- Taiwan

- /

- Tech Hardware

- /

- TWSE:6414

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, major indices such as the S&P 500 and Nasdaq have reached record highs, buoyed by optimism surrounding potential trade policy shifts and burgeoning interest in artificial intelligence. In this dynamic environment, high growth tech stocks are capturing attention due to their potential for innovation-driven expansion, making them an intriguing focus for investors looking to capitalize on emerging trends in technology.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

PCL Technologies (TWSE:4977)

Simply Wall St Growth Rating: ★★★★★☆

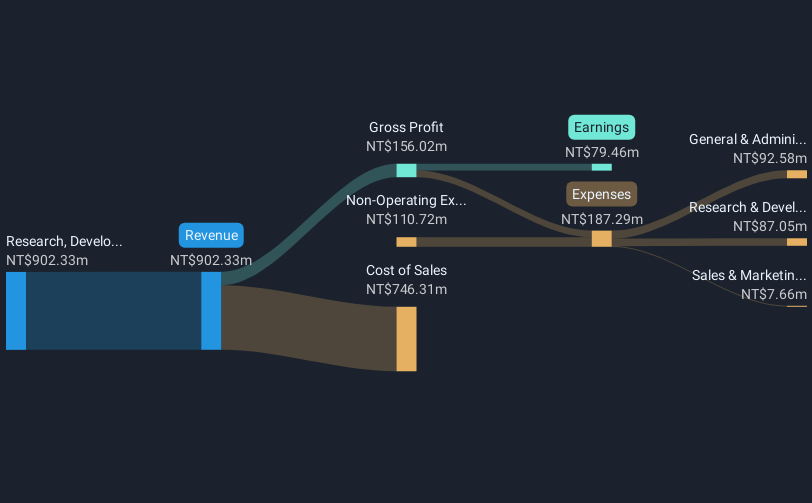

Overview: PCL Technologies, Inc. and its subsidiaries focus on the research, manufacturing, and sales of optical transceiver products both in Taiwan and internationally, with a market capitalization of NT$11.83 billion.

Operations: The company generates revenue primarily from the research, development, production, and sales of light mine devices, amounting to NT$902.33 million.

PCL Technologies has demonstrated a robust trajectory with a 47.1% annual revenue growth, outpacing the broader Taiwanese market's 11.3%. This growth is complemented by an impressive forecast of earnings increasing at 90.5% annually, significantly above the market average of 17.4%. However, despite these strong growth metrics, the company's profit margins have contracted from last year’s 22.9% to current levels at 8.8%, reflecting some underlying challenges in maintaining profitability amidst rapid expansion. Additionally, recent strategic moves include a share repurchase program aimed at employee incentives, suggesting an investment in human capital alongside financial agility to bolster future prospects.

Eson Precision Ind (TWSE:5243)

Simply Wall St Growth Rating: ★★★★★☆

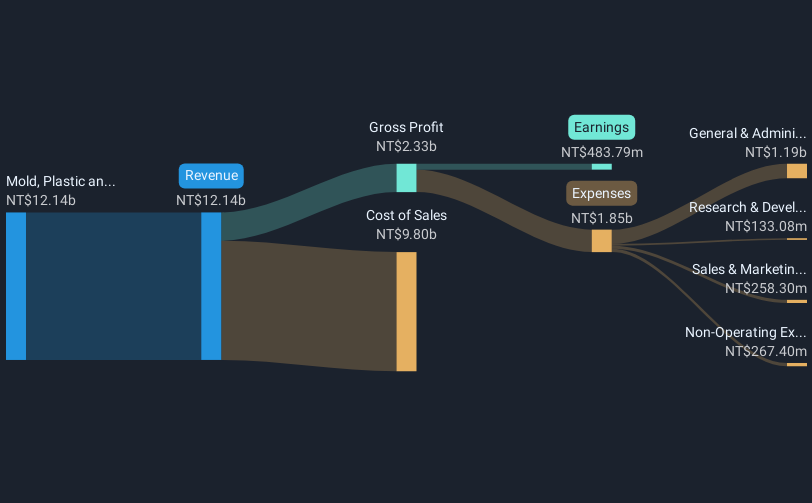

Overview: Eson Precision Ind. Co., Ltd. is a company that produces and sells molds and consumer electronic components both in Taiwan and internationally, with a market capitalization of NT$9.88 billion.

Operations: Eson Precision Ind. generates revenue primarily from its Mold, Plastic, and Metal Products segment, which accounts for NT$12.14 billion. The company's operations span both domestic and international markets in the production of molds and electronic components.

Eson Precision Ind. has recently demonstrated notable financial agility, with third-quarter sales rising to TWD 3.39 billion, a significant increase from TWD 2.73 billion the previous year. This growth aligns with an annual revenue forecast of 21.1%, outpacing the broader Taiwanese market's average of 11.3%. However, despite robust sales performance, net profit margins have dipped to 4% from last year's 5.8%, reflecting challenges in scaling profitability alongside rapid growth. The company also established a Committee for Sustainable Development, signaling a strategic pivot towards long-term corporate responsibility and potentially enhancing investor appeal by aligning with global sustainability trends.

Ennoconn (TWSE:6414)

Simply Wall St Growth Rating: ★★★★☆☆

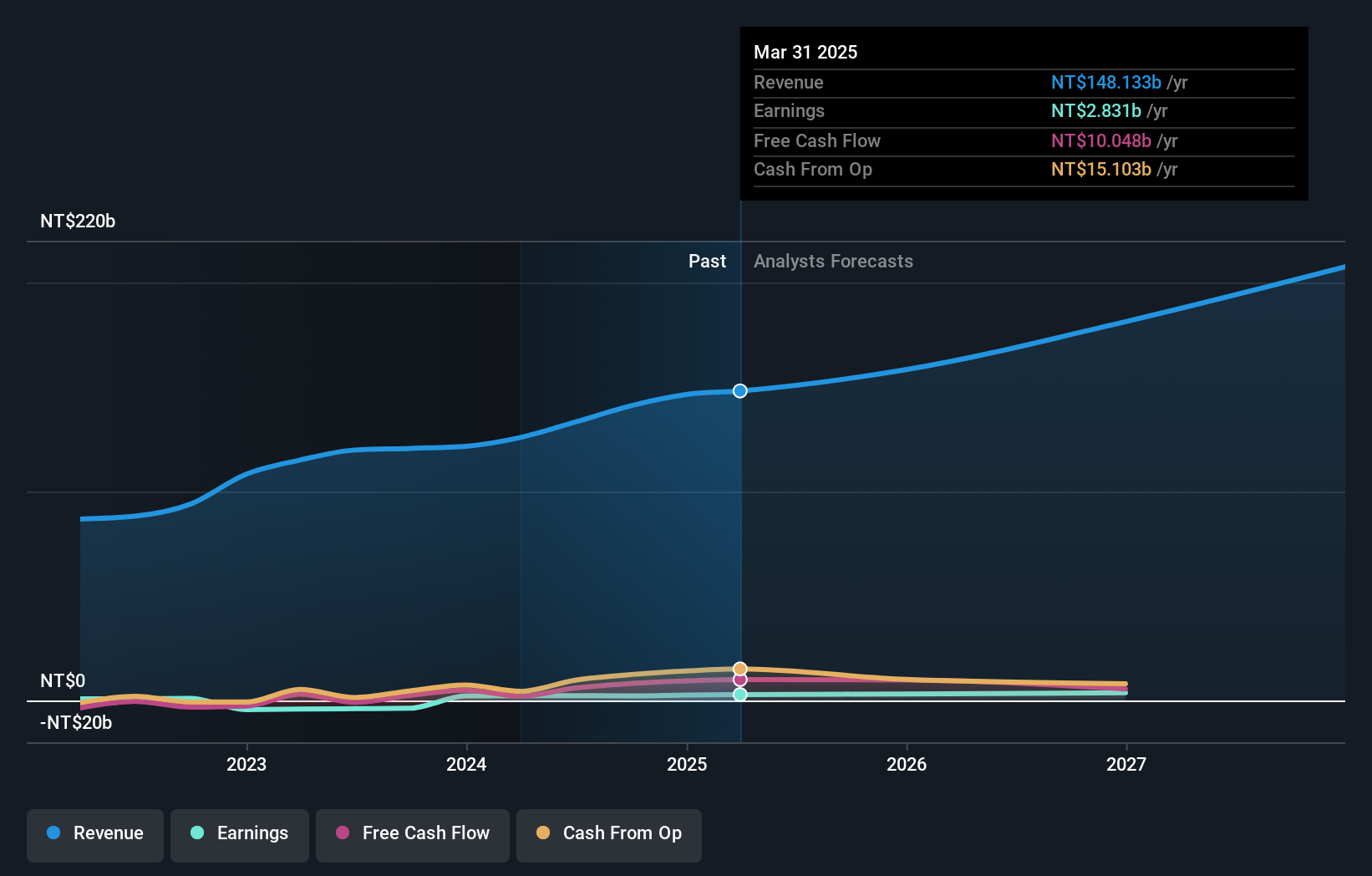

Overview: Ennoconn Corporation, with a market cap of NT$39.50 billion, operates globally through its subsidiaries by manufacturing and selling data storage and processing equipment, industrial motherboards, and network communications products.

Operations: The company generates revenue primarily from its Factory System and Electromechanical System Service Business Department (NT$60.85 billion) and Information Systems Department (NT$54.61 billion). The Industrial Computer Software and Hardware Sales Department also contributes significantly with NT$26.93 billion in revenue.

Ennoconn, amidst a vibrant tech landscape, showcased a robust financial performance with third-quarter sales soaring to TWD 37.71 billion from TWD 29.96 billion year-over-year, reflecting an impressive revenue growth of 13.9%. This growth trajectory is complemented by their strategic presentations at key industry forums, potentially enhancing investor visibility and confidence. Despite a slight dip in net income to TWD 690.67 million from TWD 762.63 million, the company's commitment to innovation is evident in its R&D initiatives aimed at securing long-term technological advancements and market competitiveness.

- Click to explore a detailed breakdown of our findings in Ennoconn's health report.

Review our historical performance report to gain insights into Ennoconn's's past performance.

Turning Ideas Into Actions

- Explore the 1231 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennoconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6414

Ennoconn

Manufactures and sells data storage, processing equipment, industrial motherboards, and network communication products in Taiwan, China, Europe, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives