- Taiwan

- /

- Tech Hardware

- /

- TWSE:6197

Why Investors Shouldn't Be Surprised By Jess-link Products Co., Ltd.'s (TWSE:6197) 37% Share Price Surge

Despite an already strong run, Jess-link Products Co., Ltd. (TWSE:6197) shares have been powering on, with a gain of 37% in the last thirty days. The last month tops off a massive increase of 215% in the last year.

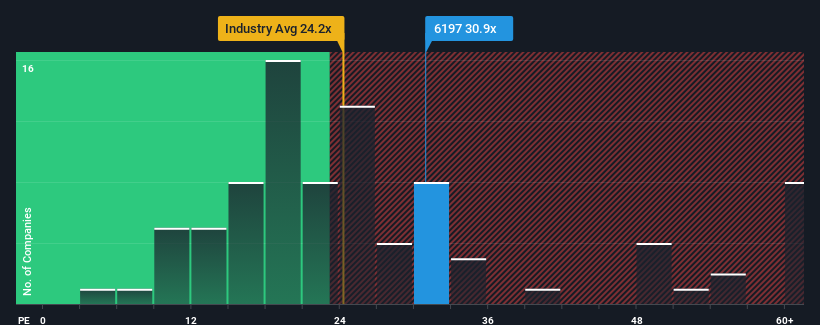

After such a large jump in price, Jess-link Products' price-to-earnings (or "P/E") ratio of 30.9x might make it look like a sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 22x and even P/E's below 16x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been quite advantageous for Jess-link Products as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Jess-link Products

Is There Enough Growth For Jess-link Products?

In order to justify its P/E ratio, Jess-link Products would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 54% last year. Pleasingly, EPS has also lifted 160% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Jess-link Products is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Jess-link Products' P/E

Jess-link Products shares have received a push in the right direction, but its P/E is elevated too. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Jess-link Products maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Jess-link Products (1 is concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Jess-link Products, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6197

Jess-link Products

An investment holding company, manufactures and sells various electronic products and components in Taiwan, China, the United States, Japan, Thailand, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.