- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:4915

Top Dividend Stocks For November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with major benchmarks reaching record highs and expectations for growth and tax reforms driving investor optimism. Amid these dynamic conditions, dividend stocks present an appealing opportunity for investors seeking steady income streams; they can offer a measure of stability and potential returns even as market fluctuations continue to unfold.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.54% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.42% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.38% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.90% | ★★★★★★ |

Click here to see the full list of 1939 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

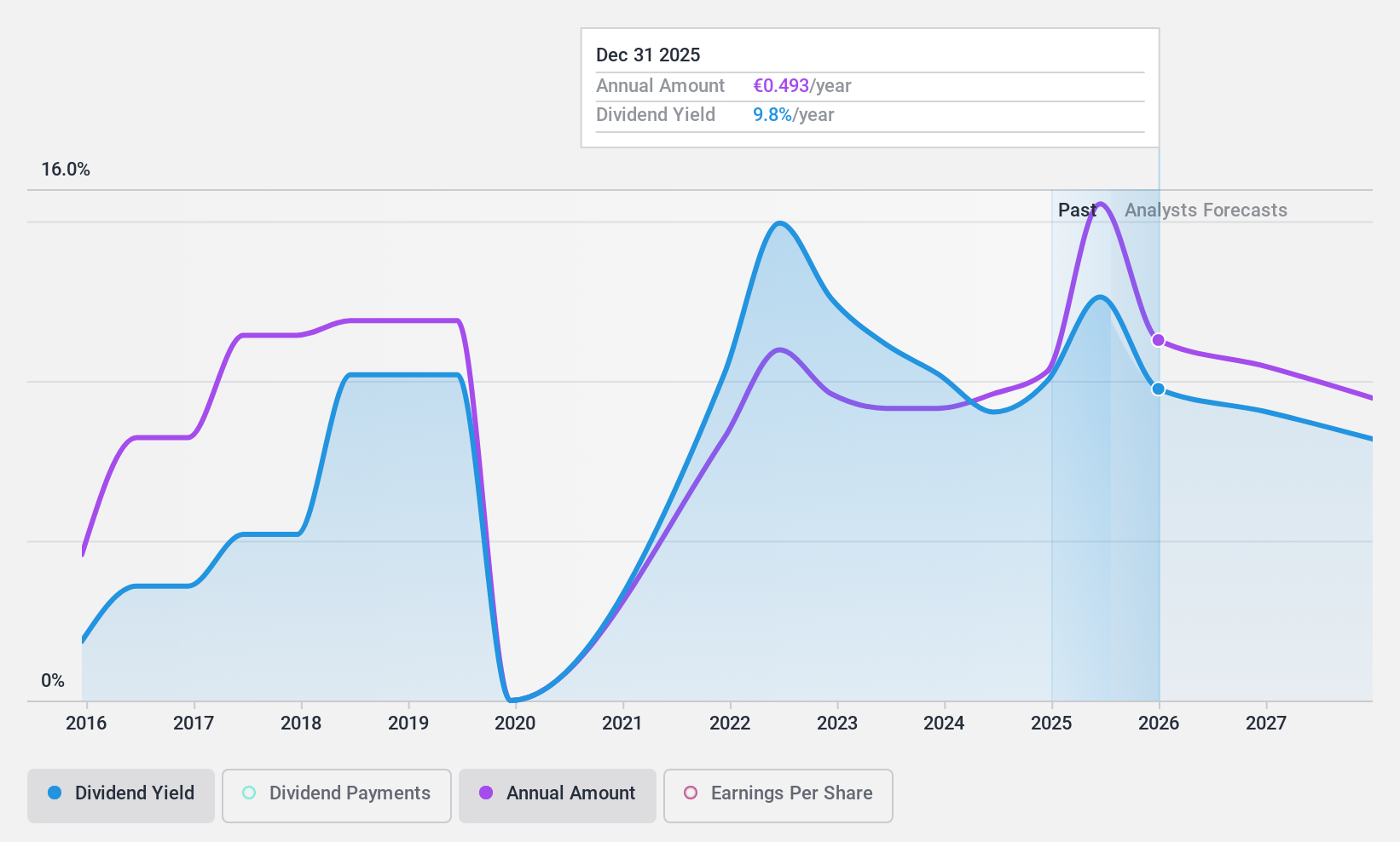

Atresmedia Corporación de Medios de Comunicación (BME:A3M)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Atresmedia Corporación de Medios de Comunicación, S.A. is an audiovisual company involved in television, radio, digital and multimedia development, cinema, and events organization both in Spain and internationally, with a market cap of approximately €1.01 billion.

Operations: Atresmedia Corporación de Medios de Comunicación generates its revenue primarily from the Audiovisual segment (€950.52 million) and the Radio segment (€79.53 million).

Dividend Yield: 9.4%

Atresmedia offers a compelling dividend yield of 9.4%, ranking in the top 25% of Spanish dividend payers, supported by a low payout ratio of 30% and cash payout ratio of 43.9%. However, its dividends have been volatile over the past decade, with earnings expected to decline by an average of 11.1% annually for the next three years. Despite these concerns, it trades at good value relative to peers and industry benchmarks.

- Take a closer look at Atresmedia Corporación de Medios de Comunicación's potential here in our dividend report.

- Our expertly prepared valuation report Atresmedia Corporación de Medios de Comunicación implies its share price may be lower than expected.

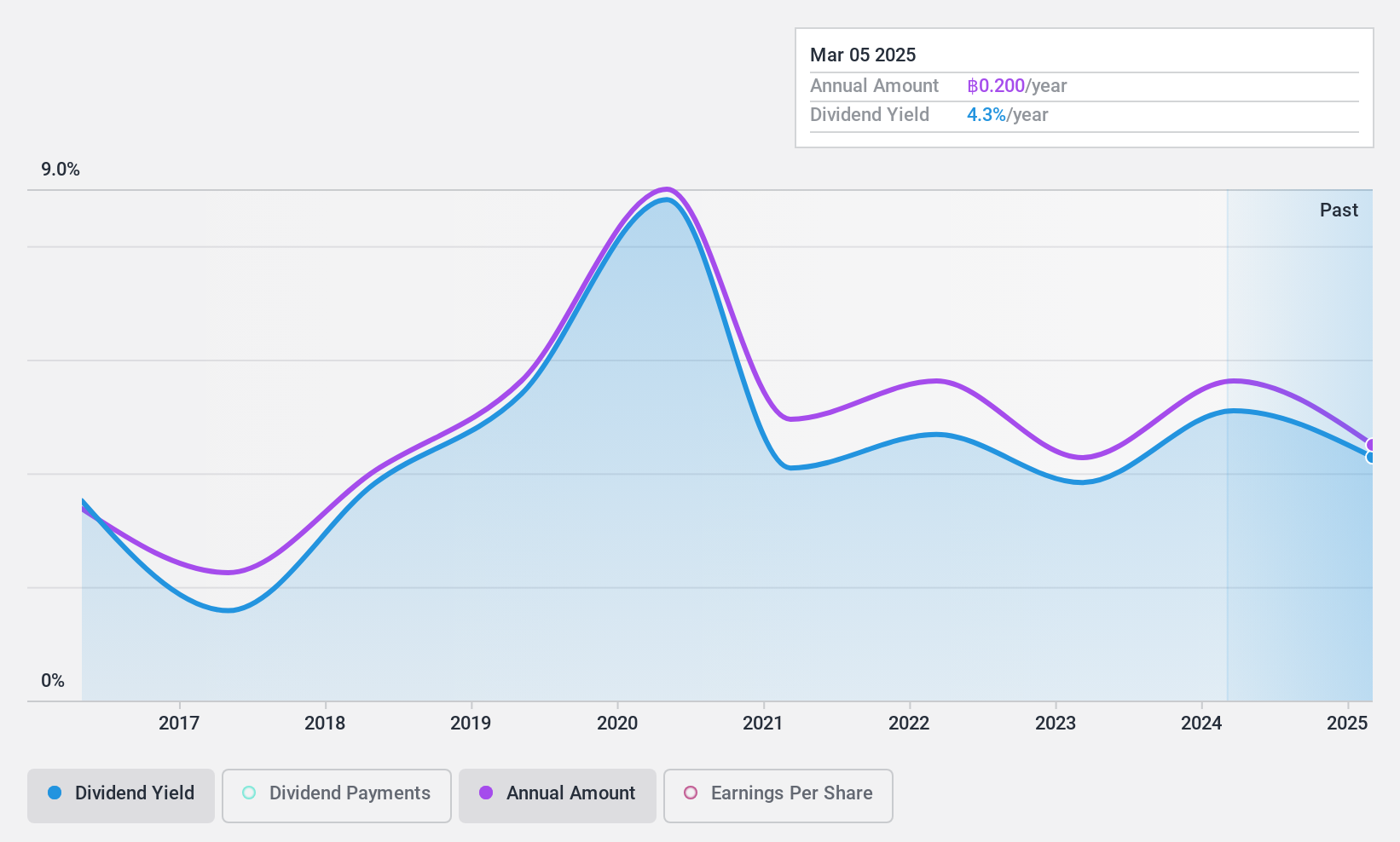

Lam Soon (Thailand) (SET:LST)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lam Soon (Thailand) Public Company Limited manufactures and distributes palm oil in Thailand with a market cap of THB4.10 billion.

Operations: Revenue segments for Lam Soon (Thailand) Public Company Limited are not specified in the provided text.

Dividend Yield: 5%

Lam Soon (Thailand) offers a dividend yield of 4.95%, which is below the top tier in Thailand's market. Its dividend track record has been unstable and volatile over the past decade, with significant fluctuations. However, the dividends are well-covered by earnings and cash flows, with payout ratios of 40.1% and 51.5%, respectively. Recent financial results show improved quarterly sales and net income growth, indicating potential stability for future dividends despite past volatility concerns.

- Click to explore a detailed breakdown of our findings in Lam Soon (Thailand)'s dividend report.

- Our valuation report unveils the possibility Lam Soon (Thailand)'s shares may be trading at a discount.

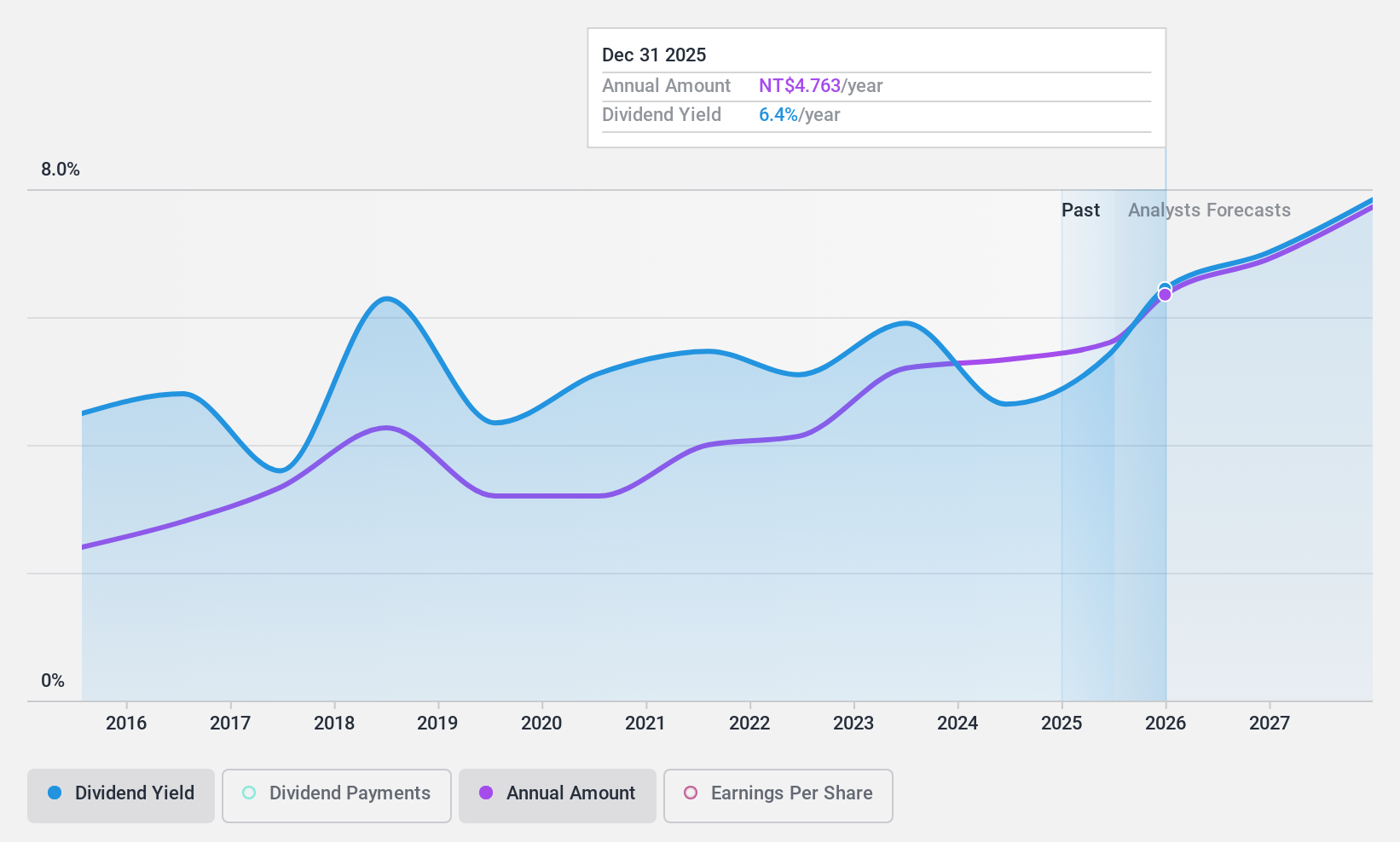

Primax Electronics (TWSE:4915)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Primax Electronics Ltd. manufactures and sells computer and non-computer peripherals globally, with a market cap of NT$36.96 billion.

Operations: Primax Electronics Ltd.'s revenue segments include the manufacturing and sale of computer peripherals and non-computer peripherals across China, Europe, the Americas, and other international markets.

Dividend Yield: 5%

Primax Electronics' dividend yield of 5.03% ranks it in the top 25% of Taiwan's market, though its dividend history has been unstable and unreliable over the past decade. Despite this, dividends are well-covered by earnings (71.5% payout ratio) and cash flows (32.2% cash payout ratio). Recent financials indicate modest growth in net income and sales for Q3 2024, which may support future dividend stability amidst ongoing product innovations like their HOC miniature camera module.

- Click here and access our complete dividend analysis report to understand the dynamics of Primax Electronics.

- The analysis detailed in our Primax Electronics valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Discover the full array of 1939 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4915

Primax Electronics

Manufactures and sells computer peripherals and non-computer peripherals in China, Europe, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion