- Taiwan

- /

- Communications

- /

- TWSE:8045

Asian Growth Companies With High Insider Ownership In August 2025

Reviewed by Simply Wall St

As global trade tensions and economic uncertainties weigh on markets, Asia remains a focal point for investors seeking growth opportunities amidst the volatility. In this environment, companies with high insider ownership can offer a unique appeal, as such ownership often aligns management's interests with those of shareholders, potentially fostering long-term growth and resilience.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.9% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Samyang Foods (KOSE:A003230) | 11.7% | 27.2% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 26.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

Let's dive into some prime choices out of the screener.

Sino Medical Sciences Technology (SHSE:688108)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sino Medical Sciences Technology Inc. is a Chinese medical device company focused on the research, development, production, and distribution of interventional devices, with a market cap of CN¥6.10 billion.

Operations: The company's revenue is primarily derived from its medical products segment, totaling CN¥468.53 million.

Insider Ownership: 26.6%

Revenue Growth Forecast: 26.8% p.a.

Sino Medical Sciences Technology is trading at 9.6% below its estimated fair value, with revenue expected to grow 26.8% annually, outpacing the Chinese market's growth rate of 12.6%. Despite becoming profitable this year, earnings are forecast to grow significantly at 77.61% per year over the next three years, surpassing the market average of 23.6%. However, return on equity is projected to remain low at 6.6%, and recent insider trading activity is unavailable for assessment.

- Click here and access our complete growth analysis report to understand the dynamics of Sino Medical Sciences Technology.

- Upon reviewing our latest valuation report, Sino Medical Sciences Technology's share price might be too optimistic.

Kasumigaseki CapitalLtd (TSE:3498)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kasumigaseki Capital Co., Ltd. operates in real estate consulting in Japan and has a market cap of ¥188.24 billion.

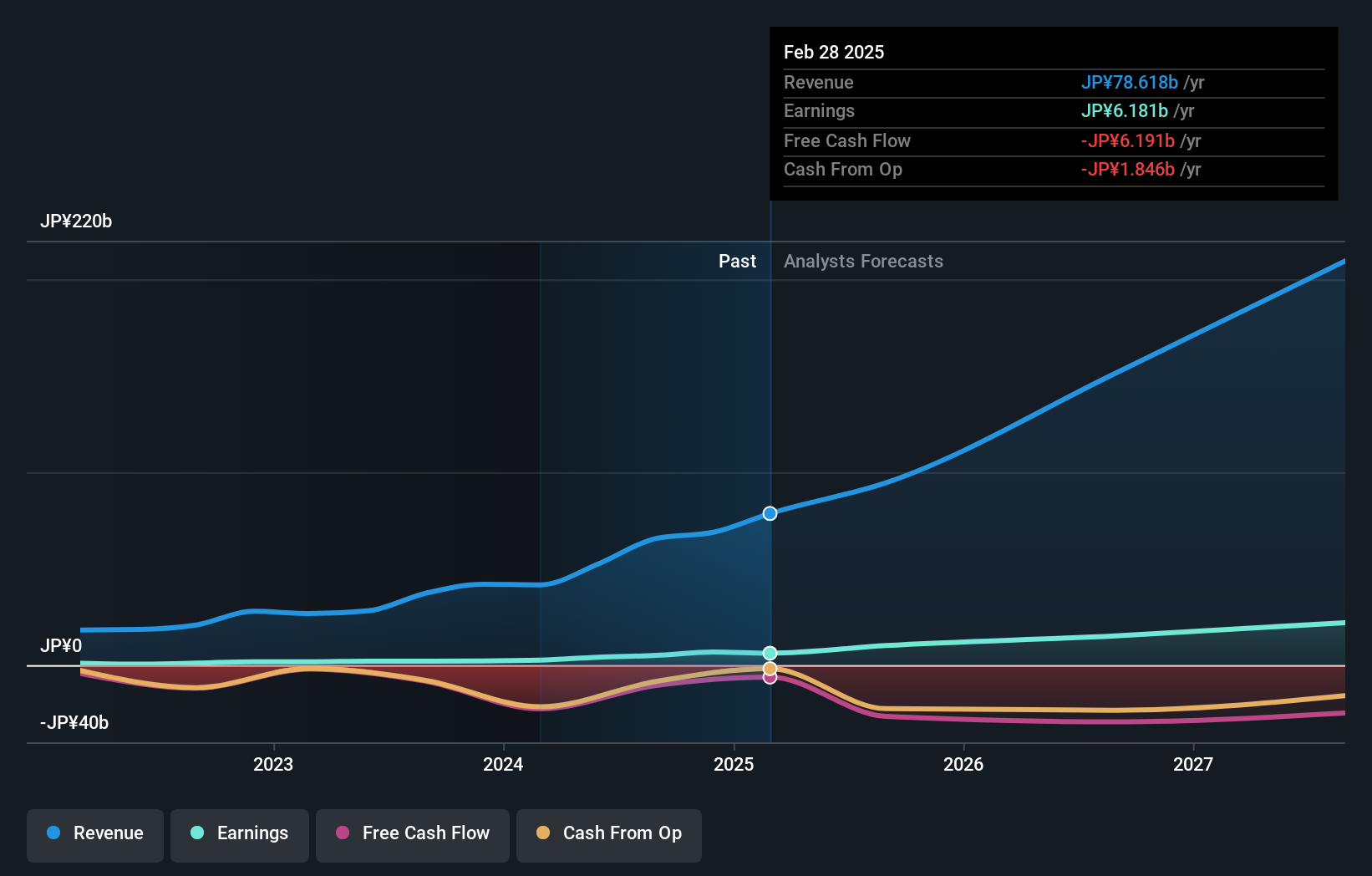

Operations: The company's revenue segment is primarily from its real estate consulting business, generating ¥82.64 billion.

Insider Ownership: 26.7%

Revenue Growth Forecast: 31.4% p.a.

Kasumigaseki Capital is poised for substantial growth, with earnings and revenue expected to increase significantly at 40.2% and 31.4% annually, respectively, outpacing the Japanese market. Despite a highly volatile share price recently and no substantial insider trading activity over the past three months, the company forecasts net sales of ¥95 billion and operating profit of ¥16.5 billion for fiscal year ending August 2025. However, its debt coverage by operating cash flow remains inadequate.

- Dive into the specifics of Kasumigaseki CapitalLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Kasumigaseki CapitalLtd's current price could be inflated.

TWOWAY Communications (TWSE:8045)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TWOWAY Communications, Inc. is involved in the research, development, manufacturing, and sale of RF and optical transmission equipment globally with a market cap of NT$10.29 billion.

Operations: The company's revenue segments include NT$1.42 billion from the Broadband Network Equipment Division, NT$614.63 million from the Intelligent Networking Division, and NT$257.39 million from the Labor and Other Business Division.

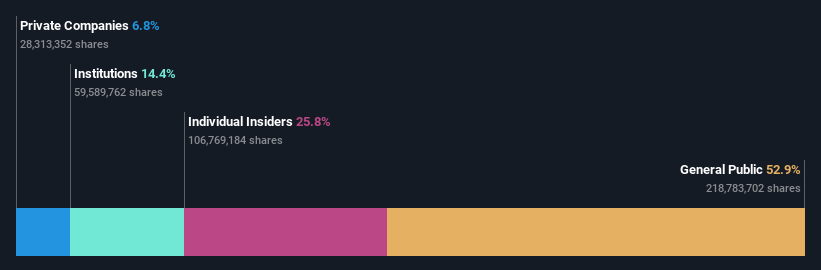

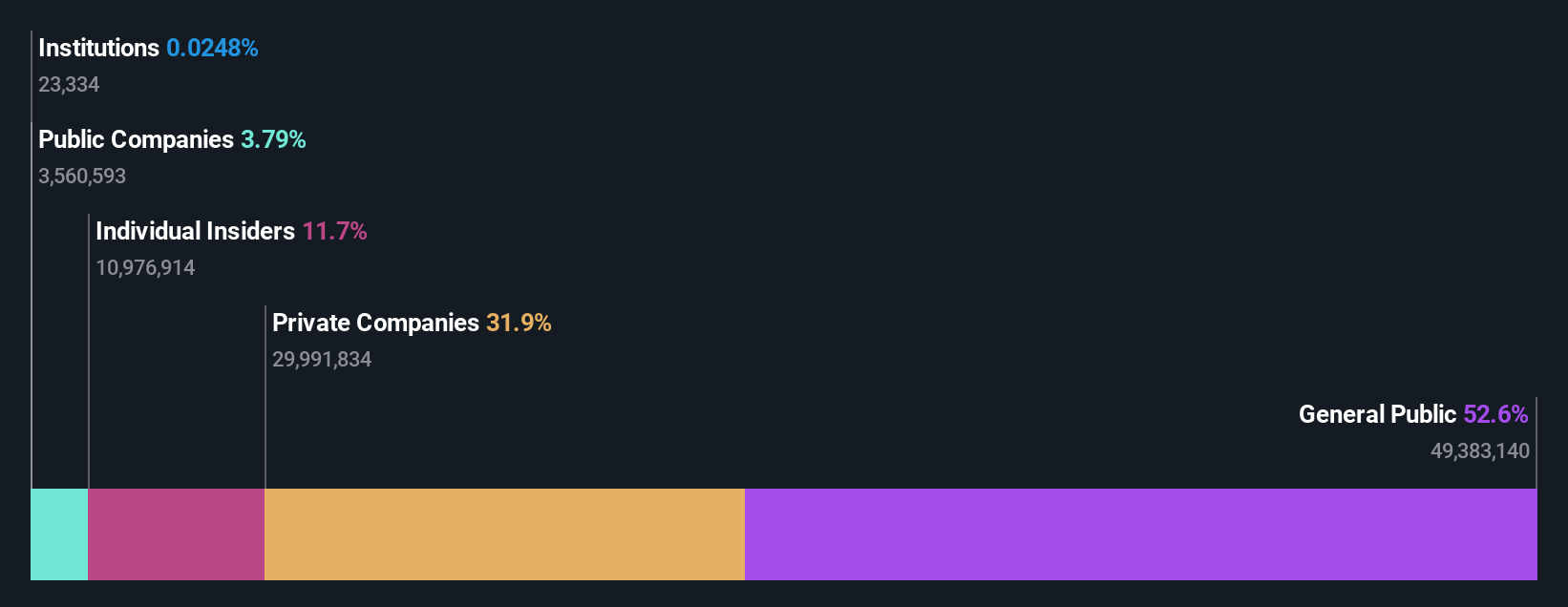

Insider Ownership: 11.7%

Revenue Growth Forecast: 48.7% p.a.

TWOWAY Communications is set for significant growth, with earnings and revenue projected to rise at 73.6% and 48.7% annually, outpacing the Taiwanese market. Despite recent board changes and a volatile share price, the company has not seen substantial insider trading activity in three months. However, profit margins have declined from last year’s figures of 20.6% to 5.8%, and shareholders experienced dilution over the past year following amendments to its Articles of Association in June 2025.

- Click here to discover the nuances of TWOWAY Communications with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that TWOWAY Communications is trading beyond its estimated value.

Next Steps

- Investigate our full lineup of 589 Fast Growing Asian Companies With High Insider Ownership right here.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TWOWAY Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8045

TWOWAY Communications

Engages in the research and development, manufacturing, and sale of indoor and outdoor RF, and optical transmission equipment in Taiwan, the United States, rest of Asia, Europe, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives