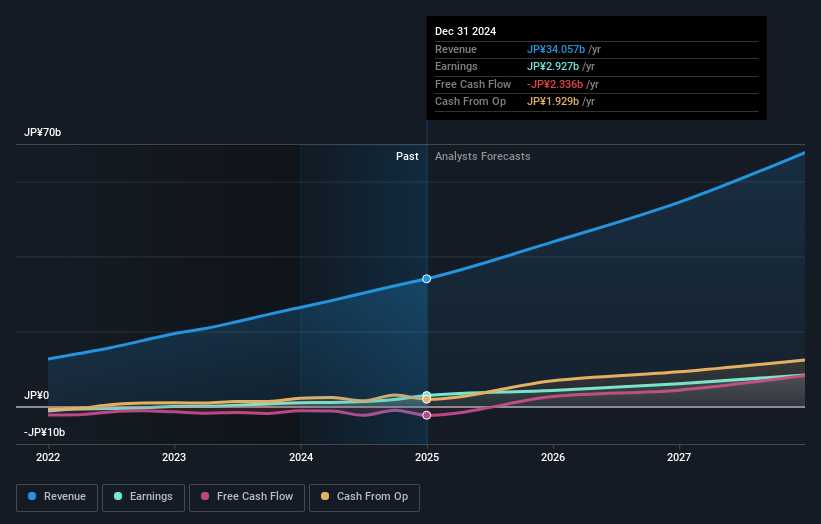

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of ¥157.64 billion.

Operations: Appier generates revenue primarily through its AI SaaS business, which reported ¥32.19 billion. The company focuses on leveraging AI to support enterprise decision-making processes across various markets.

Appier Group, a trailblazer in AI-driven marketing solutions, showcases robust growth with its revenue and earnings forecast to climb by 17.9% and 32.2% annually, respectively. This performance outstrips the broader Japanese market's projections of 4.3% and 7.8%. A significant driver is Appier’s R&D commitment, which strategically allocates funds to foster innovations like its AIXPERT platform—an AI-enhanced tool that optimizes digital advertising efficiency through dynamic keyword generation and campaign management. Recent strategic moves include initiating a dividend at JPY 2 per share and repurchasing shares worth ¥854 million, underscoring confidence in sustained financial health and shareholder value enhancement.

- Unlock comprehensive insights into our analysis of Appier Group stock in this health report.

Examine Appier Group's past performance report to understand how it has performed in the past.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

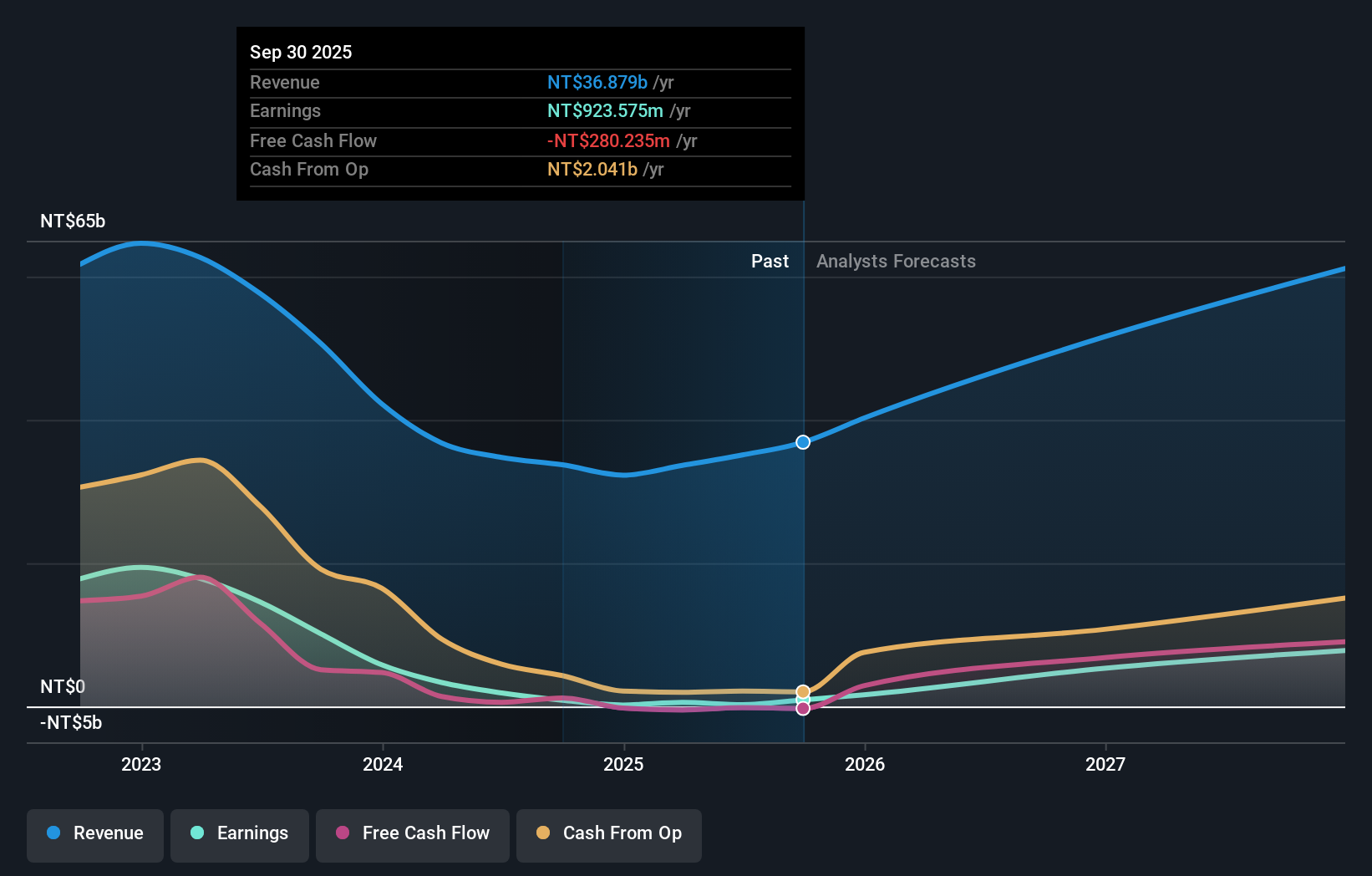

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally with a market capitalization of NT$87.23 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards, with significant contributions from Asia (NT$14.60 billion) and domestic markets (NT$23.30 billion). The American market contributes a smaller portion to the overall revenue stream.

Nan Ya Printed Circuit Board is navigating the competitive tech landscape with notable strides in financial and operational realms. With an anticipated annual revenue growth of 17.5%, it outpaces Taiwan's market average of 11.3%. This growth is complemented by a remarkable earnings forecast, expected to surge by 95.3% annually, highlighting its robust profitability trajectory compared to the broader industry's more modest expectations. Strategic investments in R&D are pivotal, with expenses aligned closely with innovative outputs, ensuring Nan Ya remains at the forefront of technological advancements in circuit board manufacturing—a critical component for myriad electronic devices. Recent operational reviews underscore a commitment to expanding market share and enhancing shareholder value through focused fiscal management and strategic planning sessions aimed at refining long-term goals.

Next Steps

- Navigate through the entire inventory of 1222 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Ya Printed Circuit Board might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8046

Nan Ya Printed Circuit Board

Manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives