- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3701

3 Undiscovered Gems With Strong Potential On None Exchange

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets saw mixed performances, with small-cap stocks demonstrating resilience compared to their larger counterparts. Amidst cautious investor sentiment due to manufacturing slumps and divergent job signals, the search for promising investments remains crucial. In this environment, identifying undiscovered gems—stocks that show potential through solid fundamentals and strategic positioning—can offer intriguing opportunities for investors looking beyond the major indices.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Forth Smart Service | 21.94% | -8.16% | -16.02% | ★★★★★★ |

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.90% | 5.39% | 47.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

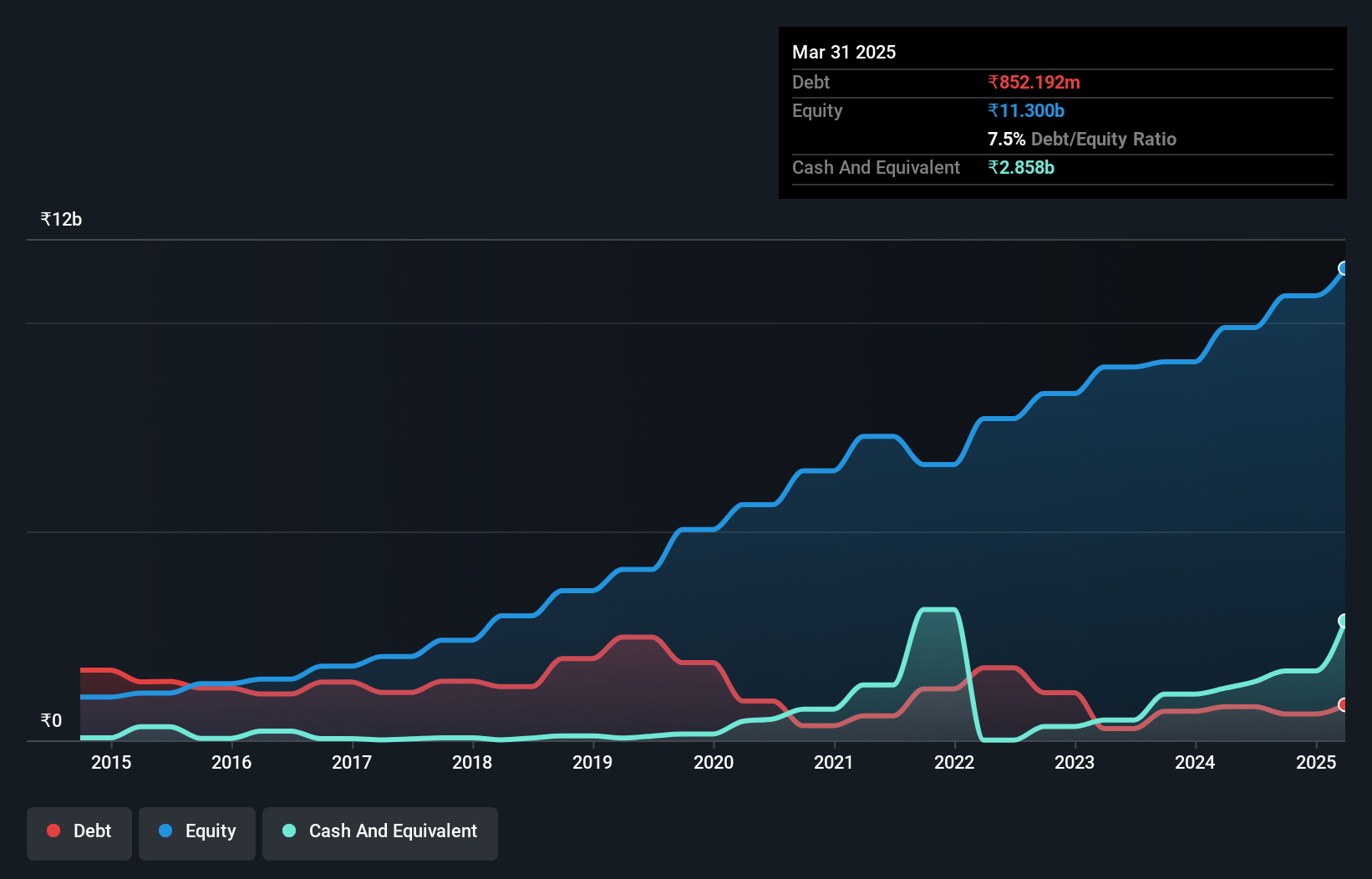

Bharat Rasayan (NSEI:BHARATRAS)

Simply Wall St Value Rating: ★★★★★★

Overview: Bharat Rasayan Limited manufactures and sells technical grade pesticides and intermediates in India, with a market capitalization of ₹47.25 billion.

Operations: The company's primary revenue stream is from pesticides, generating ₹10.88 billion.

Bharat Rasayan, a dynamic player in the chemicals sector, has demonstrated robust financial health with its earnings growing by 39.9% over the past year, outpacing the industry average of 10.4%. The company's debt to equity ratio impressively decreased from 60.4% to 8.1% over five years, indicating effective debt management. Interest payments are comfortably covered by EBIT at a strong multiple of 33.2x. Despite recent share price volatility, Bharat Rasayan's net income soared to ₹431 million for Q1 ending June 2024 from ₹71 million previously, showcasing high-quality earnings and positive free cash flow amid industry challenges.

- Dive into the specifics of Bharat Rasayan here with our thorough health report.

Gain insights into Bharat Rasayan's past trends and performance with our Past report.

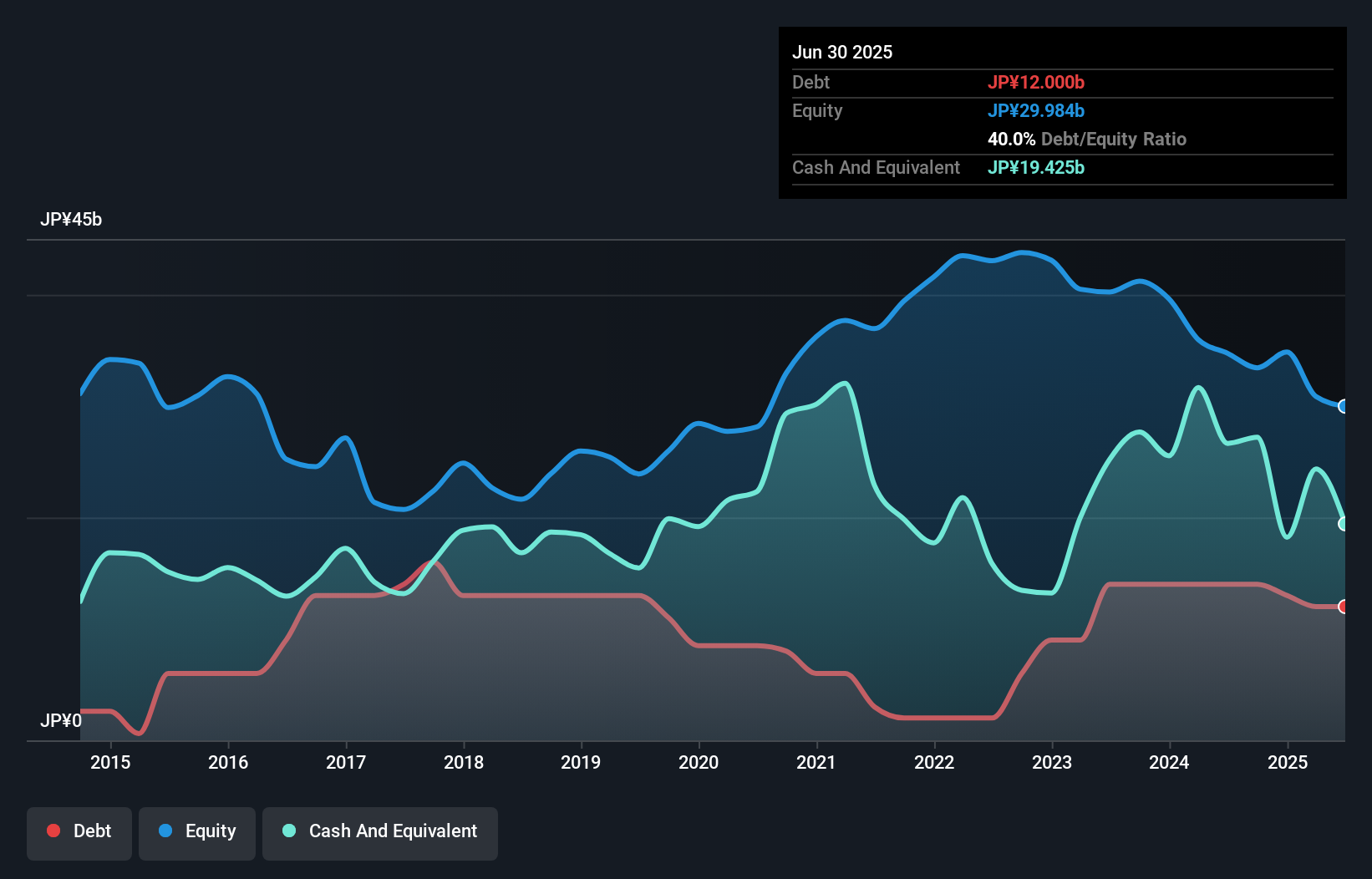

Wacom (TSE:6727)

Simply Wall St Value Rating: ★★★★★★

Overview: Wacom Co., Ltd. develops, manufactures, and sells pen tablets and related software worldwide with a market capitalization of approximately ¥100.71 billion.

Operations: Wacom generates revenue primarily from its Branded Products Business, contributing ¥31.56 billion, and the Technology Solution Business, which adds ¥88.96 billion.

Wacom, a notable player in the tech space, has showcased impressive earnings growth of 78.7% over the past year, outpacing the broader industry average of 7.5%. Despite a significant one-off loss of ¥4.2 billion impacting recent financials, its debt situation appears manageable with more cash than total debt and interest payments covered 519 times by EBIT. The company is trading at an attractive valuation, estimated to be 41% below fair value. Additionally, Wacom's strategic share repurchase plan aims to enhance shareholder returns by acquiring up to 4 million shares worth ¥2 billion by January 2025.

- Take a closer look at Wacom's potential here in our health report.

Examine Wacom's past performance report to understand how it has performed in the past.

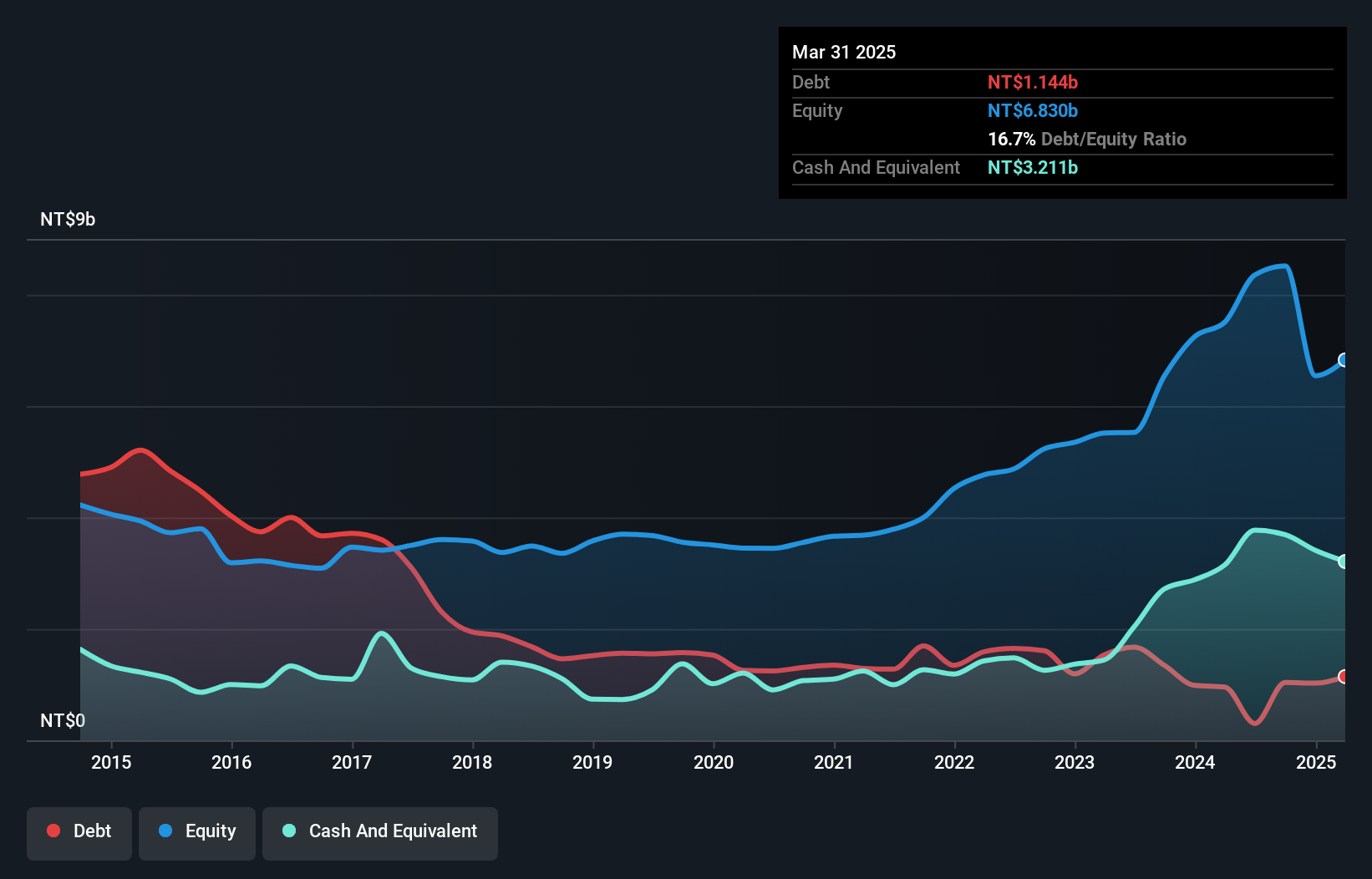

FIC Global (TWSE:3701)

Simply Wall St Value Rating: ★★★★★★

Overview: FIC Global, Inc. is involved in the manufacturing, design, engineering, and system integration sectors with a market capitalization of NT$10.64 billion.

Operations: FIC Global derives its revenue primarily from 3CEMS and Its Subsidiaries, contributing NT$9.44 billion, followed by Youtai and Its Subsidiaries with NT$3.88 billion. Popular Computer and Its Subsidiaries add NT$827.96 million to the revenue stream.

FIC Global, a company with a small market presence, has experienced notable earnings growth of 20.6% over the past year, outpacing the electronics industry average of 3.7%. However, recent financial results show mixed signals; while sales increased to TWD 3.55 billion in Q2 2024 from TWD 3.33 billion the previous year, net income dropped significantly to TWD 21 million from TWD 152 million. The company's debt situation seems stable as interest payments are well covered by EBIT at a ratio of 92.7x, indicating strong operational efficiency despite recent leadership changes impacting strategic direction.

- Unlock comprehensive insights into our analysis of FIC Global stock in this health report.

Evaluate FIC Global's historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4741 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3701

FIC Global

Invests in the manufacturing, design, engineering, and system integration businesses.

Excellent balance sheet very low.

Market Insights

Community Narratives