- India

- /

- Entertainment

- /

- NSEI:TIPSMUSIC

Undiscovered Gems And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced significant shifts, with small-cap stocks like those in the Russell 2000 Index leading gains despite not reaching record highs. As investors navigate this evolving landscape marked by expectations of policy changes and economic growth, identifying promising small-cap stocks becomes crucial; these companies often offer unique opportunities for growth due to their agility and potential for innovation within dynamic market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| AGI Infra | 61.29% | 29.16% | 33.44% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.20% | 16.85% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Tips Music (NSEI:TIPSMUSIC)

Simply Wall St Value Rating: ★★★★★★

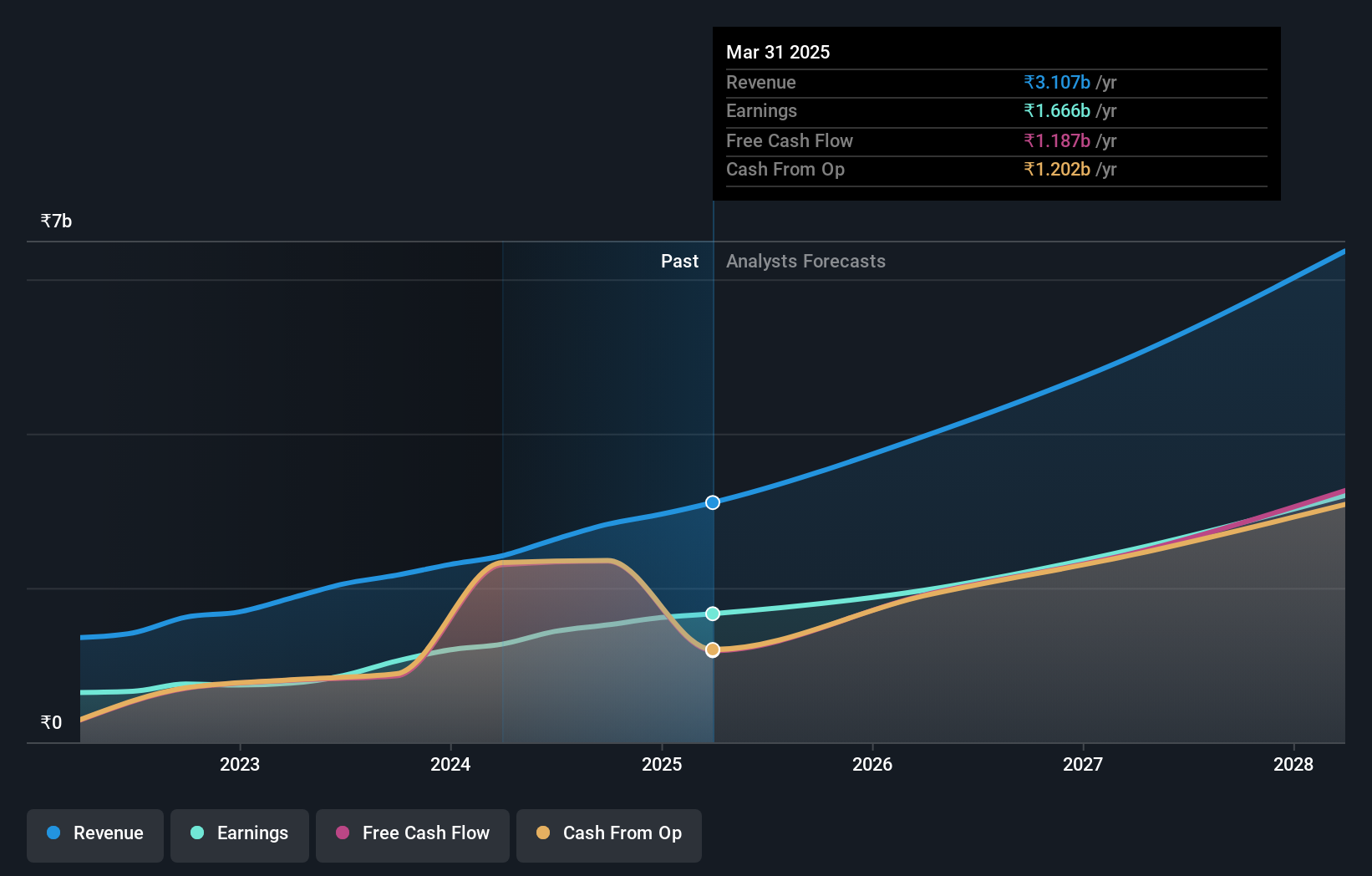

Overview: Tips Music Limited focuses on acquiring and exploiting music rights both in India and internationally, with a market capitalization of ₹118.18 billion.

Operations: Tips Music Limited's primary revenue stream is from its music segment, generating ₹2.83 billion.

Tips Music, a nimble player in the entertainment sector, has shown impressive financial resilience. Over the past year, earnings surged by 44.5%, outpacing the industry's 20.2% growth rate. The company reported Q2 sales of INR 806 million and revenue of INR 862 million, reflecting robust demand compared to last year's figures of INR 609 million and INR 645 million respectively. With no debt on its books now versus a debt-to-equity ratio of 2.1% five years ago, Tips Music seems well-positioned financially while maintaining high-quality non-cash earnings that bolster its profitability outlook.

- Click here and access our complete health analysis report to understand the dynamics of Tips Music.

Gain insights into Tips Music's historical performance by reviewing our past performance report.

Nagano Keiki (TSE:7715)

Simply Wall St Value Rating: ★★★★★★

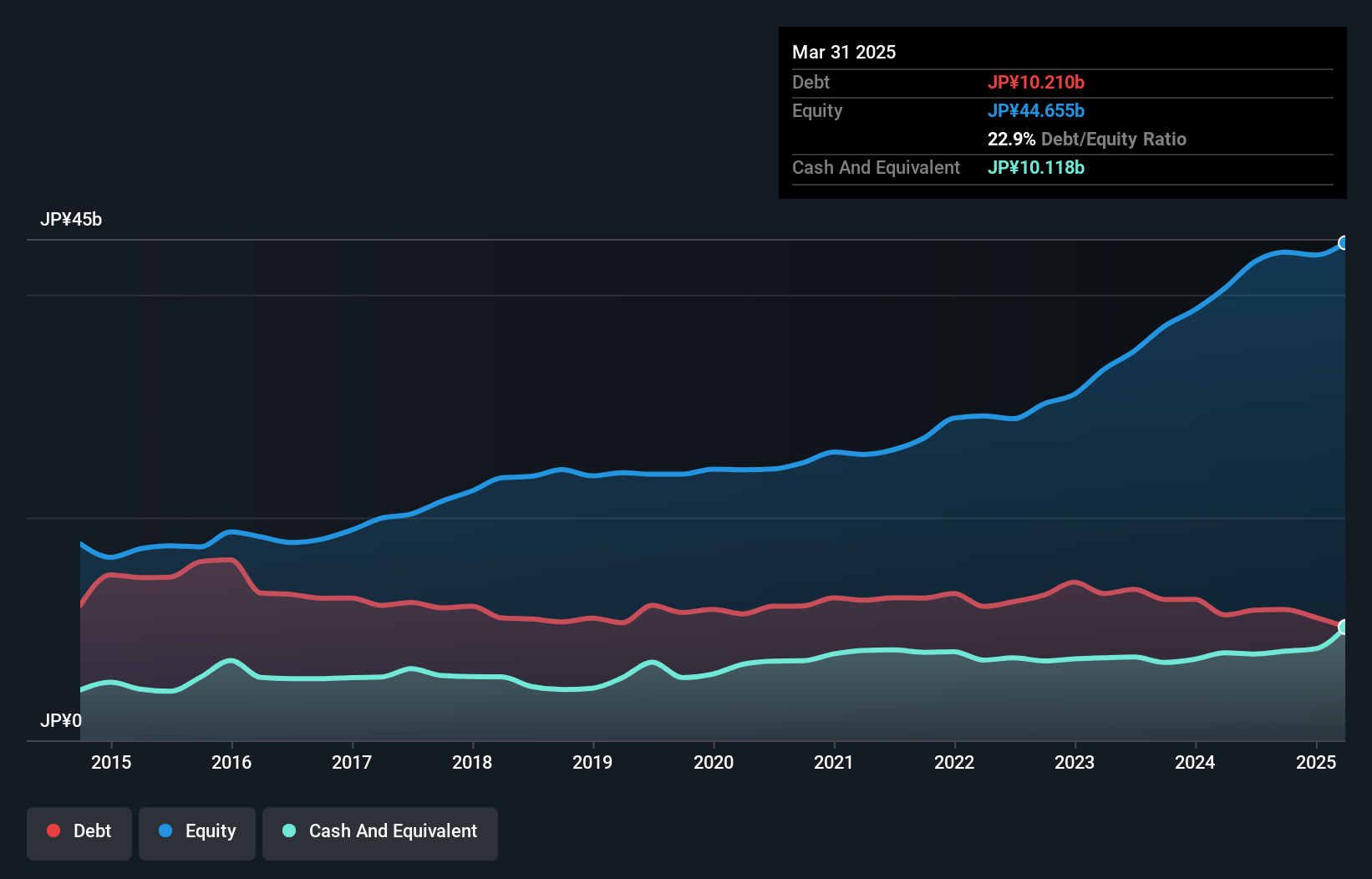

Overview: Nagano Keiki Co., Ltd. manufactures and sells pressure measurement and control equipment both in Japan and internationally, with a market capitalization of ¥49.94 billion.

Operations: Nagano Keiki generates revenue primarily from pressure gauges, contributing ¥34.92 billion, and pressure sensors, with ¥22.49 billion. The die-cast segment adds ¥5.19 billion to the total revenue stream.

Nagano Keiki, a smaller player in the electronics sector, has been making waves with its impressive 32% earnings growth over the past year, outpacing an industry decline of 1.7%. This growth trajectory is likely supported by its strong financial health, evidenced by a net debt to equity ratio of 9%, which is quite satisfactory. The company's interest payments are well covered with EBIT covering them 35 times over. Trading at about 56% below estimated fair value suggests potential undervaluation. Recent events include a special cash dividend and upcoming earnings release slated for November 13, indicating active shareholder engagement and transparency.

Young Fast Optoelectronics (TWSE:3622)

Simply Wall St Value Rating: ★★★★★★

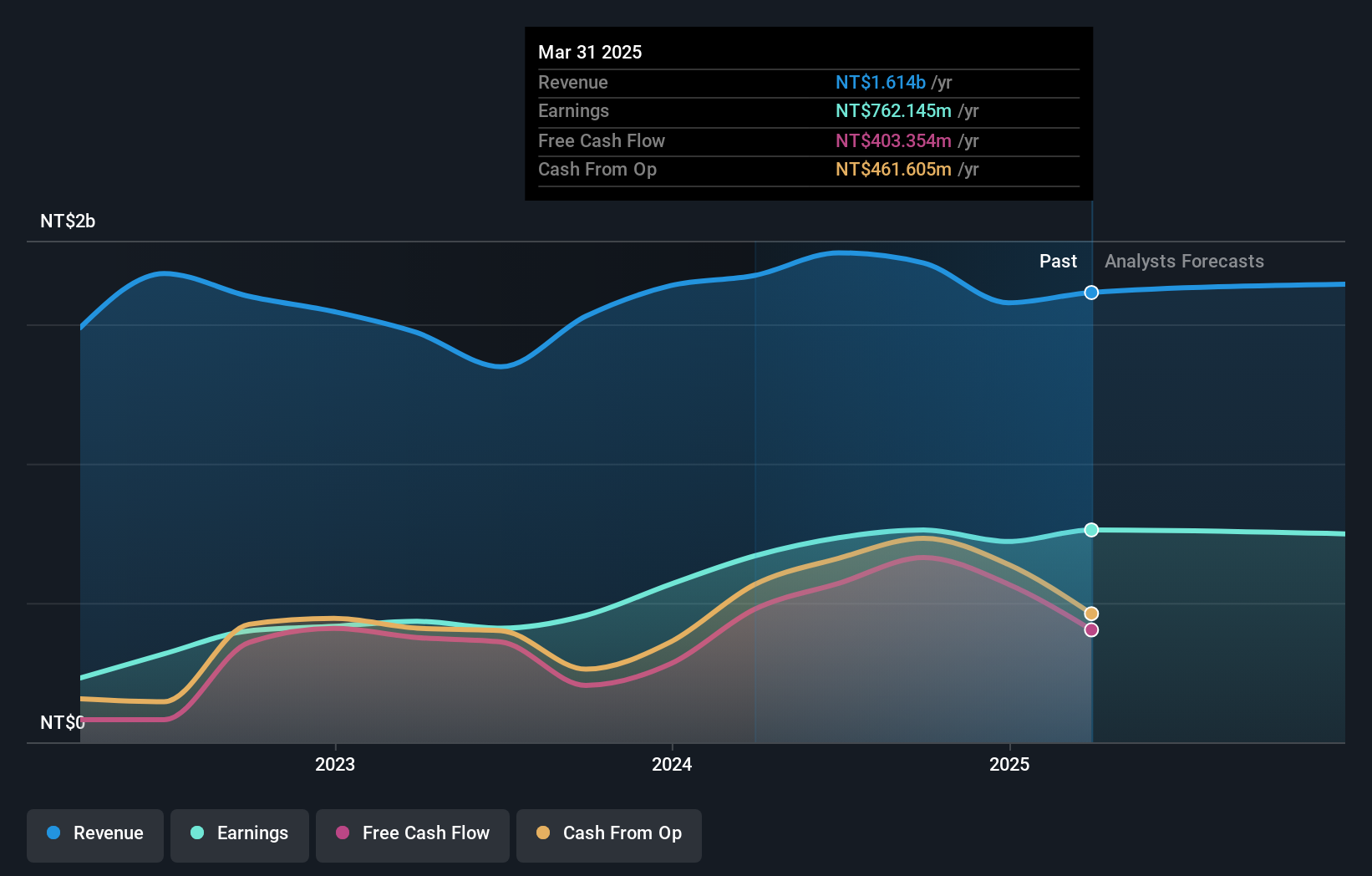

Overview: Young Fast Optoelectronics Co., Ltd. focuses on the research, development, manufacture, and sale of touch panels across Taiwan, the rest of Asia, and the Americas with a market capitalization of NT$10.50 billion.

Operations: Young Fast Optoelectronics generates revenue primarily from the sale of touch panels across various regions. The company's financial performance is influenced by its net profit margin, which reflects its ability to convert sales into net income efficiently.

Young Fast Optoelectronics, a nimble player in the electronics sector, has shown impressive earnings growth of 67.3% over the past year, outpacing the industry average of 5.8%. The company is trading at a value 59% below its fair estimate, suggesting potential undervaluation. Recent results for Q3 2024 show net income rising to TWD 306.57 million from TWD 279.09 million last year, with basic EPS increasing to TWD 2.02 from TWD 1.85 previously. Despite volatile share prices recently, Young Fast's debt-to-equity ratio has improved significantly over five years from 1.3% to just 0.5%.

Summing It All Up

- Navigate through the entire inventory of 4658 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tips Music might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TIPSMUSIC

Tips Music

Engages in the acquisition and exploitation of music rights in India and internationally.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives