As global markets navigate the complexities of rising inflation and fluctuating interest rates, small-cap stocks have found themselves lagging behind larger indices like the S&P 500. Despite this challenging environment, opportunities remain for investors willing to explore lesser-known companies that exhibit strong fundamentals and growth potential. In this context, identifying undiscovered gems involves looking for stocks with solid financial health and the ability to thrive despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bahnhof | NA | 8.39% | 14.20% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Isracard | 69.54% | 9.35% | 3.37% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Power HF (SHSE:605100)

Simply Wall St Value Rating: ★★★★★★

Overview: Power HF Co., Ltd. is engaged in the research, development, manufacturing, and sale of diesel engines both in China and internationally, with a market capitalization of CN¥2.69 billion.

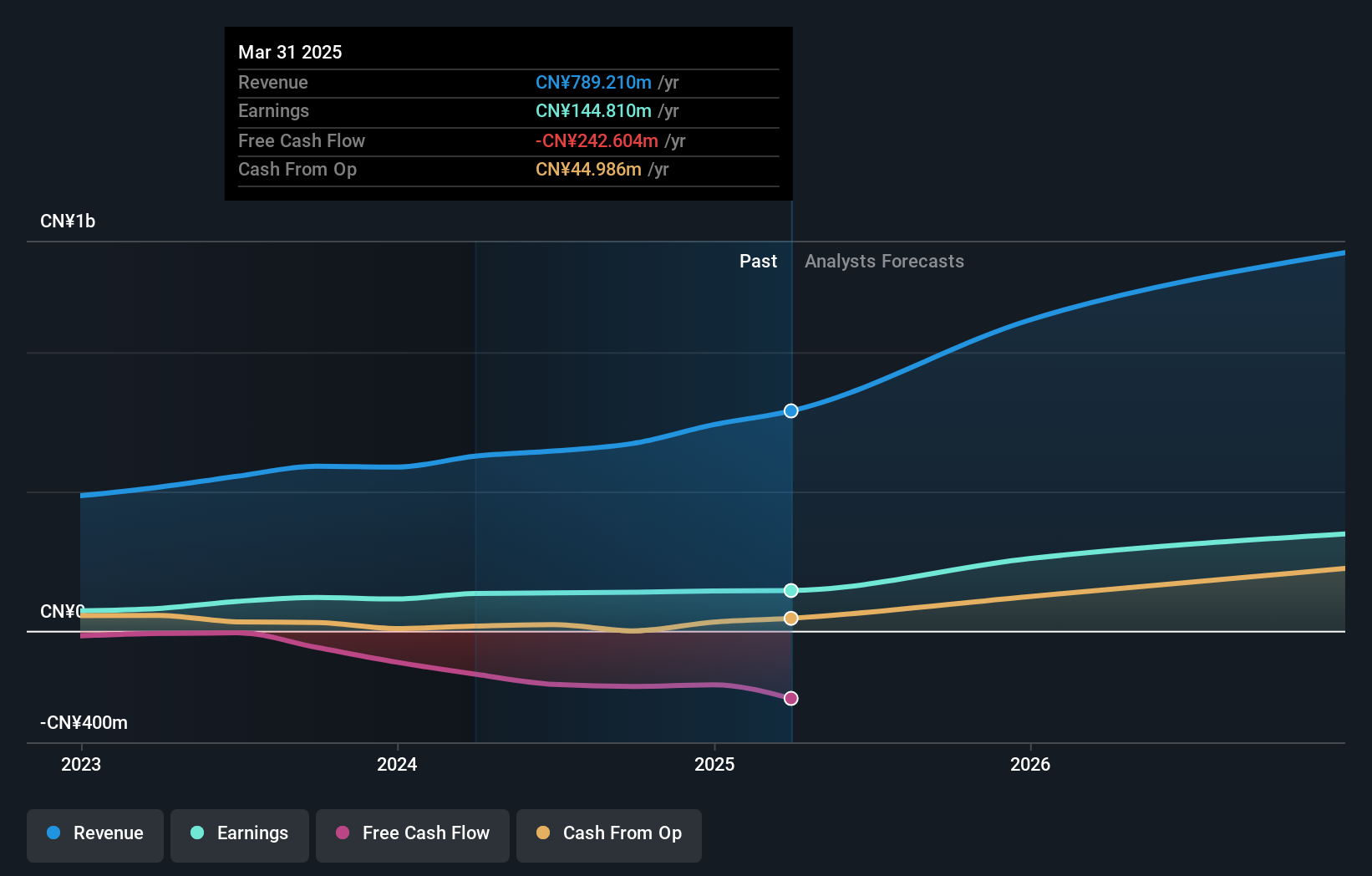

Operations: Power HF's revenue is primarily derived from the sale of diesel engines. The company's net profit margin has shown fluctuations, with recent figures indicating a 6.5% margin.

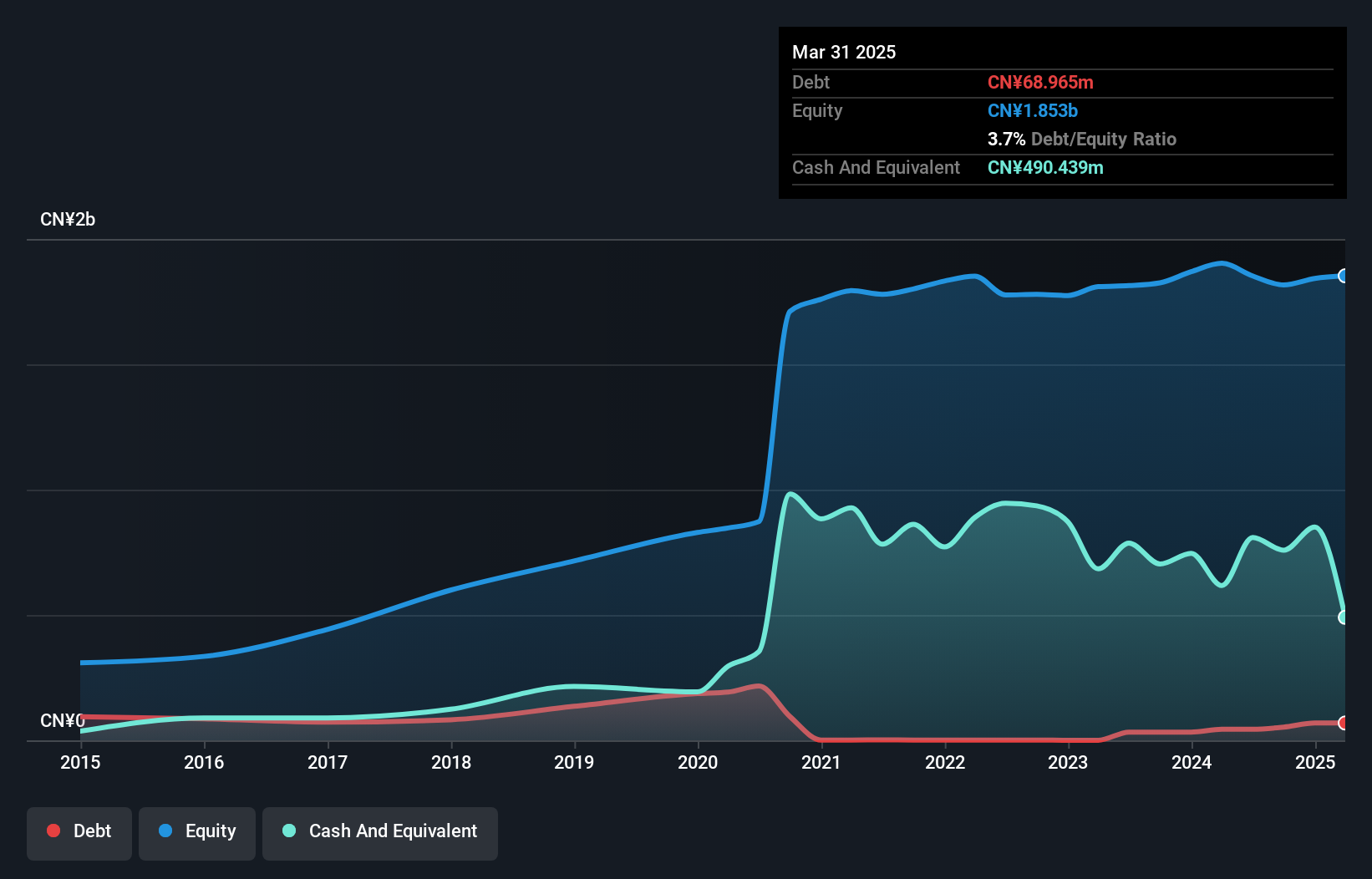

With a volatile share price recently, Power HF stands out in its sector due to impressive earnings growth of 70.8% over the past year, far surpassing the Machinery industry's average. The company seems well-positioned financially, with more cash than its total debt and a reduced debt-to-equity ratio from 21.7% to 2.9% over five years. Despite not being free cash flow positive, its high-quality earnings and a price-to-earnings ratio of 26.3x offer potential value compared to the broader CN market at 37.9x, suggesting room for appreciation if current trends persist.

- Dive into the specifics of Power HF here with our thorough health report.

Review our historical performance report to gain insights into Power HF's's past performance.

Wuxi Unicomp Technology (SHSE:688531)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Unicomp Technology Co., Ltd. focuses on the research, development, manufacture, and sale of X-ray technology and intelligent detection equipment in China, with a market cap of CN¥5.97 billion.

Operations: Wuxi Unicomp generates revenue primarily from the sale of X-ray technology and intelligent detection equipment. The company's market cap stands at CN¥5.97 billion, reflecting its position in the industry.

Wuxi Unicomp Technology, a nimble player in the electronics sector, has demonstrated strong earnings growth of 15.5% over the past year, outpacing the industry average of 1.9%. With no debt on its books now compared to a debt-to-equity ratio of 73.2% five years ago, it operates with financial flexibility. Its price-to-earnings ratio stands at 43.1x, which is attractive against the industry average of 52.9x, suggesting potential value for investors. Despite not being free cash flow positive recently and high non-cash earnings levels, its forecasted annual earnings growth rate is an impressive 37.24%.

Taiwan Surface Mounting Technology (TWSE:6278)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Surface Mounting Technology Corp. is involved in the design, processing, manufacturing, and trading of TFT-LCD panels, general electronic information products, and PCB surface mount packaging on a global scale with a market cap of NT$32.60 billion.

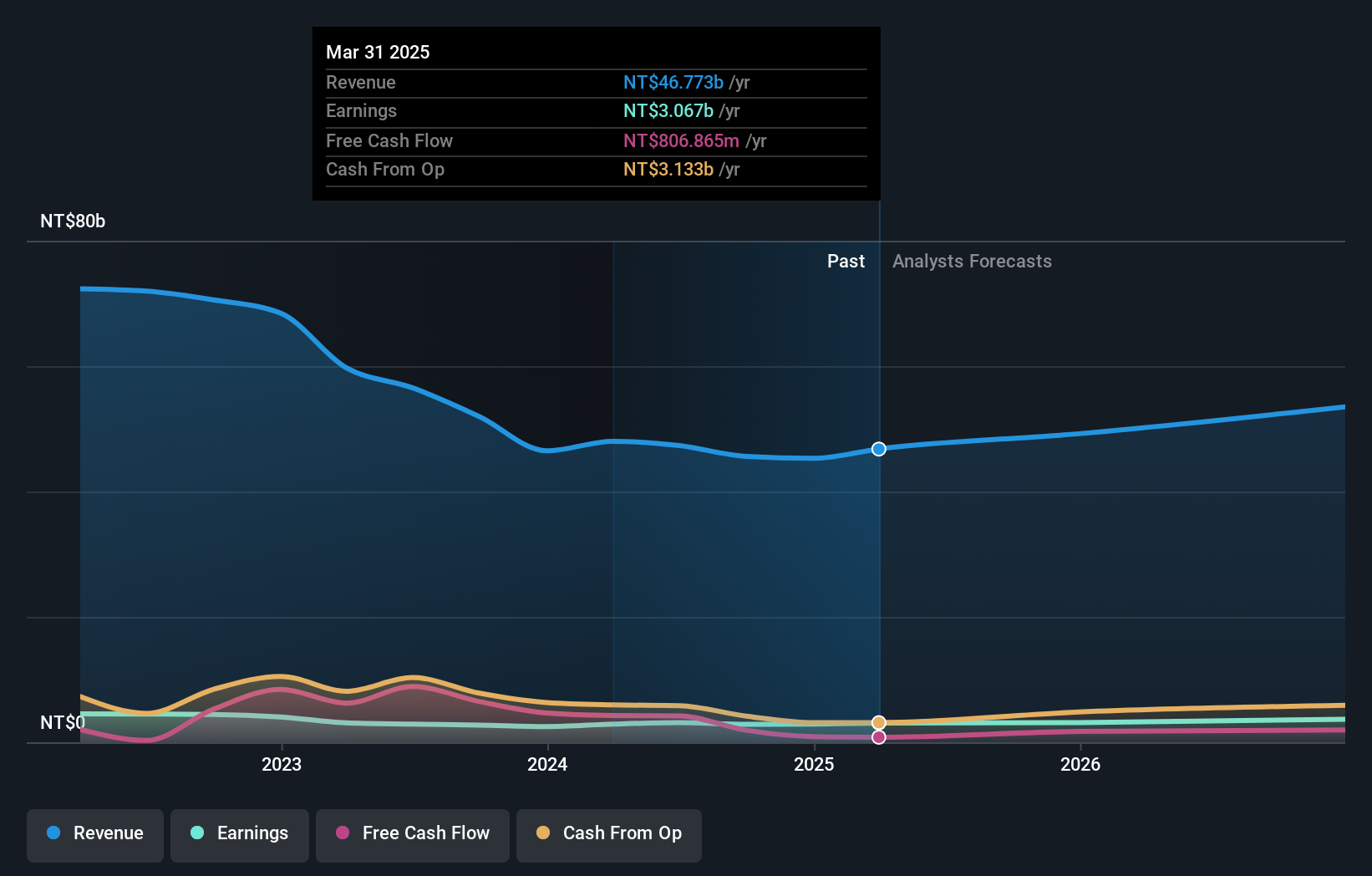

Operations: The primary revenue stream for Taiwan Surface Mounting Technology Corp. comes from its Electronic Components & Parts segment, generating NT$45.60 billion. The company's financial performance is influenced by its cost structure and market dynamics within the electronics industry.

Taiwan Surface Mounting Technology, a smaller player in the electronics sector, presents an interesting profile with its debt to equity ratio rising from 29.8% to 34.7% over five years, indicating increased leverage. The company trades at a price-to-earnings ratio of 11.3x, which is favorable compared to the Taiwan market average of 21.7x, suggesting potential undervaluation. Despite not outpacing industry growth last year with earnings up by only 4.7%, it has maintained a solid earnings growth rate of 9.3% annually over five years and remains profitable with positive free cash flow and robust interest coverage capabilities.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4757 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605100

Power HF

Researches and develops, manufactures, and sells diesel engines in China and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives