- Taiwan

- /

- Communications

- /

- TWSE:6285

3 Reliable Dividend Stocks Offering Up To 6.7% Yield

Reviewed by Simply Wall St

As global markets navigate a mix of moderate gains and economic uncertainties, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In the current environment, characterized by fluctuating consumer confidence and mixed economic indicators, reliable dividend stocks can offer stability and attractive yields for those seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

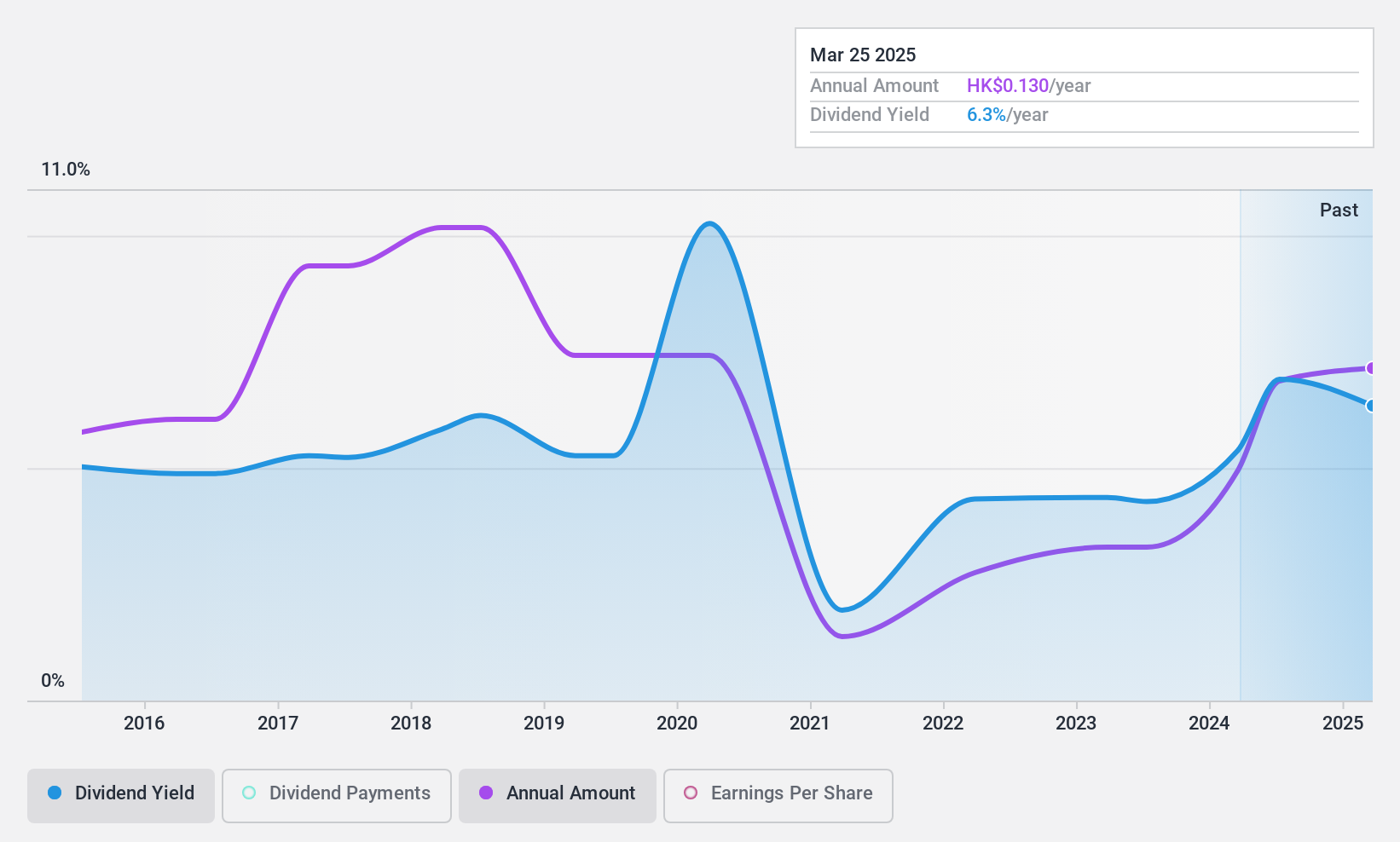

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation services, as well as visual branding and themed environments, with a market cap of approximately HK$2.23 billion.

Operations: Pico Far East Holdings Limited generates revenue from several segments, including Exhibition, Event and Brand Activation (HK$5.01 billion), Visual Branding Activation (HK$454.95 million), Meeting Architecture Activation (HK$162.78 million), and Museum and Themed Entertainment (HK$444.37 million).

Dividend Yield: 6.8%

Pico Far East Holdings' dividend payments have been volatile and unreliable over the past decade, despite recent growth in earnings by 63.5%. The company's dividends are well-covered by both earnings, with a payout ratio of 48.6%, and cash flows, at a cash payout ratio of 36.2%. Trading at 82.9% below its estimated fair value suggests potential for capital appreciation, but its dividend yield of 6.79% is lower than top-tier payers in Hong Kong (7.92%).

- Navigate through the intricacies of Pico Far East Holdings with our comprehensive dividend report here.

- Our expertly prepared valuation report Pico Far East Holdings implies its share price may be lower than expected.

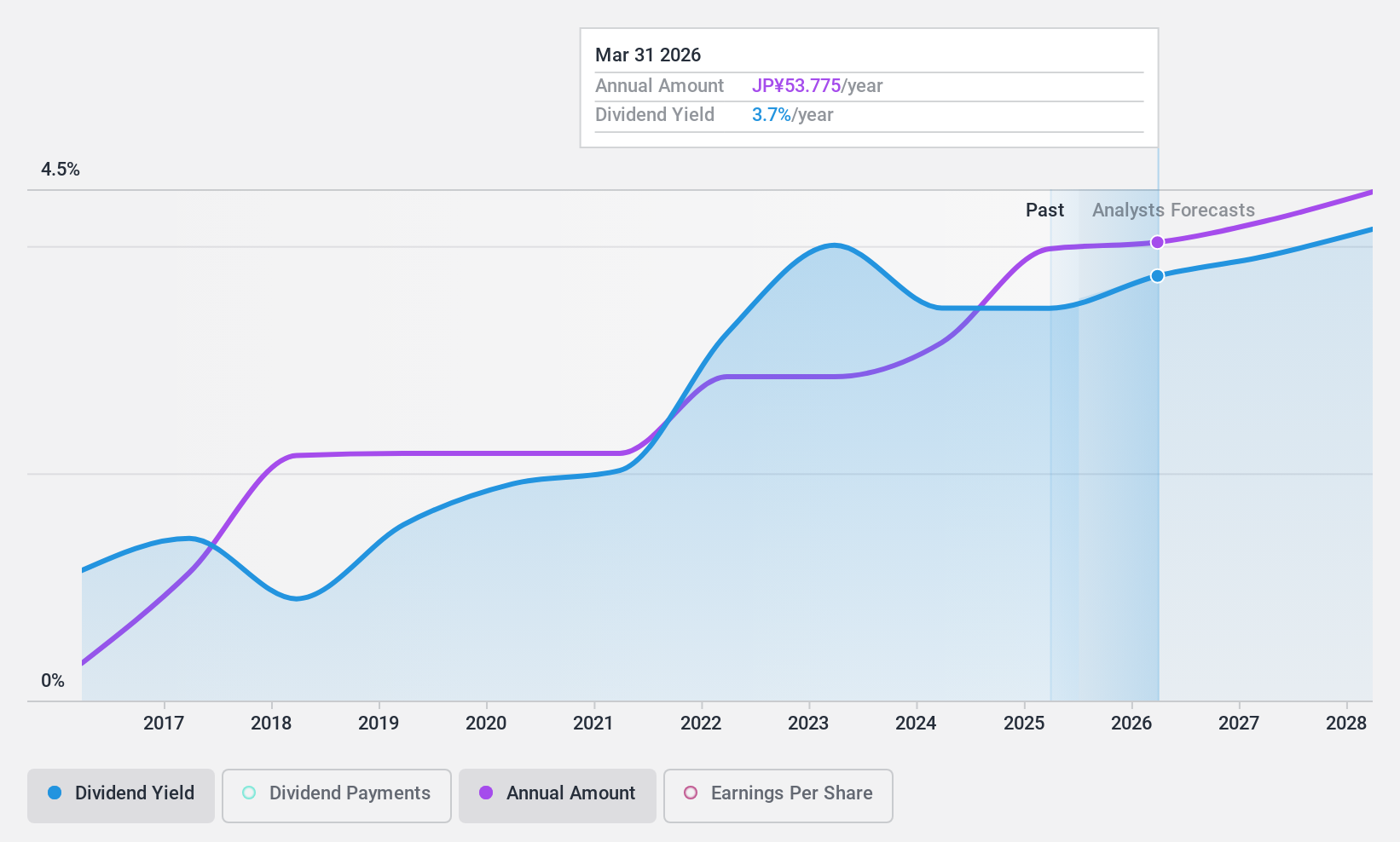

Japan Lifeline (TSE:7575)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Japan Lifeline Co., Ltd. is a medical device company that focuses on the development, production, importation, distribution, and trading of cardiovascular-related medical devices in Japan, with a market cap of ¥96.67 billion.

Operations: Japan Lifeline Co., Ltd. generates revenue primarily from the manufacture and sale of medical devices, amounting to ¥54.24 billion.

Dividend Yield: 3.3%

Japan Lifeline's dividends are well-supported by earnings and cash flows, with payout ratios of 39% and 57.3% respectively. The company has maintained stable and growing dividends over the past decade, recently increasing its annual dividend to ¥46 per share from ¥42. Trading at a significant discount to its estimated fair value, Japan Lifeline also benefits from a new distribution agreement with Terumo Corporation, potentially enhancing future revenue streams.

- Get an in-depth perspective on Japan Lifeline's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Japan Lifeline's current price could be quite moderate.

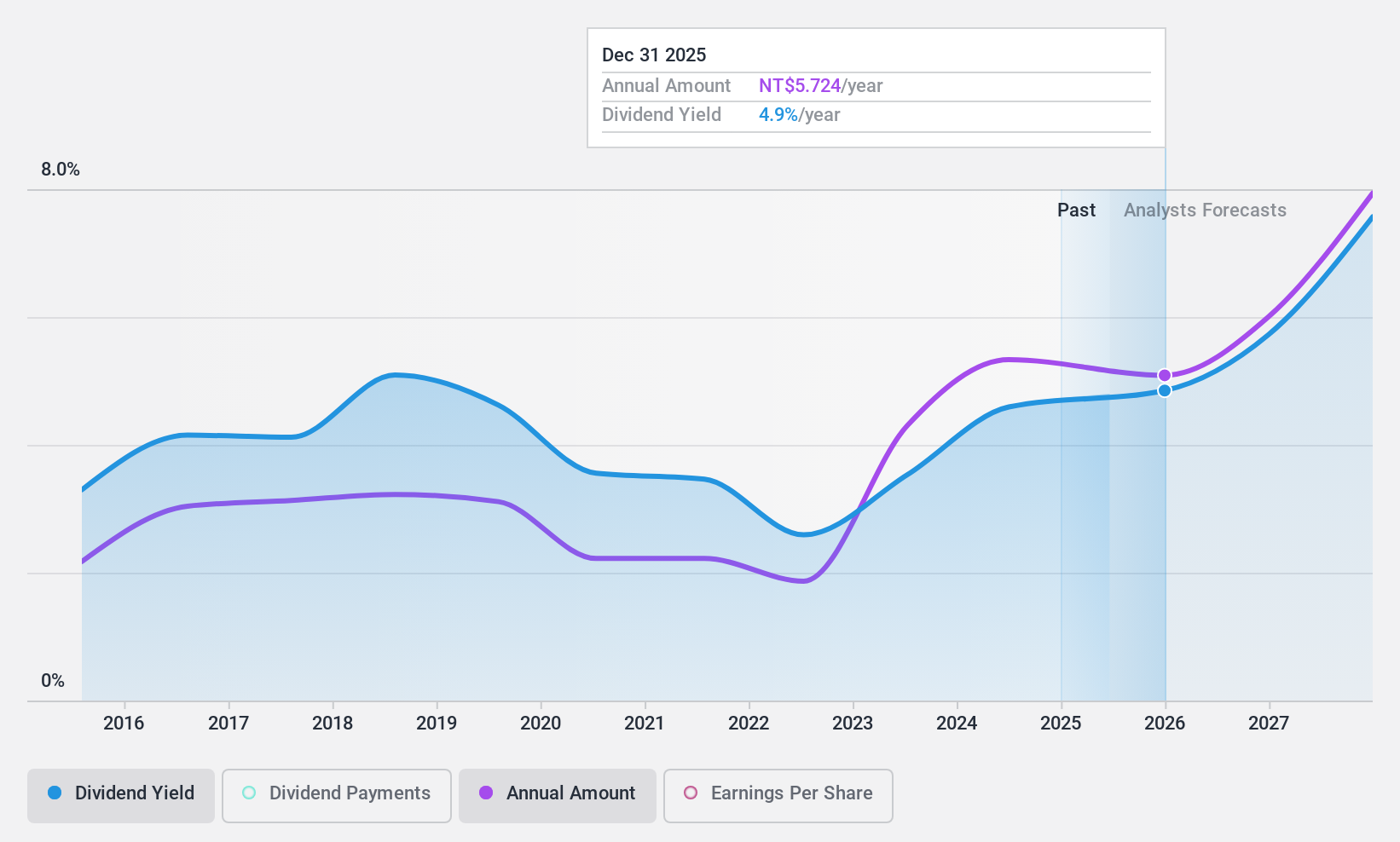

Wistron NeWeb (TWSE:6285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wistron NeWeb Corporation focuses on the research, development, manufacture, and sale of satellite communication systems and mobile and portable communication equipment across the Americas, Asia, Europe, and internationally with a market cap of NT$65.51 billion.

Operations: Wistron NeWeb Corporation's revenue is primarily derived from its Wireless Communications Equipment segment, which generated NT$111.95 billion.

Dividend Yield: 4.4%

Wistron NeWeb's dividends are covered by earnings and cash flows, with payout ratios of 85% and 70.5%, respectively, though its dividend yield of 4.36% is slightly below the market's top quartile. The company's dividend history has been volatile over the past decade despite some growth in payments. Recent financials show a decline in Q3 net income to TWD 519.9 million from TWD 1,411.97 million year-over-year, indicating potential challenges ahead for maintaining stable dividends.

- Click here to discover the nuances of Wistron NeWeb with our detailed analytical dividend report.

- Our valuation report here indicates Wistron NeWeb may be undervalued.

Seize The Opportunity

- Delve into our full catalog of 1952 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WNC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6285

WNC

Engages in research, development, manufacture, and sale of satellite, mobile, and portable communication equipment in the Americas, Asia, Europe, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives